Image Source: Marathon Oil Investor Presentation

Let’s take a look at how Marathon Oil, a midsized oil & gas producer, is navigating capricious oil markets at a time when the industry is waiting to see what impact the OPEC+ production cut deal might have on global energy markets.

By Callum Turcan

Key Takeaways

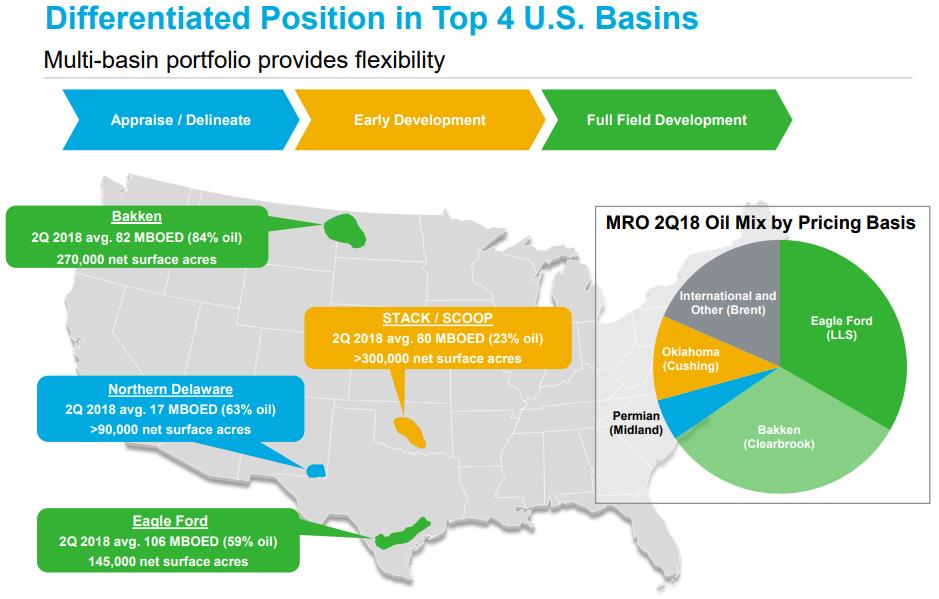

Marathon Oil has built its asset base around four key unconventional oil and gas plays in the US in the Permian Basin, the SCOOP/STACK, the Eagle Ford, and the Bakken. Its goal is to develop well locations within its unconventional drilling inventory that are liquids-rich, enabling the firm to grow crude production, which carries higher margins.

In light of recent geopolitical events, it is possible oil prices will begin to firm up starting in 2019 as a notable amount of supply is removed from the market. Strong non-OPEC supply growth, particularly in America and Brazil, creates a ceiling for oil prices, but that doesn’t mean there isn’t room to run after the recent tumble.

In order to manage a portion of the inherent risk being an upstream operator entails, Marathon Oil hedges a portion of its expected production. Oil and natural gas liquids sales generate the vast majority of its Marathon Oil’s revenue, and natural gas liquids realizations tend to be closely correlated with WTI.

Should things pick up in the global crude market Marathon Oil could have an oil-rich growth runway at its disposal. We currently value shares of Marathon Oil at $20 each, and shares yield just under 1.3% as of this writing.

Introduction to Marathon Oil

In 2011, Marathon Oil Corporation (MRO) split its upstream division from its downstream division, creating two independent, publicly-traded companies. Marathon Oil was then a pure upstream player that solely focuses on exploring, appraising, and producing raw energy resources from oil & gas plays around the world, and Marathon Petroleum Corporation (MPC) became a midstream and downstream player that focuses on both operating industry-specific infrastructure (pipelines, processing plants, storage facilities) and refining oil into petroleum products.

Marathon Oil has built its asset base around four key unconventional oil and gas plays, or operations that utilize horizontal drilling and hydraulic fracturing to unlock vast amounts of recoverable hydrocarbons, in the US in the Permian Basin, the SCOOP/STACK, the Eagle Ford, and the Bakken. During the third quarter of 2018, Marathon Oil pumped 303,000 barrels of oil equivalent (BOE) net per day from its domestic division. The firm also has a sizeable presence in Equatorial Guinea and a very small footprint in the UK North Sea. Last quarter, Marathon Oil produced 112,000 BOE/d net from its international division.

With a company-wide quarterly production base of 415,000 BOE/d net Marathon Oil is classified as a midsized upstream operator, and roughly 65% of its output is liquids, making the firm highly levered to changes in oil prices. Natural gas liquids and condensate prices are also heavily influenced by global oil prices.

Business Developments

Management has been allocating capital towards developing the firm’s four unconventional assets as Marathon Oil aims to grow its higher margin oil production streams. The company’s total US production grew by 59,000 BOE/d to 303,000 BOE/d net in the third quarter of 2018 from the year-ago period. Domestic oil production rose by 34,000 bpd net while its natural gas liquids output jumped by 14,000 bpd net to 58,000 bpd, highlighting its liquids-rich drilling inventory. Organic growth more than offset the output Marathon Oil lost when it divested its non-operated working interests in three conventional projects this year (two in the Gulf of Mexico and one CO2 flood project in Texas).

However, during this period the firm’s international output dropped by 53,000 BOE/d to 112,000 BOE/d net. This is largely due to the firm exiting Libya by selling its stake in the Waha Concession to Total SA (TOT) for $450 million and Kurdistan by selling its non-operating working interest in the Sarsang and Atrush blocks.

Company-wide production growth came in at only 6,000 BOE/d net in the third quarter of 2018 from the comparable quarter of 2017. When adjusting for divestments, Marathon Oil’s output rose by 56,000 BOE/d net over that period. When analyzing publicly-traded upstream companies that are fond of touting adjusted production growth figures, it is important to identify the discrepancy between it and actual production growth.

Marathon Oil’s divestment program is nearing an end. After selling off its high-cost oil sands division back in 2017 for $2.5 billion, various conventional assets over the past three years, and pieces of its international portfolio, there isn’t much left for Marathon Oil to sell. Its transformation is nearly complete. Reportedly, Marathon Oil is actively marketing its UK North Sea assets, which produced less than 10,000 BOE/d net last quarter. The sale of Marathon Oil’s working interest in the Foinaven fields and the Brae complex is expected to raise a couple hundred million dollars and would likely represent the last significant divestment from this multi-year transformation.

New Strategy and a New Play to Boot

Going forward, Marathon Oil will be doing things a little differently. Its goal is to develop well locations within its unconventional drilling inventory that are liquids-rich, enabling the firm to grow crude production, which carries higher margins. Without being held back by its very uneconomical oil sands mining unit and the lack of focus a far-flung asset base inevitably creates, Marathon Oil aims to emerge from its transformation as a reinvigorated force in the unconventional upstream world.

Marathon Oil moved into Louisiana’s emerging Austin Chalk play earlier this year and has since built up a 240,000 net acre position in the area. 3D seismic mapping activities are underway, and Marathon Oil is in the process of drilling its first exploration well targeting the play. Louisiana’s Austin Chalk formation is still in the very early stages of development, and any exploration upside is highly speculative. There was a modest amount of conventional development activity targeting the formation back in the 1990s, but that offers only limited insight into the play. The goal is to uncover additional liquids-rich well locations to add to Marathon Oil’s drilling inventory.

Buybacks on Deck?

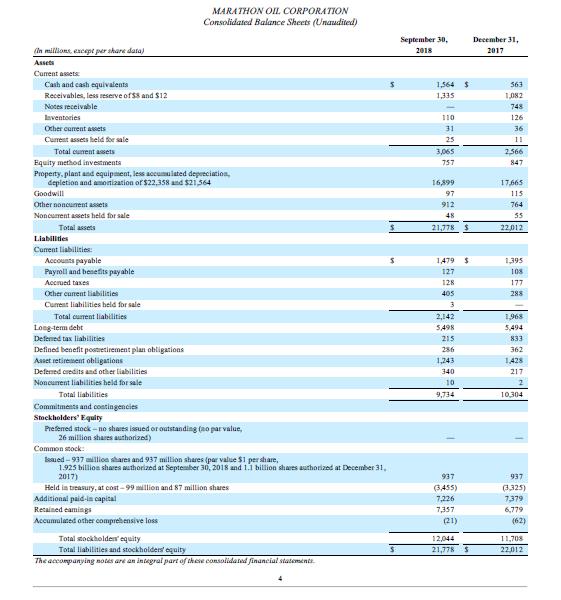

Due to Marathon Oil’s strong balance sheet, the firm was able to repurchase another $150 million of its shares under its existing buyback program during the fourth quarter of 2018 as of a mid-December update from management. Marathon Oil has now spent $650 million in the year-to-date period repurchasing its stock with $850 million in buyback authority remaining. The company is sitting on nearly $1.6 billion in cash and cash equivalents, but it does hold ~$5.5 billion in long-term debt. As of the end of the third quarter, management estimates its net debt-to-EBITDA ratio at less than 1x, which is among the lowest in its peer group.

During Marathon Oil’s latest quarterly conference management commented on its buyback program:

“Our view is that a discipline[d] repurchase of our shares is a good use of capital and it offers very competitive returns given our current market valuation. The pace of that buyback is going to be governed or informed by our sustainable free cash, organic free cash flow generation. It, we do not want that program reliant on disposition proceeds. That is not the intent.”

It appears more buybacks could be on tap, but it depends on how much Marathon Oil allocates to capital expenditures next year in light of the ongoing turbulence in global energy markets. It is worth noting, however, that the company repurchased $349 million in shares in the first nine months of 2018 despite only generating $310 million in traditional free cash flow. Dividends paid in the period were $128 million. Management does not define organic free cash flow generation in the traditional sense (operating cash flow less all capital spending). Instead, it excludes the impact of changes in working capital to operating cash flow, subtracts development capital spending and dividends paid in place of all capital spending, and adds back “return of capital & other” from its equity investment in EG LNG. We prefer the use of traditional free cash flow in evaluating sustainable capital allocation policies.

Marathon Oil’s next debt maturity isn’t until 2020 when $600 million comes due, which provides it with some nice near-term flexibility. The company also extended the maturity of its undrawn $3.4 billion revolving credit line by a year to May 28, 2022, which gives the firm ample financial flexibility to go along with its current ratio of 1.4x.

Image Source: Marathon Oil Corporation – third quarter 2018 10-Q

Recent Developments in the Global Oil Industry

Starting in early-October, the value of both crude oil benchmarks, Brent and West Texas Intermediate, began to move precipitously lower as worries of a coming glut prompted investors to exit their long crude positions. US sanctions on Iran weren’t as heavy-handed as the market had expected as eight nations were given waivers to continue importing Iranian oil supplies. That list includes mega-importers China, India, Japan, and South Korea, along with Italy, Turkey, Greece, and Taiwan. Those waivers last for six months, but there is a chance the US government will extend them in order to keep a lid on oil and thus gasoline prices.

From October 2 to December 6, spot prices for Brent fell from $85.63 to $57.83 a barrel. Over that period, spot prices for WTI slipped from $75.16 to $51.07 a barrel. OPEC+ members (in particular, Russia and Saudi Arabia) ramped up production expecting Iranian oil exports to begin moving swiftly lower, but that didn’t come to pass. The world was once again swimming in oil.

The slide in crude prices encouraged OPEC+ to agree to cut 1.2 million barrels of daily oil production from the market starting in January 2019 at the group’s meeting December 7. Oil prices have had a mostly muted response to this news and are only up modestly from where they were trading at before the deal was announced. As per the terms of the agreement, OPEC pledged to reduce their collective output by 800,000 bpd and the non-OPEC member nations pledged to reduce their collective output by 400,00 bpd from October 2018 levels. Saudi Arabia and Russia represent the bulk of those reductions.

Alberta also announced that it was going to cut 325,000 bpd of production from the market during the first quarter of 2019, which will move down to just 95,000 bpd by the end of next year. The Canadian province is hoping that the expected drawdowns in Alberta’s oil inventories will reduce regional pricing differentials relative to WTI as the industry waits for a more permanent solution to the province’s takeaway problems (more pipeline takeaway capacity, additional regional refining capacity, and material increases in crude-by-rail takeaway capacity).

Output from Libya’s Sharara oil field was recently shut-in due to protests at the facility, which removed 315,000 bpd from the market. That facility supplies electricity to the El Feel oil field, which was also recently shut-in due in part to the Sharara facility being forced offline and in part due to protests at the El Feel oil field. This will remove another 70,000 bpd from the market, but it is worth noting that these are very recent developments and the market is still watching these events unfold. If both of these Libyan oil fields are forced offline for a prolonged period of time, that will fundamentally change the supply-demand dynamic for oil markets heading into 2019. Libyan oil output came close to 1.3 million bpd in November 2018.

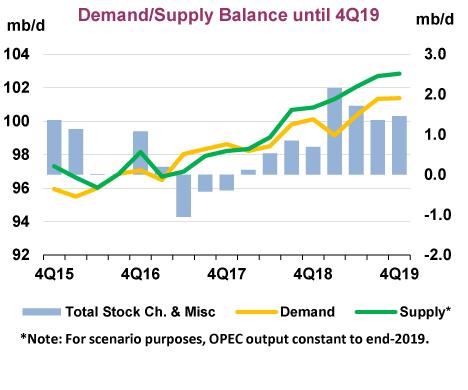

It is important to keep in mind that global demand for oil has historically moved lower during the latter part of the fourth quarter heading into the first quarter of the New Year, before rebounding on a sequential basis in the second and third quarters. Below is a graph from the International Energy Agency from November 14 that highlights its expectations for global crude markets through the end of 2019. Global oil demand growth is expected to come in at 1.3 million bpd in 2018 and 1.4 million bpd in 2019, but that won’t be enough to stop a projected build in global oil inventories of 2 million bpd and 1.5 million bpd during the first and second quarters of 2019, respectively, according to the IEA. This was the agency’s forecast before the OPEC+ deal was announced, the cut out of Alberta was made public, and recent events in Libya, so the dynamics may have changed.

Image Source: IEA

In light of recent geopolitical events, it is possible oil prices will begin to firm up starting in 2019 as a notable amount of supply is removed from the market. Strong non-OPEC supply growth, particularly in America and Brazil, creates a ceiling for oil prices, but that doesn’t mean there isn’t room to run after the recent tumble. That being said, any potential price increases are far from guaranteed as we have yet to see what the average compliance rate will be among OPEC+ members and Albertan oil producers.

Realizations and Hedging Strategies

Raw energy resource producers operate at the mercy of global pricing benchmarks. The price oil and gas producers receive for their oil, condensate, natural gas liquids, and natural gas production is a function of those benchmarks, with other factors coming into play as well. Those other factors include the impact regional pricing differentials, hedging programs, firm transportation agreements (giving oil supplies access to out-basin markets), and quality adjustments have on raw energy resource realizations.

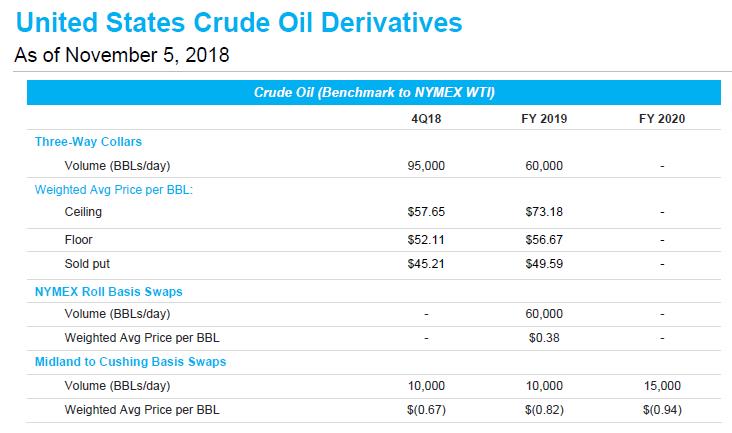

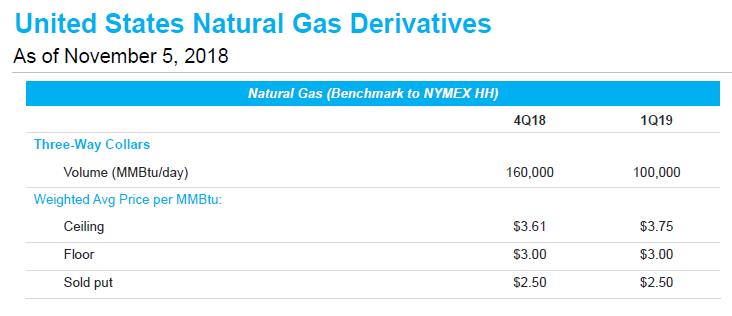

In order to manage a portion of the inherent risk being an upstream operator entails, Marathon Oil hedges a portion of its expected production. Oil and natural gas liquids sales generate the vast majority of its Marathon Oil’s revenue, and natural gas liquids realizations tend to be closely correlated with WTI, especially for American upstream players.

As of early-November, Marathon Oil hedged 95,000 bpd of its domestic fourth quarter oil production through three-way collars benchmarked to West Texas Intermediate. During the third quarter of 2018, Marathon Oil pumped out a net 168,000 bpd of crude oil from its US operations (adjusted for divestments). With roughly half of its expected US oil production hedged this quarter, Marathon Oil has some downside protection from the recent fall in WTI.

This hedging strategy had a weighted-average floor and ceiling price per barrel of $52.11 and $57.65, respectively (as of early-November). When WTI trades in that range, Marathon Oil realizes market prices for its hedged oil sales (minus any premiums paid, regional differentials and transportation expenses).

WTI is down by roughly a third since its early-October peak, which will drag down Marathon Oil’s liquids realizations this quarter. While American natural gas prices, measured by the Henry Hub benchmark, have done quite well during the fourth quarter, that will likely not be enough to offset the impact of WTI moving lower. As an aside, the market expects Henry Hub to move below $3 per million British thermal units by April 2019 from over $4 in January 2019. That would put Henry Hub back down to where it was trading at for most of 2018.

Looking ahead at 2019, Marathon Oil’s oil hedging position is much lighter. The company had hedged only 60,000 bpd of its expected 2019 oil production by early-November. That output is hedged at a weighted-average per barrel price of $49.59, $56.67, and $73.18 for the sold puts, floor, and ceiling, respectively.

Note that while the floor of its hedging program has increased by $4.56 per barrel compared to its hedging position this quarter, a positive, the weighted-average price of its sold puts has climbed upwards by $4.38 per barrel. If WTI trades below $49.59 next year for a sustained period of time next year, Marathon Oil’s oil hedging program starts working against it.

Strip pricing for WTI as of this writing indicates that American light sweet oil prices will trade between $52–$54 per barrel throughout 2019, but due to the volatile nature of raw energy resource prices, the futures curve could change materially in a short period of time. Including the impact of its hedging program, Marathon Oil realized an average price of $59.90 per barrel for its US oil production during the first nine months of 2018.

Marathon Oil will be able to realize $56.67 per barrel of its hedged oil production next year as things stand today, while most of its crude output may very well be sold at market prices that are currently below the firm’s realizations in 2018. If there isn’t a rebound in oil prices, that will make it significantly harder to grow its revenue streams as expected oil production growth is counterbalanced by lower liquids realizations.

Beyond hedging its exposure to fluctuations in WTI, Marathon Oil has also hedged a portion of its in-basin differential risk via Midland-to-Cushing basis swaps. Crude sold in the Permian Basin is expected to fetch $8-9 per barrel below WTI until June 2019. Starting in June, the differential steadily winds down to negligible levels by the end of next year, according to the futures curve.

Marathon Oil has entered into Midland basis swaps that cover 10,000 bpd of its Permian oil output through the end of 2019. That ensures its differential will only be $0.67 a barrel below WTI in this quarter and $0.82 per barrel below WTI next year for its hedged Permian oil sales. During the third quarter of 2018, Marathon Oil pumped 12,000 barrels of crude per day net out of the Permian. Its Midland basis swaps will cover most of its expected Permian oil output this quarter and a large portion of its expected crude output next year.

Image Source: Marathon Oil Corporation

Conclusion

This may seem trite, but at the end of the day where oil prices end up is what matters most. Almost two-thirds of Marathon Oil’s production is liquids, making it highly levered to changes in oil prices. Management has stated in the past it will adjust the capital expenditure budget of Marathon Oil to match a lower oil pricing environment in order to preserve cash flow if necessary. In our opinion, management wants to communicate that the firm won’t try to grow when energy investors are clearly signaling the market is already well-supplied.

With plenty of liquidity, Marathon Oil appears to have the financial flexibility to navigate the capricious oil market. When things pick up in the global crude market, which could happen sooner than investors expect in light of ongoing production cuts and other disruptions around the world, the company should have an oil-rich growth runway at its disposal. We currently value shares of Marathon Oil at $20 each, and shares yield just under 1.3% as of this writing.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of Marathon Oil Corporation. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.