Image Source: Netflix

By Brian Nelson, CFA

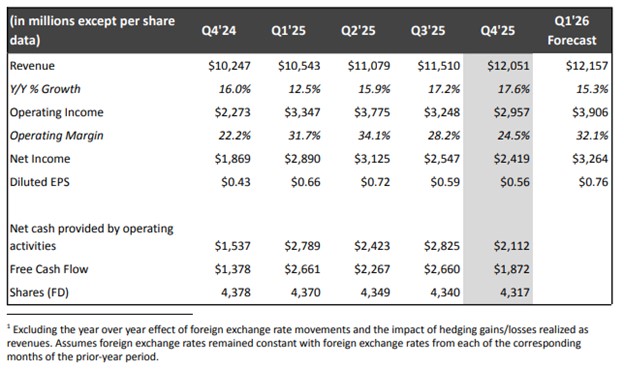

On January 20, Netflix (NFLX) reported fourth quarter results that came in better than expected on both the top and bottom lines. In the period, revenue increased 17.6% year-over-year, while the firm crossed the 325 million paid membership milestone. Operating income increased 30% year-over-year, with its operating margin increasing roughly 230 basis points. Net income came in at $2.4 billion versus $1.9 billion in the year-ago period and diluted earnings per share came in at $0.56 versus $0.43 in the year-ago period. Free cash flow was $1.9 billion in the quarter, up from $1.4 billion in last year’s period.

The results were driven by membership growth, higher pricing, and increased ad revenue. Management noted that revenue was 1% above its guidance due to stronger-than-forecasted membership growth and ad sales. For all of 2025, Netflix grew revenue 16%, to $45 billion, and it increased its operating margin to 29.5%, up from 26.7% in 2024. Management noted that ad revenue grew by more than 2.5x versus 2024 to over $1.5 billion.

Looking to 2026, Netflix is forecasting revenue of $50.7-$51.7 billion, reflecting 12%-14% year-over-year growth thanks to “increases in membership and pricing plus a projected rough doubling of ad revenue in 2026 versus 2025.” The firm is targeting an operating margin of 31.5% on the year, up from 29.5% in 2025, the 2026 measure including roughly $275 million of acquisition-related expenses. Many were expecting a stronger guide when it came to margins, and uncertainty regarding its pursuit of Warner Bros. Discovery (WBD) continues. We remain on the sidelines.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.