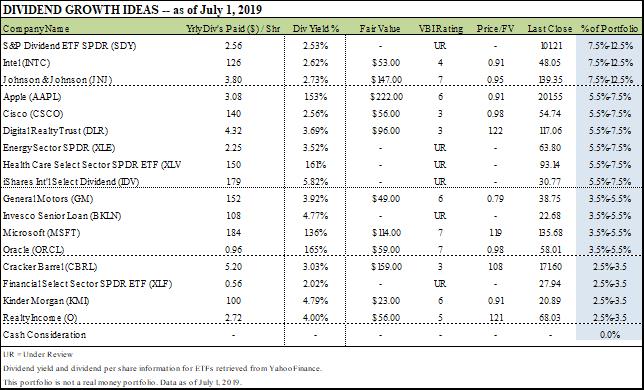

Image shown: Valuentum’s Dividend Growth Newsletter portfolio. Since inception, the newsletter portfolio has *never* had a constituent that experienced a dividend cut. We moved to weighting ranges beginning in 2018.

“The less the prudence with which others conduct their affairs, the greater the prudence with which we must conduct our own.” – Warren Buffett (2018)

By Brian Nelson, CFA

While others are celebrating, we know better. This market could come down upon itself like nothing else. But for now. We breathe a sigh of relief. A company, Valuentum, that emphasizes the importance of timing and then delivers on that cold December 26 day to move to all-in in the newsletter portfolios is something remarkable (see image below). We cannot go back to the fateful time, some 20%+ ago now, but we can learn from it. This bull market is not going down without a fight.

The political environment seems nothing less than a circus these days, and it is only being amplified by social media. As I write in Value Trap, I couldn’t have envisioned a Republican President winning again for many a term after Barack Obama, but here we are with President Trump at the helm. Not only that, but he was able to push through corporate tax cuts, has the 10-year falling, and is working aggressively to right trade deals. That’s the trifecta, and he’s pretty close to hitting it.

—

The combination of lower corporate tax rates and a reduced 10-year benchmark rate almost always translates into higher equity values, holding all else equal, of course. But how high is too high, or how high is about right. For starters, we know that equity values are not bargains at current levels. The forward 12-month P/E ratio on S&P 500 companies (SPY) is 16.6x, above the 10-year average of 14.8x. That doesn’t mean stocks are terribly expensive either. The 10-year benchmark rate is a huge lever to intrinsic value, and it fell below 2% recently after advancing to almost 3.25% in November.

—

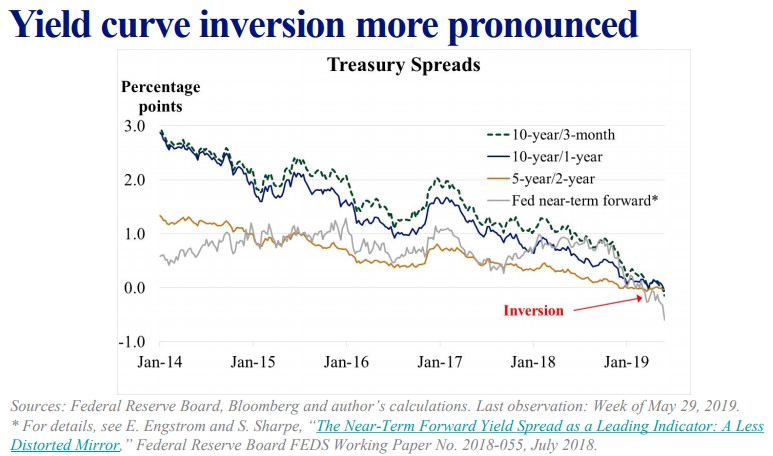

Most bloggers have been pointing to economists’ inability to predict the trajectory of the discount rate, but we didn’t make any moves with our valuation infrastructure. Anybody that is trading valuations on benchmark Treasury rates is going to get whipsawed. What we do know is that not even the Fed has an answer for this market environment. With unemployment so low, inflation tame, the markets at new highs, how in the world can the Fed be looking to cut rates. But they are, and therein lies the rub. The behavioral implications of an inverted yield curve may be more catastrophic than an inverted yield curve itself. Regardless, yield curve inversion has only become more pronounced since we last spoke.

Image Source: Federal Reserve, St. Louis

—

When it comes to risks, there’s more than just the inverted yield curve, of course. Trade negotiations with China continue, de-nuclearization talks with North Korea are ongoing, and companies continue to buy back stock at a record pace (is this stealth value-destruction?). The good thing is that the banks appear healthy, save for Deutsche Bank (DB) and some weaker European entities, and while geopolitical tensions with Iran can never be a good thing, it seems that cooler heads are prevailing.

—

As we said on that fateful December day last year when we went to 0% cash in the newsletter portfolios, where we nearly called the exact near-term bottom, our finger remains on the put-option trigger. We may look to remove a few ideas in the coming months if the markets continue to accelerate higher, but we’re going to continue to stay fully invested in the Dividend Growth Newsletter portfolio for the time being. We’re taking Warren Buffett’s quote about prudence to heart. A lot of people just aren’t paying attention to their investments these days (as many as 80% of the market may be on autopilot, either passive or in quant).

—

Aside from our REIT exposure, June was a very strong month for the Dividend Growth Newsletter portfolio. We really like Cracker Barrel’s (CBRL) move (see page 6 in the pdf file below), and our diversification with the Energy Select Sector SPDR (XLE) was quite savvy. Things are lining up pretty well, in our view. We hope you enjoy this edition of the Dividend Growth Newsletter!

—

Download here (pdf).

—

Thank you!

—

The Valuentum Team

valuentum.com/

—

Tickerized for stocks in the Dividend Growth Newsletter portfolio.

—

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum‘s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.