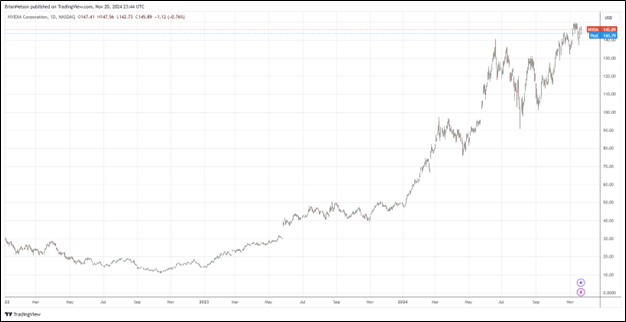

Image: Nvidia’s shares have surged higher in recent years.

By Brian Nelson, CFA

Nvidia (NVDA) reported better than expected fiscal third quarter 2025 results on November 20 with both revenue and non-GAAP earnings per share coming in ahead of forecasts. Revenue was up 94% on a year-over-year basis in the quarter, while Data Center revenue was up 112%. Both were quarterly records. Nvidia’s non-GAAP gross margin of 75% in the quarter was unchanged from the same period a year ago. Non-GAAP operating margin was 66.3% in the quarter, up from 63.8% in the prior-year period. Non-GAAP earnings per share was $0.81 in the quarter, more than doubling from last year’s mark and beating consensus by $0.06.

CEO Jensen Huang had the following to say about the quarter:

The age of AI is in full steam, propelling a global shift to NVIDIA computing. Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference. AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure.

For the nine months ended October 27, cash flow from operations increased to $47.46 billion, up from $16.59 billion during the same period a year ago. Capital spending was $2.1 billion during the nine months ended October 27, up from $815 million in the same period last year. Free cash flow in the nine months ended October 27 was $45.2 billion, up from $15.7 billion during the same period a year ago. During the quarter, Nivida bought back $11 billion in stock and returned $245 million to shareholders in the form of dividends.

Looking to the fourth quarter of fiscal 2025, Nvidia’s revenue is expected to be $37.5 billion, plus or minus 2%. Non-GAAP gross margins are expected to fall sequentially to 73.5%, while non-GAAP operating expenses are expected to be $3.4 billion in the fourth quarter. Nvidia’s third quarter report was fine, but its fourth-quarter revenue guidance was a bit light relative to some buyside estimates, and its non-GAAP gross margin guidance for the fourth quarter revealed modest sequential pressure. The high end of our fair value estimate stands at $180 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.