Image Source: Occidental Petroleum Corporation – IR presentation

The bidding war over Anadarko Petroleum is heating up with Warren Buffett’s Berkshire Hathaway offering to invest $10.0 billion in a new 8% preferred issue from Occidental Petroleum, along with warrants to purchase up to 80 million shares of OXY at $62.50, if the energy company successfully acquires Anadarko. Occidental is bidding against Chevron because both firms want Anadarko’s Permian Basin acreage, but the leverage Occidental would take on the fund the deal would be extremely onerous in our view.

By Callum Turcan

Apparently three’s a crowd in the energy world, with the bidding war over Anadarko Petroleum Corporation (APC) heating up now that Warren Buffett has thrown his hat into the ring, sort of. Chevron Corporation (CVX) offered to purchase Anadarko in a cash/stock deal worth $65 per share at the time of the announcement, with Occidental Petroleum Corporation (OXY) one-upping that offer with a cash/stock bid of $76 per share at the time of the announcement. Warren Buffett entered the scene after Occidental’s CEO, Vicki Hollub, secured a $10.0 billion equity investment commitment from Berkshire Hathaway Inc (BRK.A) (BRK.B) which is contingent on Occidental successfully completing its proposed acquisition of Anadarko.

Occidental Goes a Little Too Big

That equity investment is one of the biggest problems with Occidental’s proposed takeover of Anadarko, alongside the fact that Occidental will be heavily indebted if this deal goes through. In return for $10.0 billion, Berkshire Hathaway will “receive 100,000 shares of Cumulative Perpetual Preferred Stock with a liquidation value of $100,000 per share, together with a warrant to purchase up to 80.0 million shares of Occidental common stock at an exercise price of $62.50 per share. The preferred stock will accrue dividends at 8% per annum (or with respect to dividends that are accrued and unpaid, 9%).” For a company whose unsecured credit rating is rated at A3 by Moody’s Corporation (MCO), making it investment grade, Occidental’s cost of capital seems steep. Moody’s placed Occidental’s credit rating on watch for a potential downgrade on April 24, and we see the financial stress in the event of an Occidental-Anadarko deal as very material, likely warranting downgrades in its credit rating.

We don’t think Occidental is making the right call here. At the end of 2018, Occidental was sitting on a net debt position of $7.3 billion while Anadarko’s consolidated net debt position came in at a hefty $15.9 billion at the end of the first quarter of this year (Occidental reports first quarter earnings May 6). When including the debt that Occidental would have to take on to finance its Anadarko purchase and the debt it would take on after the deal closed, it doesn’t appear that the company would be on solid financial ground as Occidental would add almost $40.0 billion in debt to its capital structure if the deal goes through as planned (before taking into account probable deleveraging via the equity investment and planned divestments).

For comparison purposes, keep in mind that as of this writing, Occidental’s $43.6 billion market capitalization is dwarfed by Chevron’s $226.2 billion. Chevron’s $50.0 billion deal by enterprise value is very manageable for an integrated oil & gas company with a $24.3 billion net debt position at the end of last quarter. Occidental’s $57.0 billion bid for Anadarko is a major gamble full of execution and raw energy pricing risk. In order to keep the debt concerns contained, Chevron’s bid was 25% cash/75% equity, but Occidental’s is a 50-50 split. This was likely the impetus behind Occidental seeking a major equity investment from Buffett’s Berkshire Hathaway. Occidental plans to divest between $10.0 – 15.0 billion in assets if the deal gets approved to “support rapid deleveraging.”

Readers should be aware of the potential dilution in the event OXY shares trade above $62.50 and Berkshire exercises its warrants. At the end of 2018, Occidental had 755 million shares outstanding on a diluted basis. As things stand today, exercising those warrants that cover 80 million shares of OXY would grow Occidental’s outstanding diluted share count by almost 11%. While the company would raise an additional $5.0 billion, it’s clear existing shareholders would be diluted by a material amount which is largely why shares of OXY have performed poorly over the past month when the bidding war began.

Synergies

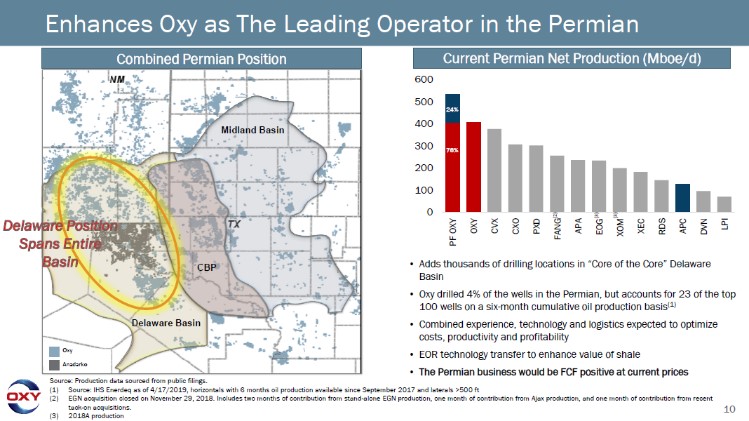

Occidental expects the combined company will realize a $3.5 billion in free cash flow uplift by 2021 due to reduced capital expenditure requirements ($1.5 billion) and pre-tax operating synergies ($2.0 billion). As both Occidental and Anadarko are big players in the Permian Basin with extensive upstream and midstream operations in the area, there are plenty of synergies to be had on the ground (on top of likely backroom and corporate-level redundancies). However, the targeted cost savings are a tad ambitious.

There are some international operational overlaps in South America (namely Colombia) where Occidental could be able to wring out some savings, but Anadarko operates in plenty of regions where Occidental doesn’t have a presence including West Africa (Ghana), North Africa (Algeria), East Africa (Mozambique), and the Gulf of Mexico (limited operational overlap with domestic onshore operations, outside of marketing opportunities and possible corporate-level redundancies). A major question relates to Anadarko’s promising liquified natural gas opportunity in Mozambique as moving forward with developing immense offshore natural gas resources would both require major capital investments from Occidental and for the firm to move into an arena (LNG exports) it has minimal experience with.

We see the level of operational synergies as being partially determined by how Occidental plans to proceeds with Anadarko’s international operations, and what assets end up getting divested. $0.9 billion of the expected savings are forecasted to come from reductions in G&A expenses, which means layoffs due to positions being made redundant. Anadarko’s overhead is quite onerous when measured as a percent of EBITDA, and that creates a major opportunity as it relates to cutting costs.

The bulk of the expected synergies that management has the best line-of-sight on probably relates to integrating Occidental’s domestic onshore upstream and midstream operations with Anadarko’s, keeping in mind Anadarko is a big upstream player in Colorado’s DJ Basin on top of having a sizable Permian position in West Texas. In theory, this could reduce capital expenditure requirements as existing midstream infrastructure in the Permian could be shared and future projects can be leveraged to support production across a wider area, reducing costs. Securing takeaway capacity is easier for a larger upstream player with the ability to become a major committed shipper on a new pipeline project, meaning Occidental can use its size to help ensure its production reaches more lucrative markets (including international markets via export, where prices are usually much higher). Occidental would also gain greater negotiation power as it relates to dealing with third-party oilfield service providers.

Another question arises and that concerns Western Midstream Partners L.P. (WES), Anadarko’s midstream spin-off. Clearly investors are starting to price in the chance Occidental is successful, as WES has moved much lower since Occidental made its competing bid. If Chevron were to acquire Anadarko, the thinking goes that the energy giant may also purchase Western Midstream and roll that entity back up into its integrated operations. That was attributed to Western Midstream’s rally on the news that Chevron planned on buying Anadarko. Occidental is unlikely to pursue that strategy and doesn’t possess the financing capacity to move forward with such a plan. Instead, it’s possible that if Occidental is successful, one way the firm will raise money after the deal closes is by dropping down additional midstream assets to Western Midstream.

Combined, Anadarko and Occidental produce roughly 1.4 million barrels of oil equivalent per day net based on fourth quarter 2018 production levels. This combination would see Occidental leapfrog past ConocoPhillips’ (COP) production base during the first quarter, cementing its status as a rising semi-integrated oil & gas player (Occidental also has a sizable petrochemical business). While Chevron may have lost its shot of quickly joining the ranks of the ultra-majors, it’s possible the company the submit a higher bid for Anadarko or deploy a wait-and-see approach considering Occidental’s shareholders still need to approve the deal. That may be a tough sell. T. Rowe Price Group Inc (TROW), a major Occidental shareholder, disapproves of the Anadarko deal. Either way, Chevron wins as it stands to reap a $1.0 billion cash payment from Anadarko if Anadarko goes with Occidental’s bid.

A Growing Giant

As stated previously and in our first note on the Chevron-Anadarko deal, Occidental and Chevron are really going after one asset in particular and that’s Anadarko’s 240,000 net acre position in the Delaware Basin (a sub-basin within the Permian Basin). With a large contiguous footprint in Ward, Reeves, and Loving counties in West Texas, Anadarko offers a potential suitor a quality growth generator. Anadarko pumped ~140,000 BOE/d net out of the region during the final three months of 2018, but most of the firm’s development strategy has rested on retaining acreage (drilling and completing smaller wells to hold leaseholds by production) instead of drilling more economical wells in a systematic fashion. That’s something both Occidental and Chevron would change going forward as it relates to developing Anadarko’s Permian acreage, which in theory should produce substantially better returns on invested capital relative to what Anadarko was realizing (at constant realized prices) in the basin.

Occidental produced over 400,000 barrels of oil equivalent net from the Permian Basin during the final quarter of 2018, which includes output from its unconventional (fracking) division and production from its conventional enhanced oil recovery operations (managing output from mature fields and attempting to boost recovery rates through new technologies and development methods). Adding Anadarko’s output to that would further entrench Occidental as the leading upstream player in the Permian with the largest production base in the region. During the conference call discussing Occidental’s thoughts on the acquisition, the firm’s CFO Cedric Burgher noted that;

“The transaction will extend our position as the largest producer in the Permian with a combined net 533,000 BOEs per day of production, which will accelerate our value driven strategy in the U.S. onshore through a combination of top tier assets and best-in-class economics. As I’ve said before, we operate our assets with a full life cycle view, we are positioned to be the long-term leader in the Permian, our position enhanced by our unique EOR expertise.

Our Permian investments will continue to provide payback in the form of lower costs as our production base expands. Our Permian cash operating costs in Q4 were the lowest this decade and we believe that there is significant opportunity for us to leverage our Permian operating experience, subsurface knowledge and technology, to make the most of Anadarko’s existing assets. Importantly, our combined business in the Permian at current oil prices would be free cash flow positive.”

Furthermore, a lot of the expected capital expenditure savings are coming from the Permian Basin. By switching to a development plan that focuses on drilling the best wells possible (which involves drilling longer well laterals, utilizing bigger “fracking” or completion designs, significant midstream investments, water handling investments, and much more), Occidental hopes to bring Anadarko’s average Permian well cost down to its own average. Note that wells drilled for acreage retention purposes usually are less productive and less economical than wells drilled for the sole purpose of making a profit. Acreage retention wells utilize shorter well laterals and generally are completed with smaller fracking techniques, yielding a cheaper well that’s faster to bring online but one that isn’t nearly as prolific (smaller estimated ultimately recovery, usually smaller initial production rates, and significantly weaker returns). Upstream operators lose the right to hold onto certain leaseholds if certain conditions aren’t met, namely that oil and/or gas isn’t flowing after a certain period, which is why acreage retention wells are an essential part of the business.

Image Shown: A map of Occidental and Anadarko’s Permian acreage positions. Image Source: Occidental Petroleum – IR presentation

Concluding Thoughts

Anadarko has decided to reopen talks with Occidental, but nothing is for certain. For starters, Chevron may up its bid for Anadarko or increase the cash portion of the deal if it really wants Anadarko’s Delaware Basin position. Conversely, Chevron may not want to pay a larger premium than it had already agreed to and could happily collect $1.0 billion for its troubles from Anadarko. What’s clear is that Occidental still needs to figure out how to sell its purchase of Anadarko to its own shareholders as a revolt is brewing. Occidental is biting off more than it can chew with this deal and will be forced to quickly embark on its divestment program to bring leverage down to more manageable levels if it goes through. Being the ‘King of the Permian’ may be a great title, but that doesn’t make a firm a quality investment, which is why we are concerned that Occidental may be engaging in an ‘Empire Building’ strategy to the detriment of its shareholders.

Anadarko, for its part, has also been up to some very questionable activity as the company just recently changed some provisions in the “change in control” rules that would enable management to receive a much larger golden parachute than previously envisioned. That creates the incentive to make sure a deal goes through, regardless of how beneficial the deal is for shareholders. We will continue to monitor this bidding war as it unfolds.

Oil & Gas – Major: BP, COP, CVX, RDS, TOT, XOM

Related: DVN, PXD, MRO, APA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.