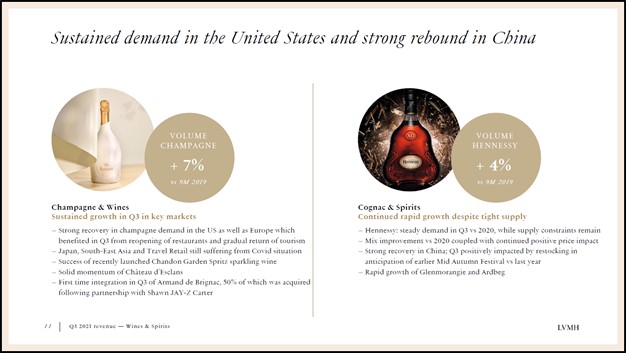

Image Source: LVMH Moët Hennessy Louis Vuitton – October 2021 IR Presentation

By Callum Turcan

The France-based luxury goods company LVMH Moët Hennessy Louis Vuitton (LVMUY) provided an update on its sales performance during the first three quarters of 2021 on October 12. For housekeeping purposes, please note LVMH reports its financials in accordance with IFRS accounting standards, and that LVMH acquired luxury jeweler Tiffany in January 2021 through a ~$15.8 billion deal.

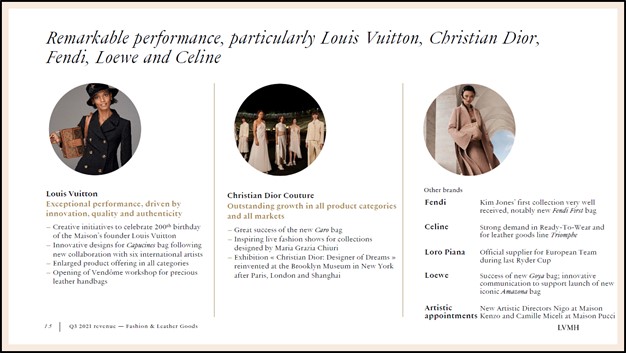

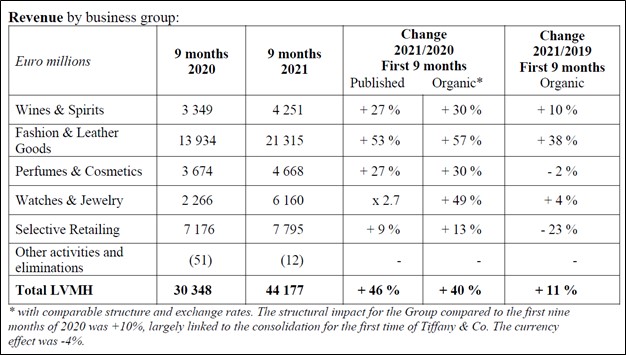

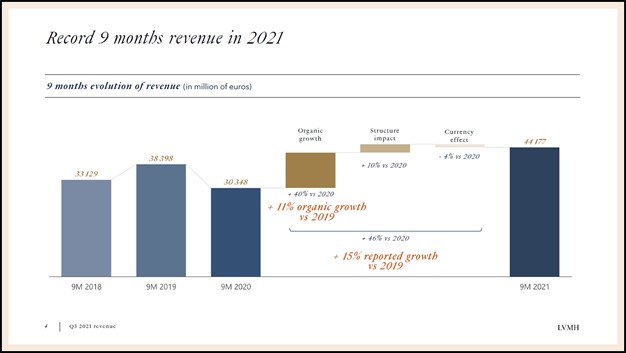

LVMH’s revenues grew by 46% year-over-year, reaching EUR44.2 billion (a record for the company), and organic sales were up 40% year-over-year during the first nine months of 2021. The company’s ‘Fashion & Leather Goods’ segment, responsible for a little under half of its total sales, saw its revenue surge higher during this period led by fashion powerhouses Louis Vuitton and Christian Dior Couture. Strength in the US and Asian luxury goods markets bolstered LVMH’s financial performance this year.

Image Shown: LVMH’s fashion & leather goods business is growing at a robust pace, led by strength at its Louis Vuitton and Christian Dior Couture fashion powerhouses supported by strength at its other key luxury brands. Image Source: LVMH – October 2021 IR Presentation

Overview

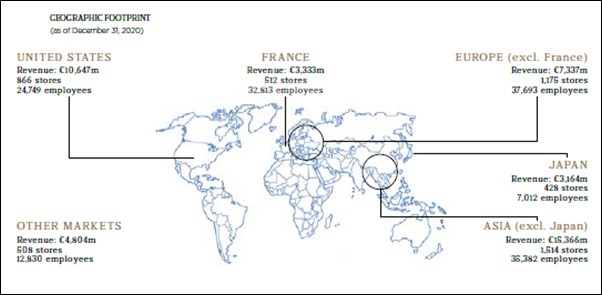

LVMH owns luxury brands across numerous categories including wine & spirits (Moët & Chandon, Dom Pérignon, Hennessy), fashion & leather goods (Louis Vuitton, Christian Dior Couture, Celine), perfumes & cosmetics (Christian Dior, Guerlain, Givenchy), and watches & jewelry (Bvlgari, Chaumet, Fred, and now Tiffany). These operations are supported by its retailing business which includes Sephora and the French department store Le Bon Marché, along with other stores that sell its luxury goods. LVMH also owns a handful of other assets including various cultural and business news publications via its Groupe Les Echos business, Royal Van Lent which builds luxury yachts under the Feadship brand, Cheval Blanc and Belmond, which are developing high-end hotels, and travel retailers DFS and Starboard Cruise Services. Its luxury portfolio is one of the most expansive in the world.

Image Shown: A look at LVMH’s geographical footprint at the end of December 2020. Image Source: LVMH – 2020 Annual Report

Recovering from the Pandemic

Compared to the first nine months of 2019, LVMH’s organic sales grew by 11% during the same period in 2021. Growth was reported in the wine & spirits, fashion & leather, and watches & jewelry categories which offset weakness in perfumes & cosmetics and selective retailing (includes its Sephora business) categories. This indicates that the company’s recovery from the worst of the coronavirus (‘COVID-19’) pandemic is in full swing with room for further upside.

As it concerns perfumes, cosmetics, and retail operations that focus primarily on selling such offerings, it makes sense that sales have been depressed in the wake of the COVID-19 pandemic as consumers are staying indoors more compared to pre-pandemic levels. However, that should eventually change as widespread COVID-19 vaccine distribution efforts enable social life around the world to resume in earnest, which will provide another growth lever for LVMH to capitalize on in the near term.

Image Shown: LVMH posted rock-solid organic sales growth across the board during the first nine months of 2021 versus year-ago levels, as its businesses continue to recover from the worst of the COVID-19 pandemic. Sales at some of its luxury goods categories remain depressed versus 2019 levels. Image Source: LVMH – October 2021 Press Release

Concerns Regarding China’s Crackdown on Wealth Inequality

Going forward, we caution that China’s recent push for “common prosperity” is a potential concern as measures tied to this central government-led initiative could lead to significant reductions in luxury goods purchases. Common prosperity initiatives aim to reduce wealth and income inequality, while also ensuring conformity with the key principles laid out by Chinese President Xi Jinping and the Chinese Communist Party. The term “conspicuous consumption” refers to consumers purchasing goods and services that reflect their socioeconomic status and level of commercial successes (effectively using commercial activities to “show off”), a dynamic that does not mesh well in the face of an expansive drive to reduce wealth inequality.

With that in mind, LVMH’s business has survived economic crackdowns in China in the past with its growth trajectory intact, particularly in 2013-2014 in the wake of a big anti-corruption push. LVMH plans to expand the digital and physical footprint of Sephora and its other luxury goods brands in China this year according to its 2020 Annual Report, building on past investments in the country. LVMH’s omni-channel selling capabilities in the US, China, and elsewhere played a key role in enabling the firm to post record revenue performance during the first nine months of 2021. We expect LVMH will stay the course and continue to build on this momentum in China going forward.

Image Shown: LVMH generated record revenues during the first nine months of 2021. Image Source: LVMH – October 2021 IR Presentation

According to the WSJ, LVMH’s management team noted during a recent investor call that wealth redistribution efforts in China might not hurt its business as much as expected as middle class consumers represent the lion’s share of luxury goods purchases in the country. The WSJ cited data from UBS Group AG (UBS) that up to four-fifths of luxury goods purchases are made by middle class Chinese consumers. The superrich remain a key part of this market, particularly for the most expensive jewelry and watches.

In theory, if middle-class Chinese consumers had greater spending power due to the ongoing wealth redistribution drive in the country, that could support the outlook for luxury goods purchases. We are not convinced of this theory, however, especially as luxury goods are considered superior goods with ample alternatives and considering these goods are primarily purchased for conspicuous consumption purposes. In a crackdown on wealth inequality and a drive to ensure conformity with Communist Party ideals, luxury goods purchases may not be impacted much.

While we expect LVMH’s growth trajectory has long legs, we caution that management’s wishful thinking may prove to be a tad too optimistic as it concerns the company’s near-term outlook. That said, the firm’s sales performance has held up well so far this year.

Concluding Thoughts

LVMH’s strong financial performance across the board speaks favorably towards the outlook for the global economic growth trajectory as consumers continue to spend lavishly on goods while services-related spending slowly recovers. Clouds are growing over China as it concerns the future of the country’s luxury goods consumption levels, though in our view, LVMH is well-positioned to navigate the storm with its growth trajectory intact. We like the resilience of the luxury goods space.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ETSY, DOCU, UBER, BYND, SFIX, CVNA, TER, GPN, PANW, VRSN, MELI, FSLR, JD, CRSP, PINS, NDAQ, FVRR, SNAP, GME, CROX, NOW

Tickerized for LVMUY, LVMHF, CPRI, PPRUY, PPRUF, BURBY, BBRYF, TIF, HESAY, HESAF, CFRHF, CFRUY, FOSL, RL, TPR, MOV, SWGAY, MONRY, FTCH, VWE, CWGL, NAPA, WVVI, THST, HNST, EL, LRLCY, LRLCF, TDPAY, PUMSY, PDRDF, PDRDY, BEL, SFRGF, SFRGY, PRDSY, PRDSF, ULTA, KORS, PVH, ELF, SBH, REV, COTY, LB, VSCO, CHDRF, REMYF, REMYY, RACE, GIII, KATE, VRA, BOSSY, BCUCF, BCUCY

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Long put options on the SPDR S&P 500 ETF Trust (SPY) with an expiration date of December 31, 2021, and strike price of $412 are included in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.