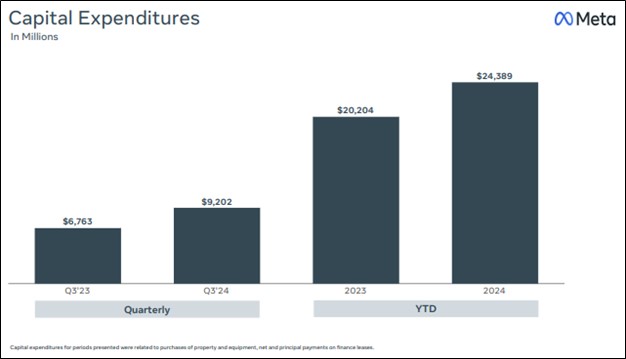

Image: Meta’s capital spending continues to be on the rise, but its free cash flow generation remains robust.

By Brian Nelson, CFA

Meta Platforms (META) reported better than expected third quarter results October 30 with revenue and GAAP earnings per share coming in better than expected. Revenue grew 19% on a year-over-year basis (20% on a constant currency basis), while its operating margin advanced ~3 percentage points. Net income increased 35%, while GAAP diluted earnings per share rose to $6.03, up 37% and beating the consensus expectation by $0.74.

Family daily active people [DAP] increased 5% year-over-year, while ad impressions delivered across its Family of Apps rose 7% year-over-year. Average price per ad increased 11% year-over-year. Total costs and expenses increased 14% year-over-year, while capital spending was $9.2 billion in the quarter, as the firm continues to invest heavily in its business. Free cash flow was $15.52 billion in the quarter, up from $13.6 billion in the year-ago quarter. Meta Platforms bought back $8.86 billion of its Class A common stock in the quarter and paid $1.26 billion in dividends.

Through the first nine months of the year, net cash provided by operating activities increased to $63.3 billion, up from $51.7 billion. Free cash flow for the first nine months was $39 billion, up from $31.5 billion in the year-ago period. Cash and marketable securities were $70.9 billion, while long-term debt totaled $28.82 at the end of the quarter, revealing a very nice net cash position.

The CFO’s outlook spoke of continued investment outlays:

We expect fourth quarter 2024 total revenue to be in the range of $45-48 billion. Our guidance assumes foreign currency is approximately neutral to year-over-year total revenue growth, based on current exchange rates.

We expect full-year 2024 total expenses to be in the range of $96-98 billion, updated from our prior range of $96-99 billion. For Reality Labs, we continue to expect 2024 operating losses to increase meaningfully year-over-year due to our ongoing product development efforts and investments to further scale our ecosystem.

We anticipate our full-year 2024 capital expenditures will be in the range of $38-40 billion, updated from our prior range of $37-40 billion. We continue to expect significant capital expenditures growth in 2025. Given this, along with the back-end weighted nature of our 2024 capital expenditures, we expect a significant acceleration in infrastructure expense growth next year as we recognize higher growth in depreciation and operating expenses of our expanded infrastructure fleet.

Meta Platforms put up excellent third quarter results with strong free cash flow generation. The company’s balance sheet also remains very healthy with a substantial net cash position. However, management spoke of continued capital spending growth, which will weigh on free cash flow generation in the coming periods. The company also noted cost pressures in depreciation and operating expense growth for next year, putting a damper on the excitement surrounding its third-quarter earnings beat. Though cost pressures should be expected, Meta Platforms remains a net-cash-rich, free-cash-flow generating powerhouse.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.