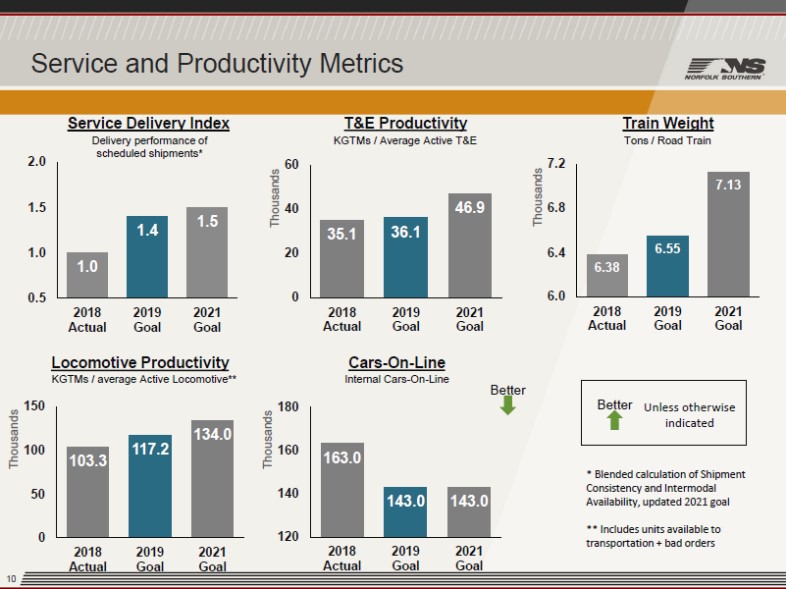

Image Source: Norfolk Southern Corporation – First quarter 2019 IR presentation

While Norfolk Southern posted a solid first quarter earnings report and continued to showcase real operational improvement, an onerous net debt load combined with the long-term decline of coal in America puts its dividend growth trajectory in doubt.

By Callum Turcan

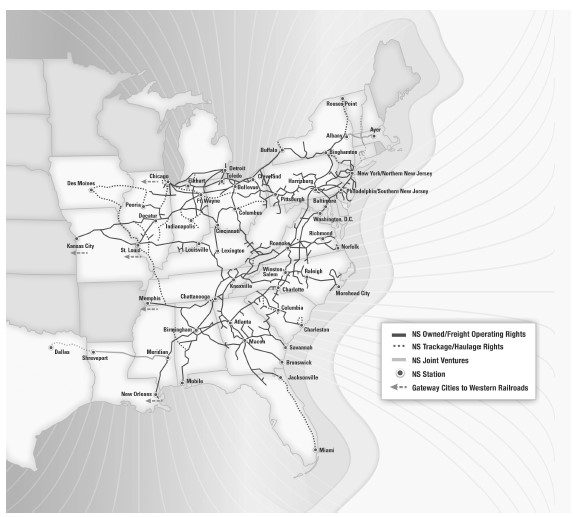

Norfolk Southern Corporation (NSC) is a major rail transportation provider with operations primarily located in the Midwest, the East Coast, and the Southeastern regions of the United States. As things stand today, the company yields 1.7% but its dividend coverage isn’t great with a Dividend Cushion ratio of just 0.6x. While we recognize that Norfolk Southern is a robust free cash flow generator, note that its dividend obligations are hefty, and its net debt load onerous. The company posted a solid first quarter earnings report and continued to showcase improvement where it’s needed, but, long-term problems in the coal industry (particularly in America) combined with its large net debt load have created clouds over its dividend growth potential.

Where Norfolk Southern is Doing Well

One thing we will give Norfolk Southern credit for is management’s focus on operational efficiency, which is already having an effect on the firm’s profitability. In our view (from our 16-page report);

“Norfolk Southern has some solid targets for the years ahead, including 100+ basis points of operating margin improvement in 2019, an operating ratio of 60% by 2021 (was ~65.4% in 2018), a revenue CAGR of ~5% through 2021 a double digit annual EPS growth, capital spending of ~16%-18 of revenue through 2021, and a dividend payout ratio of ~33%.”

Last quarter, the rail operator posted 5% annual revenue growth due to 5% growth at its ‘Merchandise’ segment and 6% growth at its ‘Intermodal’ segment. Note that its ‘Coal’ revenue was flat year-over-year. Norfolk Southern’s operating expenses were flat in the first quarter versus the same period a year-ago, enabling its GAAP operating margin to firm up by almost 330 basis points as its income from railways (operating income) jumped 16% annually to $0.9 billion. This can also be seen through Norfolk Southern’s operating ratio (or GAAP operating expenses as a percent of GAAP revenue) falling from 69.3% during the first quarter last year to 66.0% in the first quarter of this year. Lower fuel, materials, and labor costs were the primary factor, with efficiency being the key (we will get into that later on). Ultimately, this enabled Norfolk’s net income to climb up 23% year-over-year to $0.7 billion in the first quarter, resulting in 30% GAAP EPS growth as the firm’s share count fell by 6% from the first quarter of 2018 to the first quarter of 2019.

Norfolk Southern is guiding for its operating ratio to continue falling over the next couple of years, guidance that is largely predicated on meeting certain operational efficiency goals by then. That includes investments in faster rail logistics (such as enabling additional railroads to support 60 mph speeds), which markedly improved its average rail speed last quarter on a year-over-year basis. Reduced train downtime (referred to as ‘Terminal Dwell’), increased train weight (more tonnage per railcar), and other factors are all driving Norfolk Southern’s operating ratio lower and thus its operating margins higher.

Image Shown: Norfolk Southern is seeking margin expansion through operational improvements on and off the railroad. Image Source: Norfolk Southern – First quarter 2019 IR presentation

This is an area where we give Norfolk Southern a lot of credit because for the most part, these are organic improvements with long-lasting implications for its intrinsic value. However, we still view Norfolk Southern shares are very generously valued as of this writing, with NSC trading well above the upper end of our range of potential values for the company. We aren’t optimistic on the long-term trajectory of the coal industry either domestically or abroad, particularly as it relates to power generation.

Where Norfolk Southern is Struggling

As mentioned previously, Norfolk Southern’s net debt position is a problem. The company’s $0.4 billion cash balance at the end of March 2019 less total debt of $11.4 billion gives Norfolk Southern a net debt load of $11.0 billion, hefty for a company that generated $1.8 billion in free cash flow (defined as net operating cash flow less property additions) last year while spending $0.8 billion on dividend payments and $2.8 billion on share buybacks. As Norfolk Southern’s current shares are very richly valued, in our view, we would be far more supportive of management allocating funds to debt reduction. Instead, buybacks have been pursued at inopportune times leading to net debt accumulation (as was the case in 2018). Buybacks have been aggressively ramped up in recent years.

Norfolk Southern’s ‘Coal’ segment accounted for over 15% of its first quarter revenues and 16% of its full-year 2018 sales. A key excerpt from its 2018 annual report:

“Revenues from coal accounted for 16% of our total railway operating revenues in 2018. We handled 115 million tons, or 1.0 million carloads, in 2018, most of which originated on our lines from major eastern coal basins, with the balance from major western coal basins received via the Memphis and Chicago gateways. Our coal franchise supports the electric generation market, serving approximately 70 coal generation plants, as well as the export, domestic metallurgical and industrial markets, primarily through direct rail and river, lake, and coastal facilities, including various terminals on the Ohio River, Lamberts Point in Norfolk, Virginia, the Port of Baltimore, and Lake Erie.”

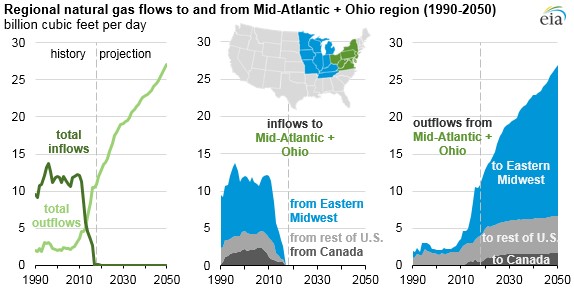

We aren’t optimistic on the long-term trajectory of coal as a source of fuel for electricity generation, especially in America which is currently awash in natural gas. Norfolk Southern caters to states that are major coal consumers, but as you can see in the chart below from the U.S. Energy Information Administration, natural gas is aggressively stealing away coal’s market share. The Marcellus and Utica shale plays in Appalachia (namely Ohio, Pennsylvania and West Virginia) have witnessed enormous natural gas production growth since 2010 due to the fracking boom. Surging gas production has heavily depressed natural gas prices both regionally and nationwide. In particular, note the rising volumes to the Eastern Midwest which is home to several major coal consuming states. Take a look at the pictures from the U.S. EIA below that highlight this threat to Norfolk Southern’s business model.

Image Shown: The United States Energy Information Administration notes that a flood of Appalachian-sourced natural gas is coming to key coal consuming regions in the Eastern Midwest. Image Source: U.S. EIA

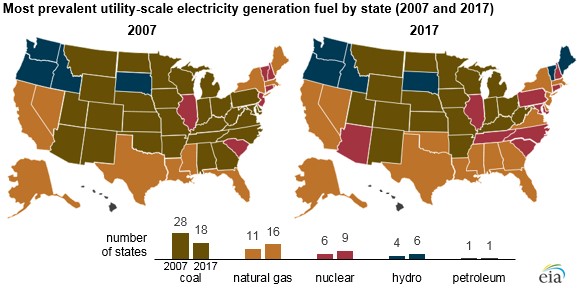

Image Shown: Natural gas is stealing market share away from coal as a fuel for electricity generation with an eye on the East Coast, Gulf Coast, and Midwestern markets. Image Source: U.S. EIA

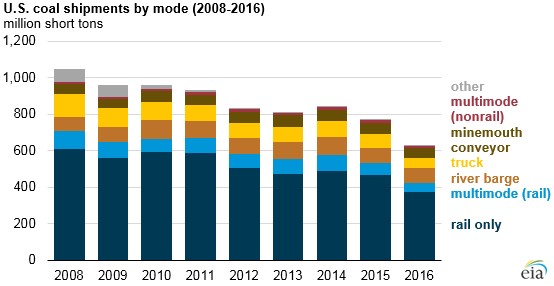

Note that natural gas overtook coal in Virginia and nuclear in New Jersey to become those state’s top type of fuel for electricity by 2017. The concern is that coal consumption will face tremendous downward pressure in states that Norfolk Southern caters to, especially in the Midwest, with coal exports not able to make up the difference. As natural gas as a fuel for electricity became more prevalent in America, total coal shipments began tanking. That includes coal shipped by rail. We view this as a long-term trend and one that’s very unlikely to change regardless of legislative or executive action, which would only have a short-term impact on this trajectory. Below is a look at the precipitous drop in American coal shipments.

Image Shown: Coal shipments in America have been on the decline for some time. Image Source: U.S. EIA

Keep in mind that this has an outsized influence on Norfolk Southern due to the company having a heavy presence in the aforementioned regions as you can see below:

Image Shown: Norfolk Southern’s operational footprint is heavily exposed to changes in the American Midwest’s coal consumption. Image Source: Norfolk Southern – 2018 Annual Report

What We Think

Here is a concise summary of what we see as Norfolk Southern’s key strengths from our two-page Dividend Report:

“Metrics at Norfolk Southern have been moving in the right direction the past few years, and its 2021 targets suggest it will keep the momentum rolling. It expects to move its operating ratio to 60% by 2021 (was ~65.4% in 2018) and is targeting capital spending as ~16%-18% of revenue (from ~19% in 2016). The company’s dividend policy may be attracting income investors more than its underlying fundamentals, however, and it is targeting a dividend payout ratio of ~33% in 2020. Norfolk Southern has a 135+ consecutive quarters of paying dividends, even as it buys back stock and allocates investment capital to growth projects. Its Dividend Cushion ratio isn’t the strongest, but management is committed to returning capital to shareholders.”

As we always say, no investment analysis is complete without looking at the downside risks involved as well. Here is a concise summary of how we view Norfolk Southern’s key weaknesses from our two-page Dividend Report:

“Norfolk Southern’s ~190-year history doesn’t mean it is immune to all challenges. A hefty tilt in its carloads to coal (15%+ of total railway operating revenues) will make for a challenging time as the commodity loses favor relative to cleaner and relatively abundant natural gas in the electric generation market, even as Trump works to reinvigorate the industry in the near term. The long-term viability of coal as an energy resource does not look favorable. Not unlike its peers, the company’s net debt load leaves a good deal to be desired, and while free cash flow generation has been robust, dividend obligations are not small. We’re expecting very modest growth in the payout, but investors should note the risks highlighted by its poor Dividend Cushion ratio.”

Furthermore, it’s important to take a look at the quality of the market the company is operating in. We like the railroad space:

“The railroad industry operates at a significant competitive advantage relative to motor transportation in that it can charge lower rates for long-haul bulk shipments (coal, grain, rock). Still, participants face competition from other railroads that operate parallel routes, from motor carriers that provide similar services, and from barges in routes close to inland and Gulf Coast waterways. Operating a railroad is a capital-intensive proposition, and participants face cost pressures from both union labor and fuel. Pricing and volume trends in commodity categories can be quite volatile from year to year. We like the group.”

Concluding Thoughts

Norfolk Southern is doing an excellent job improving its profitability, but we are very concerned with its high net debt load and exposure to the long-term decline in America’s coal market. While there could be upside through increased coal shipments for export, that strategy has its limits as its largely dependent on factors outside of Norfolk Southern’s control. Going forward, Norfolk Southern’s high debt load will inhibit its ability to keep increasing its quarterly dividend, but its strong free cash flow generation could enable management to chip away at that burden. We are not interested in the company at these levels.

Railroads: CNI, CSX, GWR, KSU, NSC, UNP

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.