Image Source: Lyft’s S-1

Reminiscences of the dot-com boom came back to the markets with the over-hyped initial public offering of Lyft, a stock that continues to get shellacked as its first days as a publicly-traded enterprise. Those that know Valuentum know that we wouldn’t touch such investments with a 10-foot pole. The company lost $43 per share in 2018.

By Brian Nelson, CFA

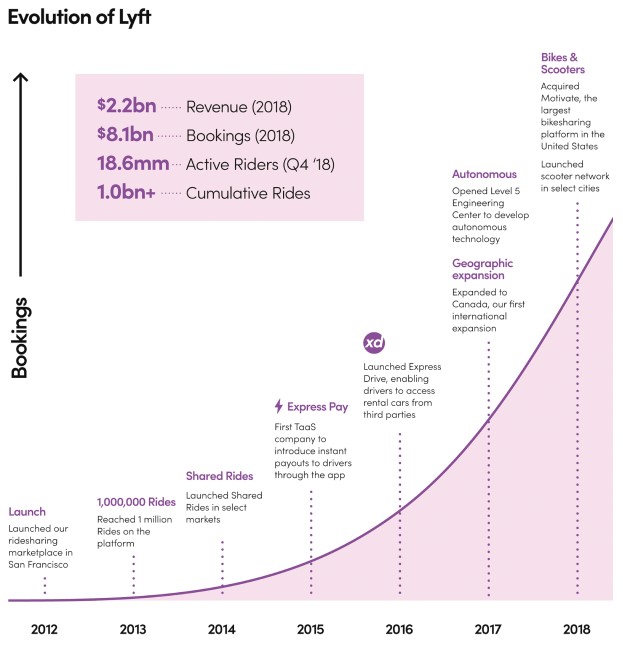

Call me old school, but I’m surprised as to the widely-accepted nature of the business models of Lyft (LYFT) and Uber, and other ridesharing services. For those that don’t know Lyft, the company maintains “peer-to-peer marketplace for on-demand ridesharing,” and thus far has “facilitated over one billion rides,” according to its S-1 filing. It generates almost all its revenue from service fees and commissions from drivers for their use of its ridesharing marketplace.

If you turn on the evening news, you’ll understand why I remain skeptical. Do you really know the person that is in the driver’s seat? Are people “hitchhiking with strangers?” There may be benefits to ridesharing, including lower vehicular fatalities and arrest rates for certain offenses (e.g. DUIs), but don’t we learn as children not to get into cars with strangers? What gives, right?

Well, the reality is that ridesharing is booming, and I must admit that I am neither a user of Lyft or Uber, nor do I think I ever will be. Nonetheless, Lyft raked in $8.1 billion in bookings in 2018 and generated $2.2 billion in revenue for the year, as it has operations in 300+ markets in the US and Canada, all while striving to achieve its mission: Improve people’s lives with the world’s best transportation.

Lyft believes that “the world is at the beginning of a shift away from car ownership to Transportation-as-a-Service.” Though it’s hard to argue with the traction ridesharing platforms have achieved thus far, car ownership is simply not going away. Nobody wants to wait in the rain to catch a cab, let alone a Lyft or Uber. Have you ever gone on a road trip, and just wished you had your car with you? Ironically, Lyft needs others to own cars for its business to work, too.

Regardless, the company’s business is firing on all cylinders:

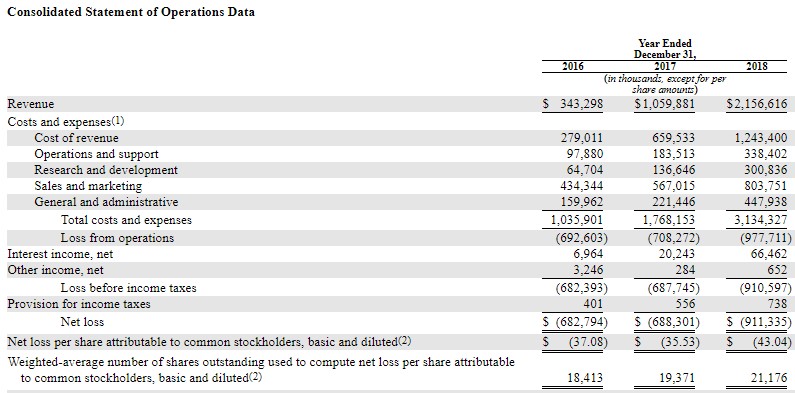

(Lyft’s) U.S. ridesharing market share was 39% in December 2018, up from 22% in December 2016…Our revenue was $343.3 million, $1.1 billion and $2.2 billion in 2016, 2017 and 2018, respectively, representing year-over-year growth of 209% from 2016 to 2017 and 103% from 2017 to 2018. We generated Bookings of $1.9 billion, $4.6 billion and $8.1 billion in 2016, 2017 and 2018, respectively, representing year-over-year growth of 141% from 2016 to 2017 and 76% from 2017 to 2018.

That said, here’s where the rubber hits the road. Not only would I not consider taking a Lyft or Uber (for my own safety), but the company is far from profitable. Lyft lost approximately $680-$690 million in each of 2016 and 2017, and losses were over $910 million in 2018. The company’s S-1 reads like business school homework. Tell us less about what you think people may prefer and show us the path to substantial and sustainable profitability. We just don’t see it happening on sufficient scale. People still want cars. I know I do. The company lost $43 per share in 2018.

The bottom line is profits, and more specifically free cash flow. We have no qualms with the underlying metrics of Lyft, including active riders, revenue per active rider, and rides, all of which have expanded nicely in recent years, but the company’s business model is not scaling as we would like. As revenue expands, losses should be getting smaller, not larger as they have. Even if you take out all its Sales & Marketing expenses, it still would have lost money in each of the past three years. Net cash flow from operations has also been negative in each of the past three years, albeit improving. There are some serious risks inherent to business model execution, particularly as other rivals inevitably try to enter the ridesharing space in the coming years.

Image Source: Lyft S-1

I’m also very skeptical of Lyft’s proposed market opportunity. The company notes that transportation is the second-largest household expense after housing and roughly double that of healthcare, and consumer spending on transportation reached $1.2 trillion in 2017 in the US alone. Here’s the deal, however: I doubt that many will ever consider getting into a Lyft or an Uber. Lyft may operate in more of a niche segment than represent a disruption in transportation, and the company is already fending for share against Uber, Gett (Juno) and Via.

What would get us interested in Lyft? Well, first of all, we need some tangible numbers to better estimate its intrinsic value. At this point in its corporate lifecycle, the range of potential fair value estimate outcomes is just too large. That means that Lyft is merely a speculative play on ridesharing, and its financials aren’t living up to the hype. Lyft’s business model does not appear to be as highly-profitable as one that should be very asset light. Something is not lining up, even after backing out Sales & Marketing expenses. It’s too cost-heavy.

We fully expect Lyft to continue to grow its top line at a rapid pace in the coming years, but that doesn’t mean it will be a successful stock over the long haul. Because the company doesn’t have any real profits or free cash flow, the market’s only way to analyze the company will be on the growth of underlying metrics (e.g. active riders, revenue per active rider, rides, etc.), the pace of which will fluctuate wildly against expectations, in our view. Perhaps obvious after its initial public offering, the only thing investors can count on right now with Lyft, in our view, is substantial share-price volatility. Not one for the Best Ideas Newsletter portfolio.

Auto Manufacturers: F, GM, HMC, HOG, TM, TSLA

Related: UBER, MILN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.