Image Source: Nvidia

By Brian Nelson, CFA

Nvidia (NVDA) reported fiscal fourth quarter results that beat expectations on both the top and bottom lines. The bellwether reported record quarterly revenue of $39.3 billion, up 12% sequentially and 78% from the same period a year ago. Data Center revenue of $35.6 billion set another record, up 16% sequentially and 93% higher than the same period last year. Consensus for Data Center revenue was $34.1 billion, a nice beat.

The company achieved a gross margin of 73% in the quarter, down 1.6 percentage points sequentially and down 3 percentage points on a year-over-year basis. Its operating margin was 61.1% in the quarter. GAAP earnings per diluted share in the quarter came in at $0.89, up 14% sequentially and 82% from the year-ago period. Non-GAAP earnings per share was also $0.89, up 10% sequentially and 71% from the same period last year.

Founder and CEO Jensen Huang had the following to say in the press release about recent trends:

Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter.

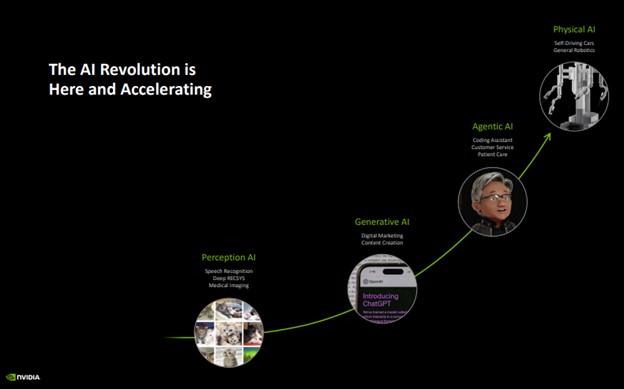

We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.

Among the highlights, Nvidia noted that it will serve as a key technology partner for the $500 billion Stargate Project and revealed that cloud service providers Amazon (AMZN) AWS, CoreWeave, Google (GOOG) Cloud, Microsoft (MSFT) Azure, and Oracle (ORCL) “are bringing Nvidia GB200 systems to cloud regions around the world to meet surging customer demand for AI.”

Looking to its first quarter of fiscal 2026, Nvidia’s revenue is expected to be $43 billion, plus or minus 2% (consensus was $42.05 billion), with GAAP and non-GAAP gross margins expected to be 70.6% and 71%, respectively, plus or minus 50 basis points. Nvidia ended its fiscal year with $43.2 billion in cash and cash equivalents, while long-term debt was $8.5 billion. Free cash flow was $15.6 billion in the quarter and $60.9 billion for the fiscal year. The high end of our fair value estimate range stands at $180 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.