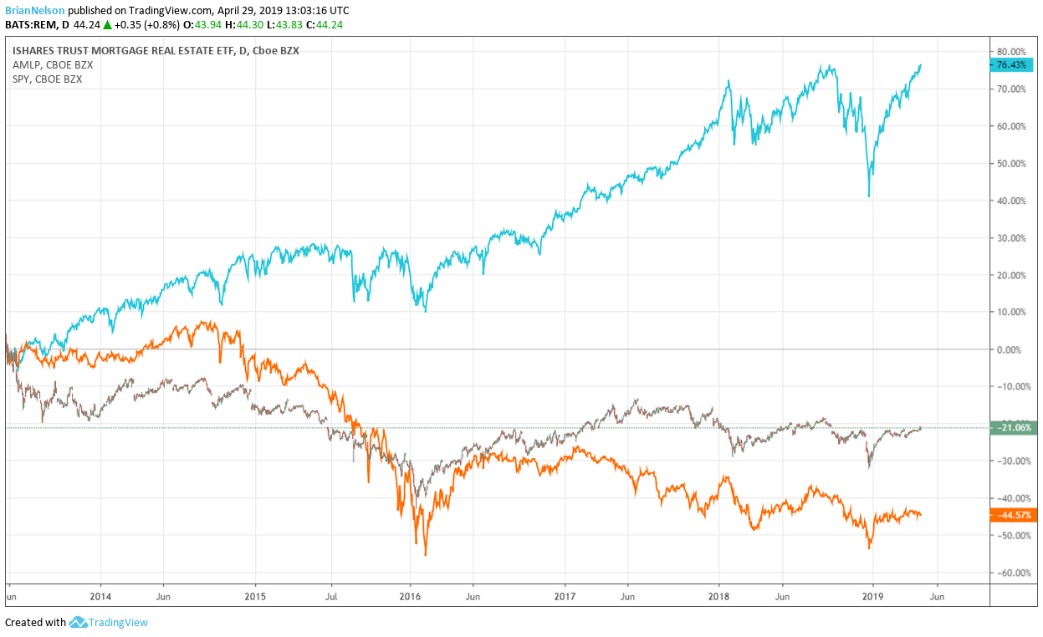

Image: Since late May 2013, mortgage REITs, as measured by the iShares Trust Mortgage Real Estate ETF (REM), middle, have fallen more than 20%, while the master limited partnership space, as measured by the Alerian MLP ETF (AMLP), has fallen by nearly 45%, bottom. Meanwhile, the S&P 500 (SPY) has rallied more than 75%, all on a price-basis, top.

By Brian Nelson, CFA

There’s nothing “safe” about mortgage REITs (REM). The industry caught a lot of attention with the high-profile performance of some of the larger players, including AGNC Investment (AGNC) and Annaly Capital (NLY), in years past, but the hype has fizzled out. Not only has the mortgage REIT industry vastly underperformed a broad market benchmark such as the S&P 500 during the past few years, but the industry is not easy for many to understand. Even a greater understanding of the space may not lead to investment success either. We think investors should continue to steer clear of the space, as we said in late May 2013. Excerpted from our May 2013 write-up:

The good times are over for mortgage REITs.

Mortgage market dynamics are inherently difficult to predict.

A flatter yield curve has negatively impacted net interest rate spread income across the entire mortgage REIT universe. We’re already seeing deteriorating gross ROE’s from some of the largest industry constituents.

The Fed has only caused a marginal tightening in mortgage spreads, and in our view, a marginal widening due to reduced Fed activity (if/when it happens) is perhaps the best-case scenario as it relates to spread income for the group. A continuation of spread tightening is likely the base-case scenario, which is negative for the group.

Net interest rate spread income and gross ROE’s will only be materially enhanced in the future through more risky dealings and increased leverage. Adding leverage is like “pulling the wool over investors’ eyes.” It’s a very, very low-quality way of bolstering returns relative to core net interest margin expansion.

The book value of some mortgage REITs will be punished regardless of what happens to interest rates. However, a rising interest rate environment can be devastating by causing other comprehensive losses (unrealized losses on investments marked to market) that will completely wipe out period spread income, causing rapid and uncomfortable declines in book value.

Dividend payments may not be sustainable under these conditions.

The issue with the mortgage REIT business model is rather straightforward. Many generate minute net interest spreads, and they have to throw on considerable leverage to create a leveraged net interest spread sufficient enough to generate economic value for shareholders. This means some can be leveraged as much as 6-8x, sometimes higher. But here’s the catch: Even if net spread income ROE is high, a mortgage REIT’s book value could still be eroded if it experiences other comprehensive losses as holdings are marked down. Here was our conclusion in late May 2013 that still is true today:

Though we admit mortgage market dynamics are inherently difficult to predict, we think the odds are stacked against many constituents in the mortgage REIT industry. Participants must deal with tightening interest rate spreads and deteriorating investment portfolios (book values) in the event of a rising interest rate environment. By extension, declining net asset values will pressure the capital decisions of industry constituents, and we would not be surprised if additional dividend cuts are around the corner. We continue to steer clear of the group.

Fast forward more than 6 years now, and the mortgage REIT industry continues to feel the pain. It’s hard to believe others can be bullish on this space, with Nomura, for example, launching coverage in late March with buy ratings on Annaly Capital, Redwood Trust (RWT), New Residential Investment (NRZ), Chimera Investment (CIM), PennyMac Mortgage (PMT), Dynex (DX), and New York Mortgage Trust (NYMT). The mortgage market dynamics are way too difficult to predict to have any sort of buy ratings, in our view.

One has to look no further than the news April 24 with AGNC Investment cutting its monthly dividend to $0.16 from $0.18, indicating that “with the Federal Reserve expected to hold short term rates steady and an even more dovish stance communicated by the European Central Bank, the LIBOR-repo rate funding dynamic that AGNC enjoyed throughout 2018 is unlikely to return to the previously favorable levels in the near term.” Income investors are simply playing with fire when they are considering the income stream of a mortgage REIT. We maintain our view that the best way to “play” this group is to stay as far away from it as possible.

Related MORL, MORT

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.