By Brian Nelson, CFA

Medical device giant Medtronic (MDT) recently reported fiscal first quarter fiscal 2025 results that came in better than expectations. Adjusted revenue was $8 billion in the quarter led by 5.3% organic growth. Adjusted diluted earnings per share was $1.23, up 2.5% and 7.5% in constant currency.

In the quarter, its Cardiovascular segment experienced 6.9% organic growth, its Neuroscience segment experienced 5.3% organic growth, its Diabetes segment experienced 12.6% organic growth, while its Medical Surgical segment experienced 1% organic growth. Year-to-date, operating cash flow was $1 billion, while free cash flow was $0.5 billion.

ESG Matters

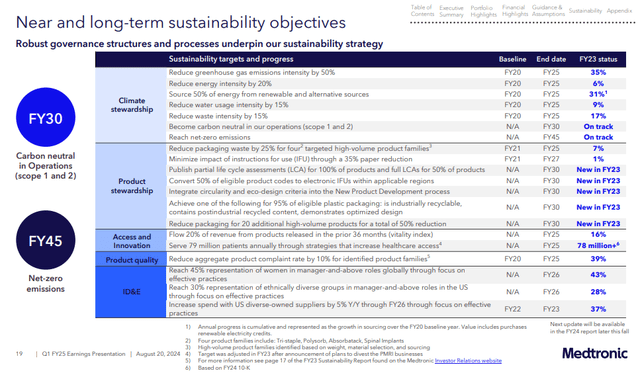

Image Source: Medtronic

Medtronic has a number of long-term sustainability objectives that are worth mentioning. It expects to reduce greenhouse gas emissions intensity by 50% this fiscal year from the baseline in fiscal 2020. The company has achieved a 35% reduction as of fiscal 2023. Reducing energy intensity, water usage intensity, and waste intensity are other key environmental goals, as are becoming carbon neutral in its operations by fiscal 2030, reaching net-zero emissions by fiscal 2045, and reducing packaging waste. Medtronic also has plans to “reach 45% representation of women in manager-and-above roles globally” and “reach 30% representation of ethnically diverse groups in manager-and-above roles in the U.S.”

Concluding Thoughts

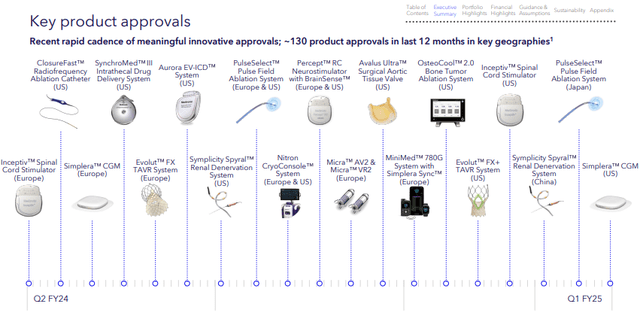

Image Source: Medtronic

Medtronic raised its fiscal 2025 organic growth guidance to the range of 4.5%-5% versus the prior range of 4%-5%, and it also raised its fiscal 2025 diluted non-GAAP earnings per share guidance in the range of $5.42-$5.50 versus the prior range of $5.40-$5.50, implying growth of 4%-6%. Medtronic is taking advantage of healthy underlying markets and “new product innovation is fueling diversified growth across many health tech growth markets.” The company continues to invest in its “future innovation pipeline to drive growth” in the longer run. The high end of our fair value estimate range stands north of $100 per share.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.