Image Source: Vertex Pharma

By Brian Nelson, CFA

There are two primary sources of cash-based intrinsic value that we focus on at Valuentum—net cash on the balance sheet and future expectations of free cash flow. Best Ideas Newsletter portfolio holding Vertex Pharma (VRTX) ended 2022 with $10.78 billion in cash and cash equivalents and no debt, while cash flow remains robust. For example, during the first nine months of 2022, the company hauled in $3.05 billion in cash flow from operations and only shelled out $171.1 million in capital spending. That speaks to a hugely cash generative operation.

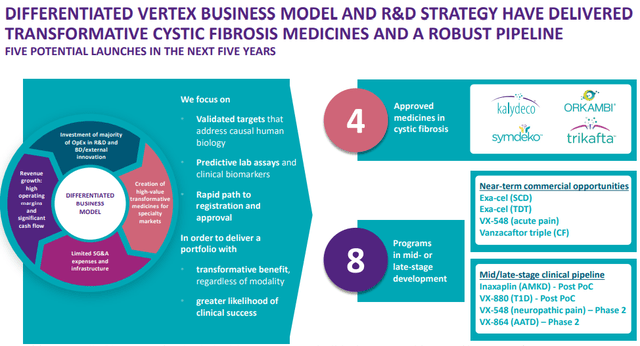

As a biotech play, Vertex Pharma offers investors the best of both worlds, in our view: 1) It’s an established, net-cash-rich player with a commercialized cystic fibrosis (CF) franchise that generates tremendous free cash flow, and 2) it has long-term upside potential with respect to its developmental pipeline that includes exposure to CRISPR gene-editing technology and non-addictive pain management medicine. At the moment, CF remains Vertex’s bread-and-butter revenue generator, and it has a near-monopoly with four CF approved treatments that are used by the majority of people diagnosed with CF across North America, Europe and Australia.

Image Source: Vertex Pharma

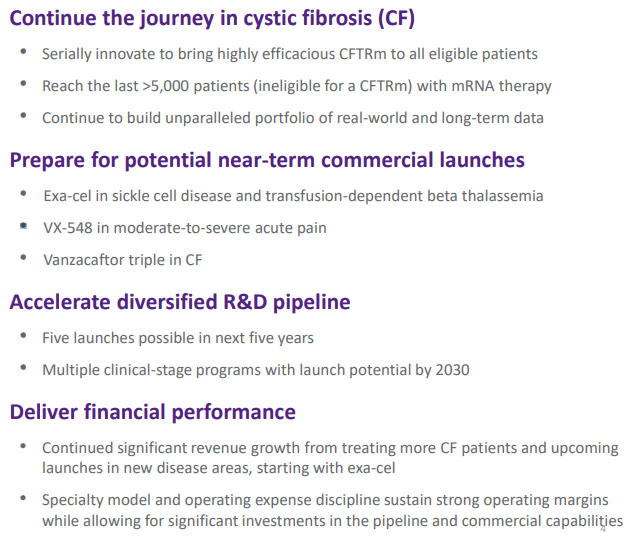

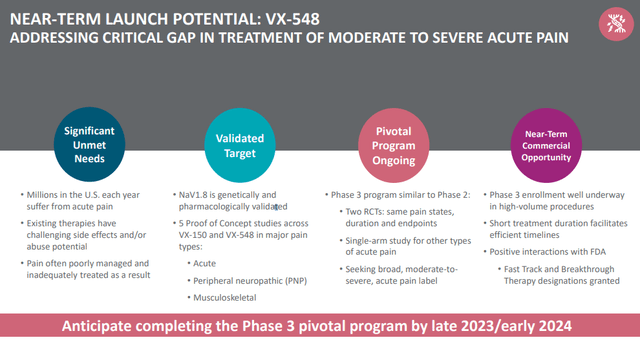

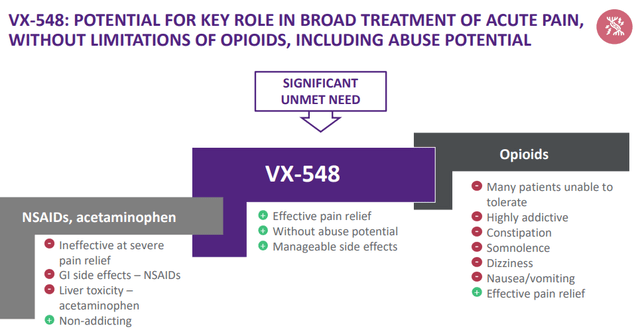

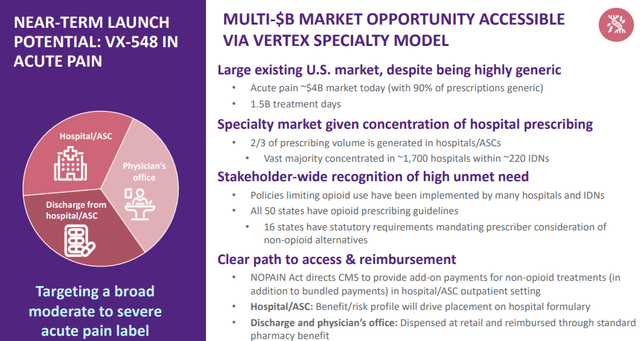

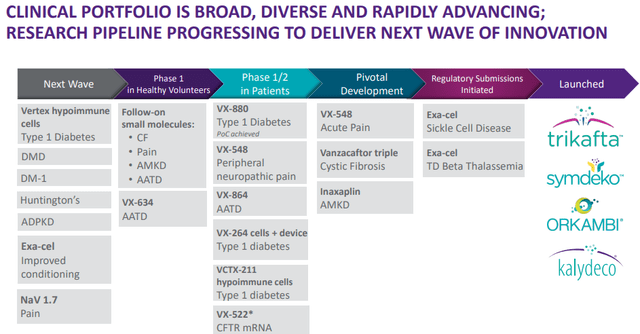

Vertex Pharma’s pipeline continues to advance, too. The company is pushing forward with new enhancements to CF treatments, and it is evaluating the use of CRISPR gene-editing technology with respect to beta thalassemia and sickle cell disease. We’re excited about Vertex’s work in pain management, too, “Best Biotech Idea Vertex Pharma Outperforming Struggling Peers, Its New Treatment for Pain a Game Changer in the Fight Against the Opioid Epidemic.” Other areas of focus include kidney disease, Type 1 Diabetes, Antitrypsin Deficiency, and Duchenne Muscular Dystrophy. All told, however, we’re most excited about the company’s potential to create a new class of non-addictive pain medicine (VX-548) that could be a game-changer in the fight against opioid abuse.

Image Source: Vertex Pharma

Image Source: Vertex Pharma

Image Source: Vertex Pharma

During 2022, Vertex’s revenue advanced 18% while non-GAAP net income jumped 53% as its TRIKAFTA/KAFTRIO combination experienced a “rapid uptake” in several countries and the company experienced continued strength in TRIKAFTA in the U.S. In conjunction with the launch of a new $3 billion share repurchase program, Vertex also released strong 2023 product revenue guidance in the range of $9.55-$9.7 billion, up from $8.93 billion in 2022 and $7.57 billion in 2021. Here’s more about what is embedded in the company’s outlook for 2023:

Vertex’s CF product revenue guidance includes expectations in the U.S. for continued performance of TRIKAFTA in ages 6+ and approval and launch of TRIKAFTA in the 2-5 age group, as well as continued uptake of KAFTRIO/TRIKAFTA in ages 6+ in countries outside the U.S., including those with recent reimbursement agreements. This guidance includes an approximately 150-basis-point negative impact from changes in foreign currency rates, inclusive of our foreign exchange risk management program. Vertex’s combined Non-GAAP R&D, Acquired IPR&D and SG&A expense guidance includes expectations for continued investment in our multiple mid- and late-stage clinical development programs, commercial and manufacturing capabilities, and approximately $300 million of upfront and milestone payments from existing collaborations and our anticipated transaction with Entrada Therapeutics (TRDA).

Image Source: Vertex Pharma

We’re huge fans of Vertex Pharma. We love its net-cash-rich balance sheet, strong free-cash-flow generating capacity and lucrative and established CF franchise. We also like its long-term potential in CRISPR gene-editing technology and pain management alternatives to opioids and believe the company has other opportunities that may eventually reach commercialization across its pipeline. Our fair value estimate of Vertex Pharma stands at $320 per share, and we continue like the company as our primary biotech exposure in the Best Ideas Newsletter portfolio.

Vertex Pharma’s 16-page Stock Report >>

Tickerized for VRTX, RPRX, MRNA, CRSP, TRDA, IBB, XBI

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.