“…the Wealth Management and Investment Management segments…are the crown jewels at Morgan Stanley with returns on tangible equity of 37% and 36%, respectively, in the quarter. Flows are positive and market levels have been friendly, though that can change on a dime.” — Matthew Warren

By Matthew Warren

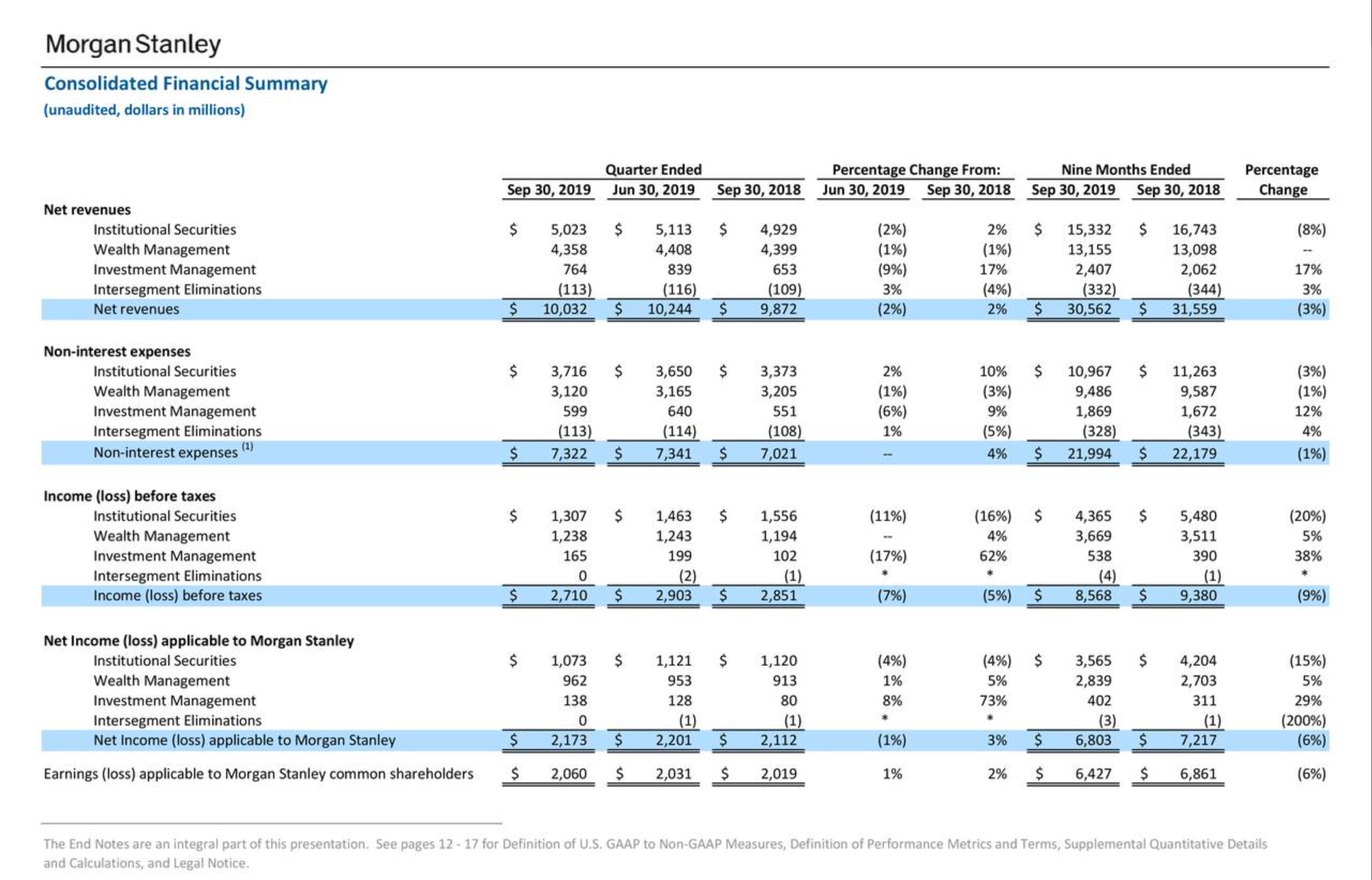

On October 17, Morgan Stanley (MS) reported third-quarter results. The bank posted revenue of $10.03 billion, which was up 1.62% versus last year and $405.3 million ahead of consensus. Earnings came in at $1.27 per share, up 9% from last year, and were 15 cents ahead of consensus. The bank’s efficiency ratio worsened to 73% from 71% last year, and it posted a return on equity (ROE) of 11.2% and return on tangible common equity (ROTCE) of 12.9% in the quarter. Morgan Stanley is very well capitalized with a common equity Tier 1 ratio of 16.2%.

Image Source: Morgan Stanley 3rd Quarter Earnings Presentation

Fixed income underwriting and sales and trading were a source of strength in the Institutional Securities Business, but all underwriting and sales and trading businesses are notoriously volatile from quarter to quarter and year to year, and the overall return on capital at 10% is lackluster indeed. It is the Wealth Management and Investment Management segments, however, that are the crown jewels at Morgan Stanley with returns on tangible equity of 37% and 36%, respectively, in the quarter. Flows are positive and market levels have been friendly, though that can change on a dime.

The most interesting discussion on the conference call was that Morgan Stanley’s management is expecting the Federal Reserve to alter its capital requirements for the firm with a greater focus on common equity Tier 1 ratio as opposed to a leverage ratio. The bank expects that the amount of capital it will be required to hold will be flat-to-down, though it wasn’t willing to speculate as to the degree of the expected change.

Needless to say, less capital would mean greater leverage, and a higher return on capital. Assuming the market agrees with the Fed that the new requirements suffice as to the amount of capital, then we would expect a higher return on equity and a higher price-to-book ratio as a result (as future expected economic returns would theoretically be higher). This would be a positive for the shares, though again we would emphasize that the magnitude of the change is altogether unknown at this stage.

We are maintaining our $45 fair value estimate for now.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.