Image Source: ZimmerBiomet

The medical device industry continues its torrid run during 2017 as the perception of a more-favorable regulatory environment continues to fuel investor enthusiasm for the industry. While a rising tide can lift all boats, shares of ZimmerBiomet have come under intense selling pressure post its recent earnings debacle. Let’s review the company’s prospects.

By Alexander J. Poulos

Overview

ZimmerBiomet (ZBH) is a leading supplier of medical devices with a focus on the musculoskeletal market. The company holds a sizeable market share in artificial knees, hips, and spinal solutions thanks in large part to the recently-completed merger of Zimmer with Biomet. The musculoskeletal market’s overall value is estimated to be worth $50 billion, but it is growing at a tepid pace. In order to gain meaningful share, a consistent flow of innovative products coupled with the absence of manufacturing woes is critical.

CEO Departure

We were surprised with the sudden departure of long-tenured CEO David Dvorak on July 11 ahead of the earnings announcement just a few weeks later. Dvorak had led Zimmer for the past ten years with the merger to form ZimmerBiomet as the most recent highlight. The issue that often crops up with bold mergers is the melding of two distinct cultures, as the combined entity searches for the elusive “synergies” that are often cited as the impetus for the transaction. ZimmerBiomet had come under fire from some of its ortho customers as surgeons have put off utilizing the products due to components being in short supply. The capacity constraints have thus far marred the merger, with Dvorak repeatedly promising the issue is under control and will be remedied in short order.

Manufacturing Woes Continue to Plague the Company

Unfortunately for ZimmerBiomet shareholders, the woes continue to linger. We think Dvorak has failed to address the issue which continues to weigh on sales, and thus has lead to his departure. Zimmer is now headed by Daniel Florin who holds the title as interim CEO. An active search for a replacement is being conducted, but we feel the new search will linger for a while, placing an additional cloud over the company’s prospects going forward.

That said, Florin spent the vast majority of his time on the recent conference call assuring investors the manufacturing issues will be addressed. Zimmer expects the backlog of the product will be effectively remedied by year end; in fairness we have heard this before and will remain in “show-me mode.”

The longer the manufacturing issues persist, the more Zimmer runs the risk of a permanent loss of customers (in addition to reputational risk). Orthopedic surgeons tend to stay with products they have confidence in and are well-versed in using. Surgeons tend to be cautious by nature–surgery can carry unforeseen risks, and the last thing a surgeon wants is for unfamiliarity of the product to lead to patient complications. Florin mentioned in a recent conference call that some surgeons are refusing to utilize a Zimmer product until full availability. In essence, Zimmer is forcing its client base to begin to learn a competitor’s product—once familiarity is gained, however, we feel the likelihood for the surgeon to switch back is diminished.

Balance Sheet

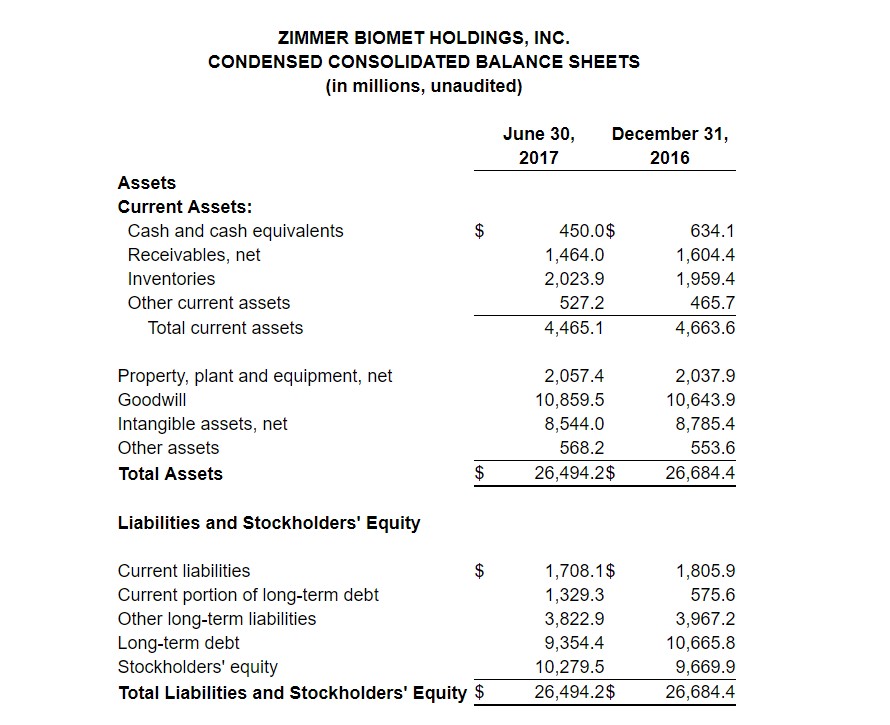

Image Source: Zimmer

Though the company’s credit rating is investment grade, the balance sheet of Zimmer remains bloated due to the debt load utilized to complete the deal for Biomet. Florin mentioned that debt repayment will continues to be a priority–we generally agree with the assessment. Zimmer has set a debt-to-EBITDA target of 2.5 times which will require an additional extinguishing of nearly $2 billion in debt. We cannot help but wonder if the former management team was overambitious in its merger goals and decided to rein in spending to pay off debt at the expense of product availability.

An Activist Appears

All of this said, we are pleased to see that famed value investors Jana Partners has taken a stake in Zimmer. We generally feel that Zimmer has bungled the merger with Biomet and is in dire need of new leadership to aggressively right the ship. Jana Partners has an excellent track record with turnaround stories with the recent sale of Whole Foods (WFM) and rapid share price acceleration of Cognizant Technologies (CTSH) serving as recent examples. We feel an activist will place enormous pressure on the current board and management team to perform. Let’s not mince words: Zimmer has significantly underperformed over the past few years.

Valuentum Proprietary Rankings

Zimmer currently registers a 7 on the Valuenetum Buying Index–impressive in light of today’s frothy market where bargains remain scarce, and the sell-off in Zimmer has brought the stock price to the low end of our $102-$152 share price range. We will continue to monitor the company’s progress and may consider including the company in the Best Ideas Newsletter portfolio, though as in the case with recently-removed Medtronic (MDT) from the Dividend Growth Newsletter portfolio, ZimmerBiomet has a large net debt position, which leaves us in a cautious stance. As for the Dividend Growth Newsletter portfolio, we don’t consider Zimmer a candidate for inclusion. Zimmer’s current dividend is a mere “token” at a dividend yield less than 1% at the time of this publishing. Given business fundamentals, we also don’t feel a meaningful dividend hike is in the cards. In any case, Zimmer remains a fantastic business, but one that is going through a difficult time. An opportunity may eventually present itself, so it’s definitely one for the radar.

Medical Devices: BIO, BRKR, EW, ISRG, MDT, MSA, STE, VAR, WAT, ZBH