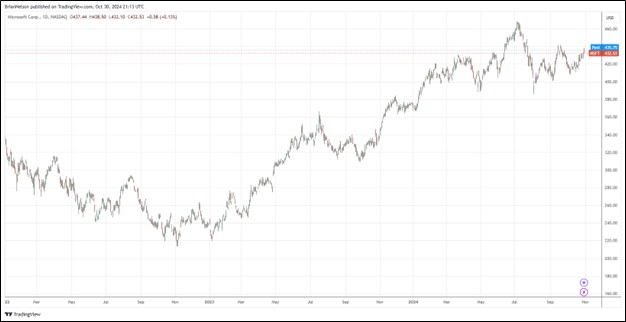

Image: Microsoft’s shares continue to flirt with all-time highs.

By Brian Nelson, CFA

On October 30, Microsoft (MSFT) reported excellent fiscal first quarter fiscal 2025 results, with both revenue and GAAP earnings per share coming ahead of the consensus forecast. In the quarter, revenue increased 16%, while operating income advanced 14%. Net income increased 11% (up 10% in constant currency) on a year-over-year basis, while diluted earnings per share of $3.30 was 10% higher than the year-ago period, beating consensus by $0.19. Management had the following to say about the quarter:

AI-driven transformation is changing work, work artifacts, and workflow across every role, function, and business process. We are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage. Strong execution by our sales teams and partners delivered a solid start to our fiscal year with Microsoft Cloud revenue of $38.9 billion, up 22% year-over-year.

Revenue in its Productivity and Business Processes division increased 12% (up 13% in constant currency), revenue in its Intelligent Cloud division increased 20% (up 21% in constant currency), while revenue in its More Personal Computing division increased 17%. In the first quarter of its fiscal 2025, Microsoft returned $9.0 billion to shareholders in the form of dividends and share repurchases. In the quarter, Azure and other cloud services increased 34% on a year-over-year constant currency basis.

Microsoft ended the quarter with $78.4 billion in cash and short-term investments against long-term debt of $42.9 billion. Cash flow from operations increased to $34.2 billion from $30.6 billion in the year-ago period, while capital spending swelled to $14.9 billion from $9.9 billion in the year-ago quarter. Free cash flow in the quarter of $19.3 billion handily covered cash dividends paid of $5.6 billion over the same time. Microsoft remains one of our top ideas in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.