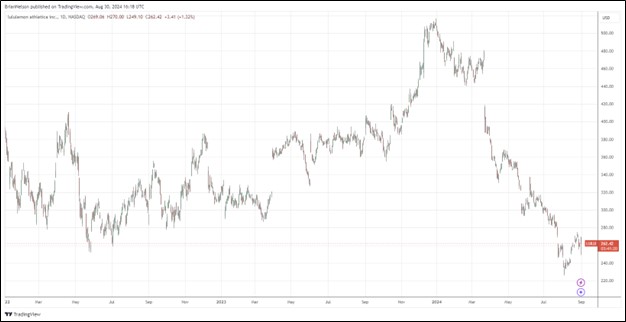

Image: Lululemon’s shares have come under pressure recently.

By Brian Nelson, CFA

Lululemon (LULU) reported mixed second quarter results on August 29 with revenue coming in slightly lower than the consensus estimate, and GAAP earnings per share beating consensus by $0.23.

Net revenue increased 7% in the quarter (8% on a constant dollar basis) led by International net revenue growth of 29% (31% on a constant dollar basis). Americas net revenue increased 1%, or 2% on a constant dollar basis. Comparable sales increased 2% in the quarter, or 3% on a constant dollar basis, led by International growth as Americas comparable sales dropped 3%, or 2% on a constant dollar basis.

Though sales growth left something to be desired, the company’s margins held up well. Gross profit increased 9% on 80 basis points of improvement in its gross margin, to 59.6%, while income from operations advanced 13%, with its operating margin up 110 basis points on a year-over-year basis, to 22.8%. Diluted earnings per share in the quarter were $3.15 compared to $2.68 per share in the second quarter of last year.

Lululemon’s Power of Three x2 growth plan “calls for a doubling of the business from 2021 net revenue of $6.25 billion to $12.5 billion by 2026. The key pillars of the plan are product innovation, guest experience, and market expansion and the growth strategy includes a plan to double men’s, double e-commerce, and quadruple international net revenue relative to 2021.”

Looking to 2024, Lululemon now expects net revenue in the range of $10.375-$10.475 billion, representing growth of 8%-9%, below consensus numbers and lower than its initial guidance of $10.7-$10.8 billion. Diluted earnings per share is now expected to be in the range of $13.95-$14.15 for the year, down from previous guidance of $14.27-$14.47. We have no plans to add Lululemon to any newsletter portfolio.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.