Image Source: Nvidia Corporation – IR Presentation

By Callum Turcan

Nvidia Corporation (NVDA) designs chips for data centers, PCs and laptops with a heavy focus on gaming performance, next-generation automobiles (such as autonomous vehicles), and other purposes. The company is built around two segments, GPUs (graphics processing units for visual, AI, and cloud computing uses) and Tegra Processors (integrates GPUs and CPUs, central processing units, into one chip for mobile devices, gaming systems, entertainment systems, autonomous vehicles, and other uses).

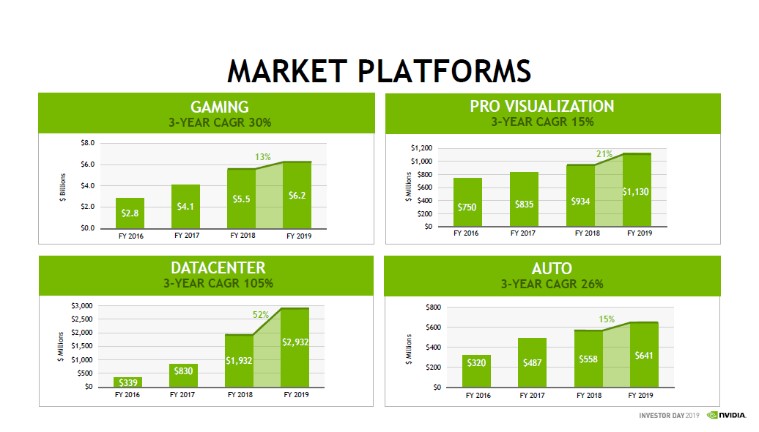

Management breaks down the markets Nvidia is targeting into four categories; Gaming, Visual Performance, Datacenter, and Automotive. Due to its low payout ratio, Nvidia yields just 0.4% as of this writing, but we think the company could become a meaningful dividend payer in the future due to its strong free cash flow potential depending on whether Nvidia’s management team picks that route. Nvidia has preferred to invest in growth and share count reductions over serious dividend payout increases.

While the company also used to have a large but volatile cryptocurrency industry, keep in mind Nvidia’s crypto business is winding down and management doesn’t expect that division to contribute a meaningful amount of revenue going forward. Here is an excerpt from Nvidia’s second quarter FY2019 conference call:

“Our revenue outlook had anticipated cryptocurrency-specific products declining to approximately $100 million, while actual crypto-specific product revenue was $18 million, and we now expect a negligible contribution going forward.”

The industry Nvidia operates in is one of the toughest in the world and while semiconductor companies can at times represent great investments, the industry itself isn’t endearing. Here is a short summary of our thoughts on the integrated circuits industry from our 16-page Stock Report:

“Firms in the integrated circuits industry make components that form the electronic building blocks used in electronic systems and equipment. The industry is notoriously cyclical and subject to significant economic upturns and downturns, as well as rapid technological changes. Firms must innovate to survive, and products stocked in inventory can sometimes become obsolete before they are even shipped. Severe pricing competition and lengthy manufacturing cycles only add uncertainty to the mix. We’re not fans of the structure of the integrated circuits space.”

Earnings Overview

The company reported earnings after the close on May 16 for the first quarter of fiscal 2020 (Nvidia’s fiscal 2019 ended on January 27, 2019) and while the initial reaction from the market was a positive one, management scrapped full-year guidance for fiscal 2020 (we’ll cover that later), which ended up pushing shares of NVDA lower a day later on May 17.

GAAP revenue of $2.2 billion was in-line with the midpoint of management’s guidance that was given during the firm’s fourth quarter fiscal 2019 conference call, while GAAP gross margins of 58.4% was at the lower end of its guidance. A big earnings beat, with adjusted (non-GAAP) EPS of $0.88 blowing past Wall Street expectations of $0.58, was a welcome sign for shareholders. Revenue was down by $1.0 billion year-over-year but up marginally sequentially, while GAAP gross margins were down 610 basis points year-over-year but up 370 basis points sequentially due to the absence of a $0.1 billion charge that occurred during the fourth quarter.

Image Shown: Where Nvidia has been able to locate revenue growth over the past few fiscal years to offset the loss of its cryptocurrency business. Image Source: Nvidia – IR Presentation

Management guided for $2.55 billion in revenue during the second quarter of fiscal 2020 while GAAP gross margins are expected to firm up further to 59.2%. In Nvidia’s press release, management stated “NVIDIA is back on an upward trajectory” and wants that to be the stock’s narrative going forward. However, keep in mind that Nvidia is no longer providing full fiscal year guidance and is instead only going to offer quarterly guidance.

This spooked the market and is likely why shares, after starting off strong, were lower by midday on May 17. If management doesn’t have a clear view of what to expect this fiscal year, that signals to the market that Nvidia still has a lot of work to do when it comes to reviving its top line (which in turn should bolster its cash flow and net income generation). Here is a key excerpt from the company’s latest quarterly conference call:

“With that let me turn to the outlook for the second quarter of fiscal 2020. While we anticipate substantial quarter-over-quarter growth for Q2 [our] outlook is somewhat lower than our expectation earlier in the quarter when our outlook for fiscal 2020 revenue was flat to down slightly from fiscal 2019. The data center spending pause around the world will likely persist in the second quarter and visibility remains low.

In gaming, the CPU shortage while improving will affect the initial round of our laptop business. For Q2, we expect revenue to be $2.55 billion plus or minus 2%. We expect a stronger second half than the first half and we are returning to our practice of providing revenue outlook one quarter at a time. Q2 GAAP and non-GAAP gross margins are expected to be 59.2% and 59.5% respectively plus or minus 50 basis points.”

Dividend Coverage and Potential Growth Story

At the end of Nvidia’s first quarter of fiscal 2020, the firm was sitting on $7.8 billion in ‘cash, cash equivalents and marketable securities’ versus $2.0 billion in long-term debt, good for a net cash position of $5.8 billion. We appreciate management’s fiscal conservatism as it relates to the company’s very cautious approach to its balance sheet, but caution that Nvidia is in the middle of a significant acquisition that we will cover later on in this piece.

Nvidia has strong free cash flow generating capabilities due to its capital-light business model and promising growth prospects (medium-term headwinds aside). Its net operating cash flow jumped from $1.7 billion in fiscal 2017 to $3.7 billion in fiscal 2019, while “purchases of property and equipment and intangible assets” tripled from $0.2 billion to $0.6 billion during this period. $3.1 billion in free cash flow easily covered $0.4 billion in dividend payments and $1.6 billion in share repurchases last fiscal year. Over the past three fiscal years, Nvidia has on average generated $2.5 billion in free cash flow while spending $1.1 billion on share buybacks and $0.3 billion on dividend payments per year. Combined with its strong balance sheet usually flush with cash and cash equivalents, Nvidia’s dividend coverage is great. However, that’s largely a product of a very low payout.

In the event Nvidia decided to start allocating a significantly larger portion of its free cash flow to dividend payments to enable a more meaningful yield (Nvidia’s current yield of 0.4% as of this writing leaves much to be desired), we might become interested in the name at some point in the future. That strategy would likely need to be paired with reductions in the size of Nvidia’s share repurchasing program, but considering the company’s free cash flow generation potential, there could still be room for both repurchases and a dividend growth story over the coming years. We like companies that carry meaningful yields as in many ways, that dividend stream is a sign of management’s commitment to rewarding shareholders. Nvidia had already been authorized to repurchase over $7.2 billion additional shares as of April 28, 2019.

From late-2012 to 2019, Nvidia’s quarterly dividend rose from $0.075 per share to $0.16 per share. Management plans to return $3.0 billion in capital to shareholders by the end of fiscal 2020, a plan that included repurchasing $0.7 billion in shares back during the fourth quarter of fiscal 2019. We expect share repurchases will continue to represent the lion’s share of Nvidia’s capital return policy in the medium-term as management prioritizes growth and anti-dilution measures. Nvidia’s outstanding diluted share count was down 2% year-over-year last quarter. We would be more supportive of Nvidia keeping that cash on hand instead of buying back stock in light of its pending acquisition, but as shares of Nvidia trade meaningfully below the midpoint of our intrinsic value of NVDA, some level of repurchases makes sense.

Buying Mellanox and Searching for Growth

Back in March, Nvidia announced the purchase of Mellanox Technologies Limited (MLNX) for $125 per share in cash, with the transaction carrying an enterprise value of $6.9 billion. That deal will be immediately accretive to Nvidia’s financials and is expected to close by the end of this calendar year. Nvidia is funding the deal with cash on hand but doesn’t expect that to interfere with its capital return policies. While this move will significantly reduce Nvidia’s net cash position in the short-term, note that the company is very free cash flow positive and could quickly rebuild its balance sheet within a few years (depending on the pace of share buybacks and dividend growth). As stated previously, we would prefer Nvidia rebuild its cash pile sooner rather than later. Nvidia’s undrawn (at the end of the first quarter of fiscal 2020) $0.6 billion revolving credit facility will provide the company additional access to liquidity as needed.

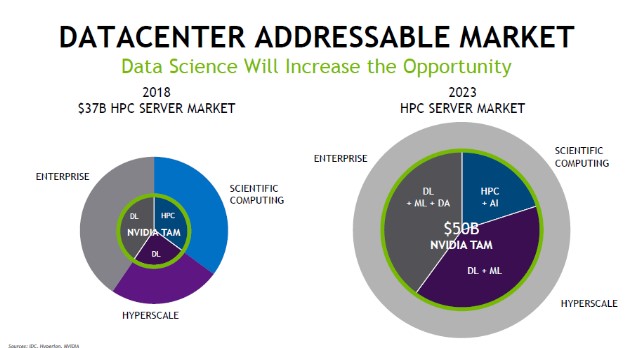

Mellanox Technologies provides end-to-end Ethernet and InfiniBand smart interconnect offerings for servers and storage operations, making this purchase a play on the datacenter space where Nvidia has grown its revenue from $0.3 billion in fiscal 2016 to $2.9 billion in fiscal 2019. However, this is also an area experiencing an investment slowdown and that’s largely why Nvidia had to scrap its full fiscal year guidance. We will be monitoring the datacenter market going forward. Merging these two companies together will create a leading player in the high-performance computing space. Nvidia notes that this market had a total addressable value of $37.0 billion in calendar year 2018. That is forecasted to grow to $50.0 billion by 2023 in the eyes of several analysts as you can see below.

Image Shown: Nvidia expects the high-performance computing market will grow by $13.0 billion over the coming years, creating greater needed for its expanded offerings once the Mellanox Technologies deal closes. Image Source: Nvidia – IR Presentation

Top-line growth is essential, and the datacenter space offers Nvidia a lot of opportunities if recent headwinds subside. Nvidia also sees autonomous vehicles as playing a key role in its growth story over the next decade (and beyond), with management noting the total addressable market may reach $30.0 billion by calendar year 2025.

Image Shown: Nvidia expects autonomous vehicles and other enhancements to automobiles will create a $30.0 billion opportunity for the industry to capitalize on by calendar year 2025. Image Source: Nvidia – IR Presentation

What makes these growth opportunities even better is that Nvidia commands stronger gross margins in these areas than it does in gaming-related sales. If that holds true going forward, moving aggressively into these markets will provide a powerful top- and bottom-line uplift to Nvidia’s financial performance. The company would likely experience meaningful cash flow growth if it maintains at least a decent market share position in these areas, but as the nature of this industry is hyper-competitive, nothing is for certain. Management likes to keep a lot of cash on hand to make funding these kinds of deals feasible without taking on too much debt.

Nvidia started construction on its new campus in Santa Clara, California, during fiscal 2019 and expects the facility to be complete by fiscal 2022. The 750,000 square foot campus, dubbed Voyager, will be used to support and house Nvidia’s growing engineering team as it pushes deeper into new markets. A growing company needs to invest in office space and considering the aggressive market out there for talent in the high-tech world, having a new campus can be a strong selling point to some potential employees.

Concluding Thoughts

There are a lot of things to like about Nvidia. The problem is management’s past capital allocation strategy has not always been the greatest. For instance, the company aggressively bought back stock over the past few years at prices well above where Nvidia has been trading at over the past few months as one can see in the graph below. Had management instead left that cash on the books or paid off Nvidia’s relatively small debt balance or simply boosted the company’s quarterly payout, shareholders would have likely been better off.

We will be monitoring the datacenter market and Nvidia’s integration with Mellanox Technologies, assuming the deal closes, going forward but we aren’t interested in Nvidia at current levels. Our fair value estimate is unchanged at this time.

Integrated Circuits: ADI, CRUS, MCHP, MRVL, NVDA, POWI, SMTC, SWKS, TSM, XLNX

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.