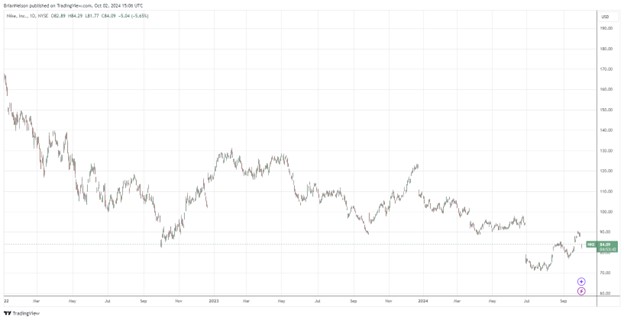

Image: Nike’s shares have been under pressure as the firm continues to underperform.

By Brian Nelson, CFA

On October 1, Nike (NKE) reported mixed first-quarter fiscal 2025 results, with revenue coming up short relative to the consensus estimate, while GAAP earnings per share came in ahead of what the Street was looking for.

The headline numbers for Nike weren’t great. First quarter revenue fell 10% on a reported basis, while Nike Brand and Nike Direct revenues dropped 10% and 13% on a reported basis, respectively. Wholesale revenues fell 8% on a reported basis, Converse sales fell 15% on a reported basis, while diluted earnings per share of $0.70 was down 26% year-over-year.

Nike is in the midst of a management transition with Elliott Hill returning to the company in the capacity of President and CEO effective October 14. Before retiring from Nike in 2020, “he was President – Consumer and Marketplace leading all commercial and marketing operations for Nike and Jordan Brand, including the P&L across the company’s four geographies.”

The outlook for Nike is murky at best, and the firm noted that its previously announced Investor Day is being postponed. As CFO Matthew Friend said in the press release, “A comeback at this scale takes time.” The company also withdrew full year guidance on the conference call:

Given our CEO transition and with three quarters left in the fiscal year, we are withdrawing our full year guidance. We intend to provide quarterly guidance for the balance of the fiscal year. This provides Elliott with the flexibility to reconnect with our employees and teams, evaluate the current strategies and business trends, and develop our plans to best position the business for fiscal ’26 and beyond. To that end, we have also decided to postpone our Investor Day.

Nike ended the first quarter of fiscal 2025 with $10.3 billion in cash and short-term investments and $9 billion in short- and long-term debt. Inventories were $8.3 billion, down 5% compared to the prior year. Nike continues to be shareholder-friendly, returning $1.8 billion to shareholders during its first quarter of fiscal 2025, consisting of $558 million in dividends and $1.2 billion in share repurchases.

Looking to the second quarter of fiscal 2025, Nike expects revenue to be down in the 8%-10% range and gross margins to be down roughly 150 basis points, pointing to higher promotions and channel mix headwinds. Though Nike has a storied brand, unmatched by rivals, it has fallen on difficult times, and we’re staying on the sidelines with respect to shares. Shares yield 1.7% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.