Image Shown: Shares of Republic Services Inc have held up quite well over the past several months while equity markets swooned lower.

By Callum Turcan

On May 5, Republic Services Inc (RSG) reported first quarter 2022 earnings that beat both consensus top- and bottom-line estimates. The waste management firm is benefiting from its immense pricing power and volume growth. We continue to like Republic Services as an idea in both the Dividend Growth Newsletter and ESG Newsletter portfolios. Shares of RSG yield ~1.4% as of this writing.

Earnings Update

In the first quarter, Republic Services generated $3.0 billion in GAAP revenues (up 14% year-over-year). Please note that Republic Services defines its average yield “as revenue growth from the change in average price per unit of service” and that metric stood at 4.2% last quarter. Additionally, the company defines its core price “as price increases to our customers and fees, excluding fuel recovery fees, net of price decreases to retain customers” and that metric stood at 6.0% in the first quarter. Strong average yield and core price performance combined with a nice uplift from volume growth enabled Republic Services to generate meaningful revenue growth.

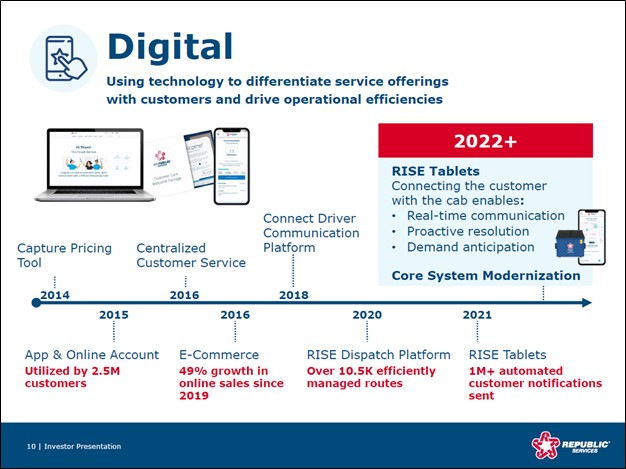

Pivoting to its profitability levels, Republic Services reported $561 million in GAAP operating income (up 14% year-over-year) in the first quarter. Past digital investments (please see the upcoming graphic down below), economies of scale, and its pricing power were key to enabling Republic Services to maintain its margins in the face of sizable inflationary hurdles. Its GAAP diluted EPS hit $1.11 last quarter, up from $0.93 in the same period a year earlier.

Image Shown: An overview of some of Republic Services’ digital initiatives. Image Source: Republic Services – March 2022 IR Presentation

Republic Services has a stellar cash flow profile as the firm notes that around 80% of its revenues have an annuity-like profile, a product of the essential services that it provides for its customers. In the first quarter of this year, the company generated $372 million in free cash flow, spent $146 million covering its dividend obligations, and another $204 million buying back its stock. Republic Services exited March 2022 with a net debt load of $9.6 billion (inclusive of short-term debt, exclusive of restricted cash and marketable securities), which is a concern, though we view that burden as manageable given its strong and stable cash flow profile.

Acquisitions are a core part of Republic Services’ growth strategy, and the firm closed on its $2.2 billion deal to acquire US Ecology in May 2022. The acquisition added specialty waste landfills, treatment, storage and disposal facilities, wastewater treatment facilities, and various service facilities to Republic Services’ operations with ample geographical overlap. We like the deal, which is expected to generate $40 million in annualized cost savings within three years of closing, and covered our thoughts on the acquisition in a February 2022 article (link here).

New Biogas Facilities

On the same day that Republic Services provided its first quarter earnings update, the company noted it had secured a major deal with Archaea Energy Inc (LFG). The two companies are creating a joint venture that will see Archaea Energy develop 39 renewable natural gas (‘RNG’) projects at Republic Services’ landfills in 19 states. Part of this joint venture involves Archaea contributing $0.8 billion and Republic Services contributing $0.3 billion over the next five years to develop these RNG projects.

Construction is slated to begin late this year, with development and commissioning activities expected to last through 2027. When fully operational, these facilities are expected to generate over 12.5 million mmBtu (million British Thermal units) of RNG per year (equal to over 34,000 mmBtu of RNG per day). These endeavors fit in with Republic Services’ plan to enact sustainable business practices in an economically feasible manner.

Here is what Republic Services’ management team had to say on the joint venture during the company’s latest earnings call (emphasis added):

“[On May 5], we announced our joint venture with Archaea to develop 39 renewable natural gas projects that are landfills. These projects generate attractive returns and accelerate achievement of our ambitious 2030 sustainability goal of increasing biogas for beneficial reuse by 50%. The projects are expected to come online between 2023 and 2027, at which point approximately 70% of our total landfill gas collected will be beneficially reused.

This joint venture together with our 17 landfill gas to energy projects under development are expected to generate approximately $100 million of incremental EBITDA. We continue to be recognized for our commitment to sustainability, Republic Services was named a Barron’s 100 Most Sustainable Companies list for the fourth time.” — Jon Vander Ark, President and CEO of Republic Services

Archaea Energy bills itself as one of the largest producers of RNG in the US and has extensive experience in this space, as does Republic Services which has its own biogas and RNG operations. We like the creation of the joint venture. Going forward, we will be keeping a close eye on how the development progresses.

Concluding Thoughts

While equity markets have swooned lower in recent months, shares of Republic Services have held up incredibly well. The company has a bright cash flow growth outlook that is supported by its pricing power, irreplaceable asset base, economies of scale, ongoing digital initiatives, potential volume growth (as the US economy and population continues to grow), and its strategy of pursing bolt-on acquisitions to further enhance its business model. We are huge fans of Republic Services.

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Related: LFG

Tickerized for RSG, WM, WCN, CWST, SRCL, EVX, USMV, CLH, CVA, DAR, VEOEY, SZEVY, ENGIY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT), and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Republic Services is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.