No changes to newsletter portfolios

By Brian Nelson, CFA

There’s a lot of news out on the first day of March 2019. Tesla’s (TSLA) big reveal was that it will be moving strictly to online purchases in a cost-savings move and that it now has the efficiencies in place to roll out a more-affordable $35,000 Model 3. We’re excited about the development, but we have to admit that we’re still skeptical of the company’s long-term success given the fierceness of the competitive environment, not the least of which is the electronic line-up at General Motors (GM), which remains an idea in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. As it relates to other news, Gap (GPS) is rising on the trading session March 1 on an announcement that it will spin off Old Navy, and eBay (EBAY) is catching a bid after issuing news that it will be pursuing a strategic review. Years ago, we thought Yahoo should have combined with eBay. We continue to enjoy the performance of its split-off PayPal (PYPL) in the Best Ideas Newsletter portfolio. We’re not looking back. As we wrap up this Friday morning note, I wanted to bring your attention to three earnings reports below.

Stericycle Is On the Road to Recovery

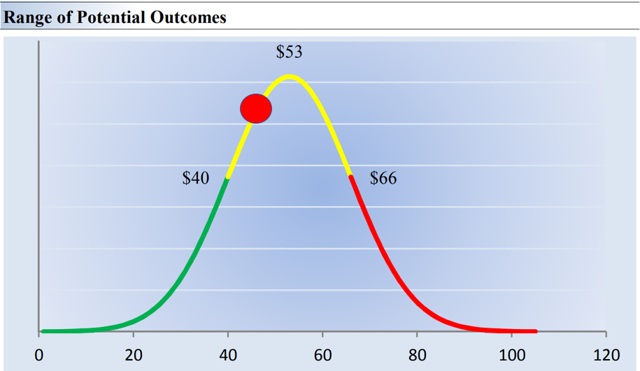

Image shown: The red dot denotes where shares of the company are trading. If it falls on the green part of the fair value estimate distribution, we think shares are undervalued. If it falls on the yellow part of the fair value estimate distribution, we think shares are fairly valued, and if it falls on the red part of the fair value estimate distribution, we think shares are overvalued (as of the time of this publishing).

Stericycle (SRCL), once the darling of the waste management business, has fallen under some more challenging times as it works to regain customer trust. During the fourth quarter of 2018, results released February 28, revenue fell 4%, while organic sales declined by more than 1%. Declines in its small quantity medical waste business continue to hurt. Adjusted earnings per share increased a modest 3%, and most of that was driven by favorable taxes. For 2019, adjusted diluted earnings per share is targeted in the range of $3.32-$3.72, which puts the company at just 12 times adjusted earnings. The worst may be over for Stericycle, but we think it has a long way to go before regaining customer trust.

Foot Locker’s Comparable Store Sales Are Fantastic

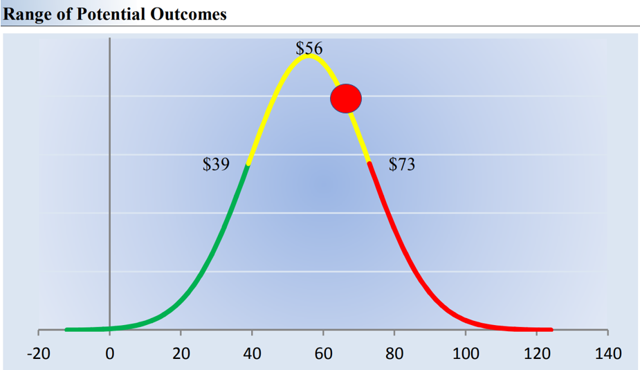

Image shown: The red dot denotes where shares of the company are trading. If it falls on the green part of the fair value estimate distribution, we think shares are undervalued. If it falls on the yellow part of the fair value estimate distribution, we think shares are fairly valued, and if it falls on the red part of the fair value estimate distribution, we think shares are overvalued (as of the time of this publishing).

Foot Locker (FL) released fourth-quarter 2018 results March 1, and they were mighty impressive. Fourth-quarter comparable sales advanced a very impressive 9.7%. The company’s focus on delivering “compelling assortments” to customers is paying off, and its collaborations with strategic partners is certainly helping. For 2019, the company is targeting a mid-single-digit comparable sales gain and a double-digit advancement in earnings per share. We like Foot Locker, and we think our fair value estimate has some upside, but shares aren’t necessarily cheap.

Innovation Has Made Monster a Winner But Shares Aren’t on Sale

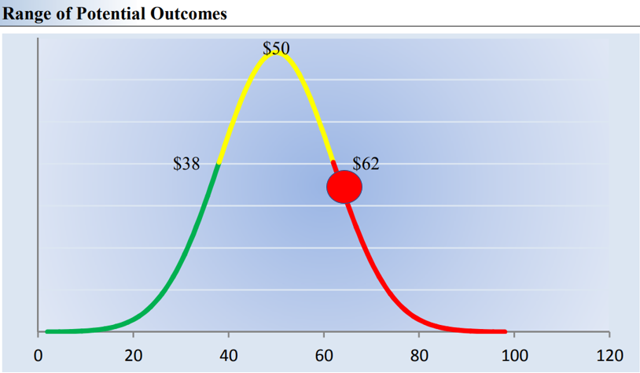

Image shown: The red dot denotes where shares of the company are trading. If it falls on the green part of the fair value estimate distribution, we think shares are undervalued. If it falls on the yellow part of the fair value estimate distribution, we think shares are fairly valued, and if it falls on the red part of the fair value estimate distribution, we think shares are overvalued (as of the time of this publishing).

I have to admit that yours truly (Brian) is a big fan of Monster Beverage (MNST). Ever since my days playing college baseball, I’ve enjoyed the company’s energy drinks. Back then, I used to love the “green” ones, but the company’s innovation has had me trying all sorts of different flavors. At the moment, I’m a huge fan of the ultra violet version, and I’m even buying bulk through Sam’s Club (WMT). In any case, Monster put up an excellent fourth-quarter 2018 report February 27, which showed net sales advancing more than 14% and net income increasing nearly 19%. The company’s strategic relationship with Coca-Cola (KO) is paying off big time, in our view. Shares aren’t cheap, however.

Have a nice weekend!

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.