This article appeared as the introduction to the June edition of the Dividend Growth Newsletter.

By Callum Turcan and Brian Nelson, CFA

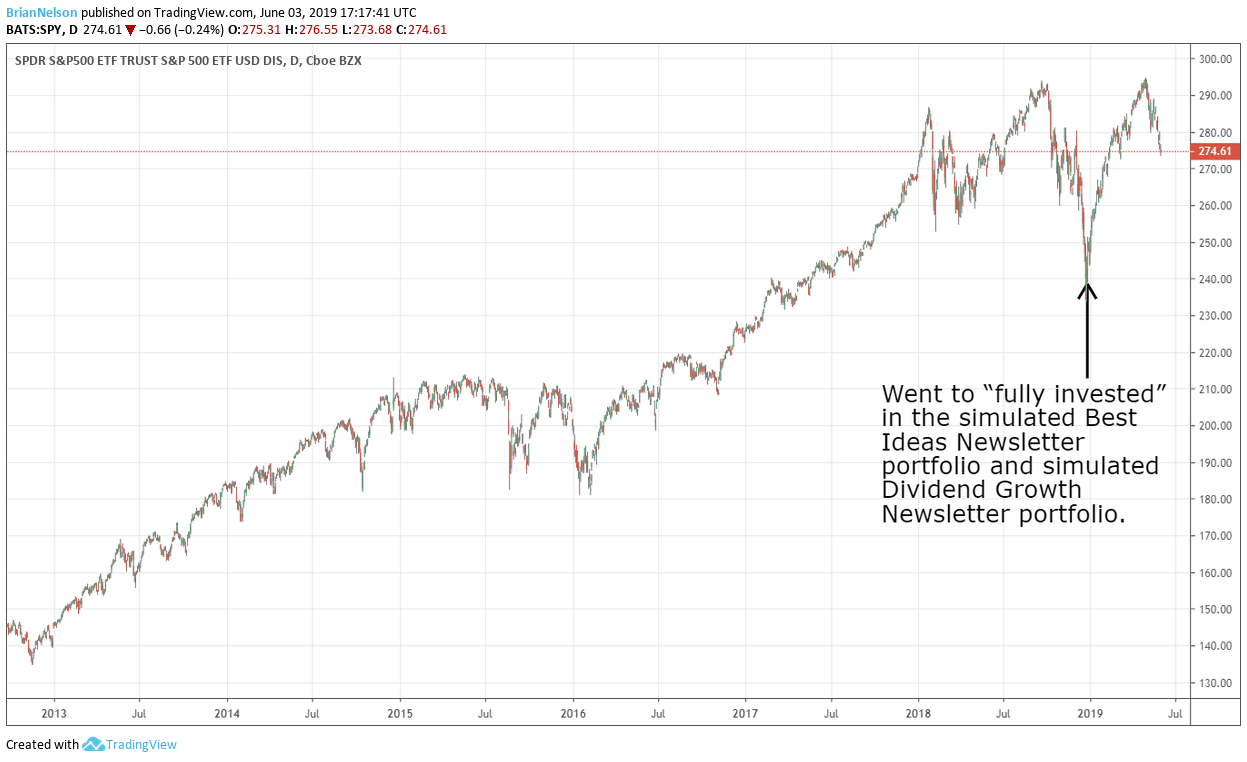

On May 5, President Trump announced via Twitter (TWTR) that he planned to raise American tariffs on $200 billion of Chinese imports from 10% to 25%, stepping up pressure on Beijing in what we initially saw as a bid to get a trade deal over the finish line. By May 10, the new tariff rates had gone into effect and it became clear that neither side was any closer to reaching an agreement, unfortunately.

Just a few weeks ago, state-sanctioned rumors were coming out of Beijing (particularly, the editor-in-chief of the influential Global Times) that China was considering an export ban of rare earth minerals to America in retaliation for the tariff increases. There is always the chance that President Trump follows through with his threat to raise American tariffs to 25% on another $325 billion of Chinese imports, which would likely spark additional retaliation from Beijing on top of what is already planned.

To complicate matters further, President Trump also announced that he is looking to tariffs on Mexico if the country doesn’t take steps to stop the flow of illegal immigration. The US is now fighting a trade war on multiple fronts.

On June 1, China is expected to raise tariffs on $60 billion of American imports up to 25%, with those increases impacting a list that covers over 5,000 products. Tariffs on other products will increase to 20%, keeping in mind most of these rates were at 5%-10% previously. As an aside, there are also numerous non-tariff barriers Chinese authorities can erect, such as delaying imports by preventing the timely offloading of American exports at Chinese ports. We have seen this play out with China’s other trade spats with Canada and Australia (with paperwork problems often cited euphemistically as the reason for the delays).

There are reports that President Trump and Chinese President Xi Jinping may meet on the sidelines of the G-20 summit in Japan, which runs from June 28 to June 29 in Osaka. It isn’t clear where trade negotiations left off, but it is clear that any progress made over the past few months has since dissipated. This could have very important implications to some dividend payers as tariffs lead to input cost increases and non-tariff retaliations can disrupt integrated global supply chains in ways we haven’t seen before. If free cash flow generation comes under fire, divided payers with lackluster coverage may find themselves between a rock and a hard place.

Here is a good example of how the trade war is negatively impacting major dividend payers. Ford Motor Company (F) –- 6.2% yield — exports luxury Lincoln vehicles from its production facility in Louisville, Kentucky, to consumers in China. With American auto exports to China facing 40% tariff rates (a combination of long-standing import tariffs on automobiles on top of more recent retaliatory tariffs), those exports quickly became far less competitive as the price of those offerings had to be increased. Keep in mind Ford also faced material input pricing pressures last year as American tariffs on steel and aluminum imports ate into its bottom line. Ford’s CEO Jim Hackett noted in Fall 2018 that operations at the Louisville plant had to be adjusted as the firm’s Chinese business cratered. Equity income from Ford’s Chinese JVs plummeted from $916 million in 2017 to a loss of $110 million in 2018, as wholesale shipments dropped by 42% year-over-year.

Note that Ford carries a mediocre Dividend Cushion ratio of 0.9x due to its hefty net debt load. While its North American division continues to perform well, the downturn in its Chinese business has put a lot of strain on its financials. If there is no resolution in the USA-China trade war, that could culminate into Ford doing what was previously considered unthinkable (meaning a dividend cut) unless there are dramatic improvements elsewhere. That isn’t to imply that a payout cut from Ford is set in stone, but we would be worried about the storied automaker’s ability to keep making good on its current dividend policy while investing heavily in EVs and autonomous vehicle technology (investments that likely won’t yield meaningful cash flow generation for some time while draining cash that could be used to service the payout) without a conclusion to the ongoing USA-China trade war. Something has to give, and that could see Ford invest less in the future to preserve its bottom line and ultimately protect its hefty dividend.

Other considerations involve companies with domestic operations that are heavily reliant on Chinese imports as inputs, with an eye on semiconductor firms with fabrication plants in America. Intel Corporation (INTC), a top holding in our simulated Dividend Growth Newsletter and simulated Best Ideas Newsletter, announced in early-2017 that it was going to finish developing its fabrication plant in Chandler, Arizona, through a $7 billion investment. Without rare earth minerals, in the event Beijing implements an export ban to America, that could put this major investment in jeopardy due to China representing 80% of American rare earth mineral imports from 2014 to 2017. Even if Intel finds a way around this situation, there is still a good chance that tariffs and inefficiencies in its supply chain will lead to meaningful input pricing pressures. Ultimately, the trade war (if unresolved) could adversely impact Intel’s dividend growth story, especially if things escalate. Intel has a solid 2.1x Dividend Cushion ratio, so we’re not too concerned, but that doesn’t make the firm immune to downside risks.

We will be monitoring the ongoing trade turmoil very closely going forward.

Related country ETFs: EWW, MEXX, FLMX, HEWW, MCHI, FXI

Related index ETFs: DIA, SPY, QQQ

Related stocks: GM

—–

The authors do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.