Image Shown: Shares of Nike Inc are on an upward climb again after dropping significantly from November 2021 to March 2022.

By Callum Turcan

On March 21, Nike Inc (NKE) reported its third quarter earnings for fiscal 2022 (period ended February 28, 2022) that beat both top- and bottom-line estimates. Shares of Nike are trading around ~$135 as of this writing, near our fair value estimate of $139 per share, after dropping significantly from November 2021 to March 2022. The company’s stock shot up initially after its latest earnings report was made public as Nike indicated it was getting a better handle on its supply chain issues, which have made keeping up with robust consumer demand quite difficult of late.

Earnings Update

In the fiscal third quarter, Nike’s GAAP net revenues grew by 5% year-over-year to reach $10.9 billion. The company’s revenues were supported by growth in North America (up 9%), Europe, the Middle East & Africa (up 7%), and Asia Pacific & Latin America (up 11%), which offset declines in the Greater China region (down 5%) last fiscal quarter. Sales growth at Nike’s apparel (up 9%) and equipment (up 32%) offerings came in quite strong last fiscal quarter, while sales of its footwear (up 2%) offerings posting modest growth.

The company’s GAAP gross margin rose by ~100 basis points year-over-year in the fiscal third quarter to reach 46.6%. Beyond Nike’s brand power and pricing strength, a big part of this increase had to do with its direct-to-consumer (‘D2C’) and digital initiatives as these efforts are allowing Nike to bypass wholesalers and reduce its promotional pricing activity. NIKE Direct sales were up 15% year-over-year and NIKE Brand Digital sales were up 19% year-over-year last fiscal quarter. Additionally, its digital platforms allow Nike to better tailor its marketing campaigns to its core customers as the firm can build a closer relationship with the consumer.

We appreciate that Nike has been able to grow its GAAP gross margins in the face of sizable inflationary and supply chain headwinds. Nike noted that rising freight and logistics costs were significant headwinds to its margin performance last fiscal quarter, though growth in its digital and D2C operations combined with a higher product mix of full-priced sales more than offset those headwinds.

Looking ahead, sharp increases in fuel expenses may continue to weigh negatively on Nike’s margin performance in the form of additional increases in its freight and logistics expenses. Furthermore, inflationary headwinds are also driving up the cost of key commodities used to produce its apparel, footwear, and equipment. Nike will need to continue investing heavily in its digital and D2C operations to stay ahead of these hurdles.

Due to sharp increases in its operating expenses (up 13%), Nike’s GAAP operating income declined by 3% year-over-year last fiscal quarter. Over the past two years, Nike’s operating expenses were held down by the coronavirus (‘COVID-19’) pandemic. For reference, Nike’s total operating expenses in the third quarter of fiscal 2021 (period ended February 28, 2021) declined by 7% year-over-year due in large part to an 18% decline in its ‘demand creation expense’ (marketing spend). Nike’s operating expenses are ‘normalizing,’ which will create noise on a year-over-year comparison basis.

The firm’s GAAP net income declined by 4% year-over-year last fiscal quarter due in part to its GAAP operating income shifting lower and in part due to a meaningful increase in its corporate income tax provision. Overall, Nike’s underlying business continues to perform well and is trending in the right direction, though there are key hurdles to keep an eye on.

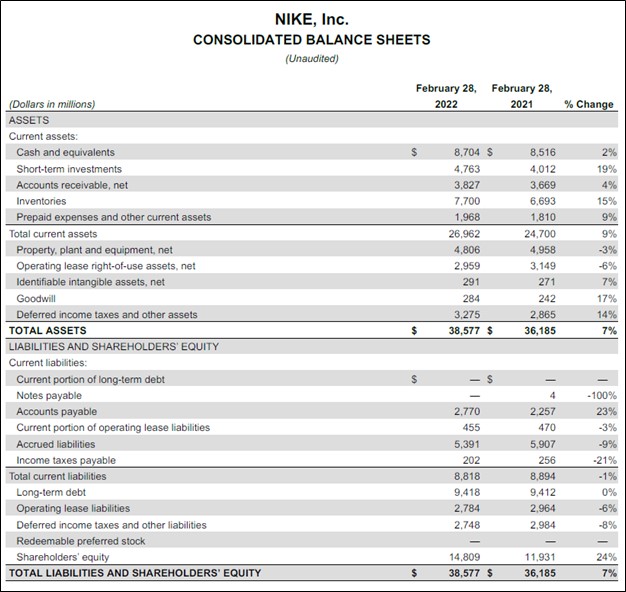

At the end of February 2022, Nike had a net cash position of $4.0 billion with no short-term debt on the books. Its pristine balance sheet is an immense source of strength during these harrowing times. Please note that Nike also had $3.2 billion in short- and long-term operating lease liabilities combined on the books at the end of this period.

Image Shown: Nike has a nice net cash position on hand. Image Source: Nike – Third Quarter of Fiscal 2022 Earnings Press Release

Nike has not yet published its 10-Q SEC filing covering the fiscal third quarter as of this writing. In fiscal 2021 (period ended May 2021), Nike generated $6.0 billion in free cash flow while spending $1.6 billion covering its dividend obligations along with another $0.6 billion buying back its stock. The company’s dividend growth runway is immense and supported by its pristine balance sheet. Nike has a nice dividend growth track record and shares of NKE yield ~0.9% as of this writing.

Supply Chain Hurdles Manageable

Last calendar year, the COVID-19 pandemic forced numerous factories in Vietnam to shut down. Vietnam is a major producer of apparel and footwear, and a key part of Nike’s supply chain. Here is what we had to say on the issue in our December 2021 article Nike Beats Estimates in the Face of Supply Chain Constraints (link here):

Factories in Vietnam and elsewhere shut down starting in the summer of 2021 to prevent the spread of COVID-19, a shutdown that lasted several months. According to Nike’s latest annual report: “For fiscal 2021, contract factories in Vietnam, Indonesia and China manufactured approximately 51%, 24% and 21% of total NIKE Brand footwear, respectively.” In the short term, there was not much Nike could do to replace lost production capacity in Vietnam (which accounts for over half of its production capacity of Nike-branded footwear). According to Reuters, it took until November 2021 for production activities in Vietnam to ramp back up to more normalized levels.

At the end of February 2022, Nike’s inventories stood at $7.7 billion, up 15% year-over-year. Here is what Nike’s management team had this to say on the issue during the company’s latest earnings call (emphasis added):

“Marketplace demand continues to significantly exceed available inventory supply, with a healthy pull market across our geographies. When inventory supply is available in region, we are quickly moving it to the appropriate channels to serve consumer demand…

All factories in Vietnam are operational, with total footwear and apparel production in line with pre-closure volumes and our forward-looking demand plans. Nearly all of our supplier base is operational without restrictions, and we are working closely with our partners around the world to navigate through the most recent risks related to COVID.

Inventory supply in our geographies is beginning to improve from here. Transit times, however, remain elevated. And in the case of North America, transit times in the third quarter have worsened. We have taken numerous actions to address these challenges, and in many cases, to protect against lead times increasing even further.” — Matt Friend, EVP and CFO of Nike

Nike is doing its best to navigate supply chain hurdles, though it will take some time for its inventory levels and transit times to normalize. Growth in its inventories will weigh negatively on its free cash flow performance in the near term.

Great Shareholder Value Generator

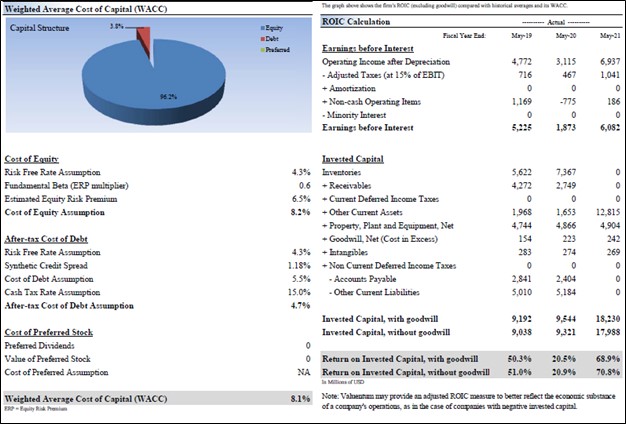

The company is a tremendous generator of shareholder value, as defined as Nike’s return on invested capital (‘ROIC’) exceeding its estimated weighted-average cost of capital (‘WACC’). Nike provides an overview of its ROIC performance, in the view of the company, during the trailing twelve month period ended February 2022 as one can see in the upcoming graphic down below.

Image Shown: Nike’s ROIC is impressive. Image Source: Nike – Third Quarter of Fiscal 2022 Financial Schedules & Key Financial Metrics

According to our calculations, Nike’s estimated WACC stands at 8.1% and its historical ROIC performance has been exceptional as one can see in the upcoming graphic down below. Looking ahead, we forecast that Nike’s ROIC ex-goodwill will continue to significantly exceed its estimated WACC. The company will continue to be a tremendous generator of shareholder value going forward, in our view, and for that reason Nike earns a “VERY ATTRACTIVE” Economic Castle rating.

Image Shown: Nike is a tremendous generator of shareholder value (its historic ROIC ex-goodwill > estimated WACC) and we expect that will continue being the case going forward. Image Source: Valuentum, with data from Nike

Concluding Thoughts

Nike is holding its own in the face of major exogenous headwinds. The firm’s pivot towards D2C and digital sales are having a powerful impact on its business and underlying financial performance. We appreciate that Nike is a stellar generator of shareholder value, though we caution that inflationary headwinds and supply chain hurdles loom large over its near term outlook, as does the Ukraine-Russia crisis due to rising fuel expenses and the risk that portions of the global economy (particularly developing and emerging markets) may enter a recession. We continue to be bullish on U.S. equities and the domestic economy.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for NKE, ADDYY, LULU, DKS, FL, SPWH, HIBB, UA, UAA, FXI, MCHI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, XLE and is long call options on DIS and FB. Berkshire Hathaway Inc Class B shares (BRK.B), Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.