We are lowering our fair value estimate of Morgan Stanley to $45 from $50 to update our view of what mid-cycle results might look like.

By Matthew Warren

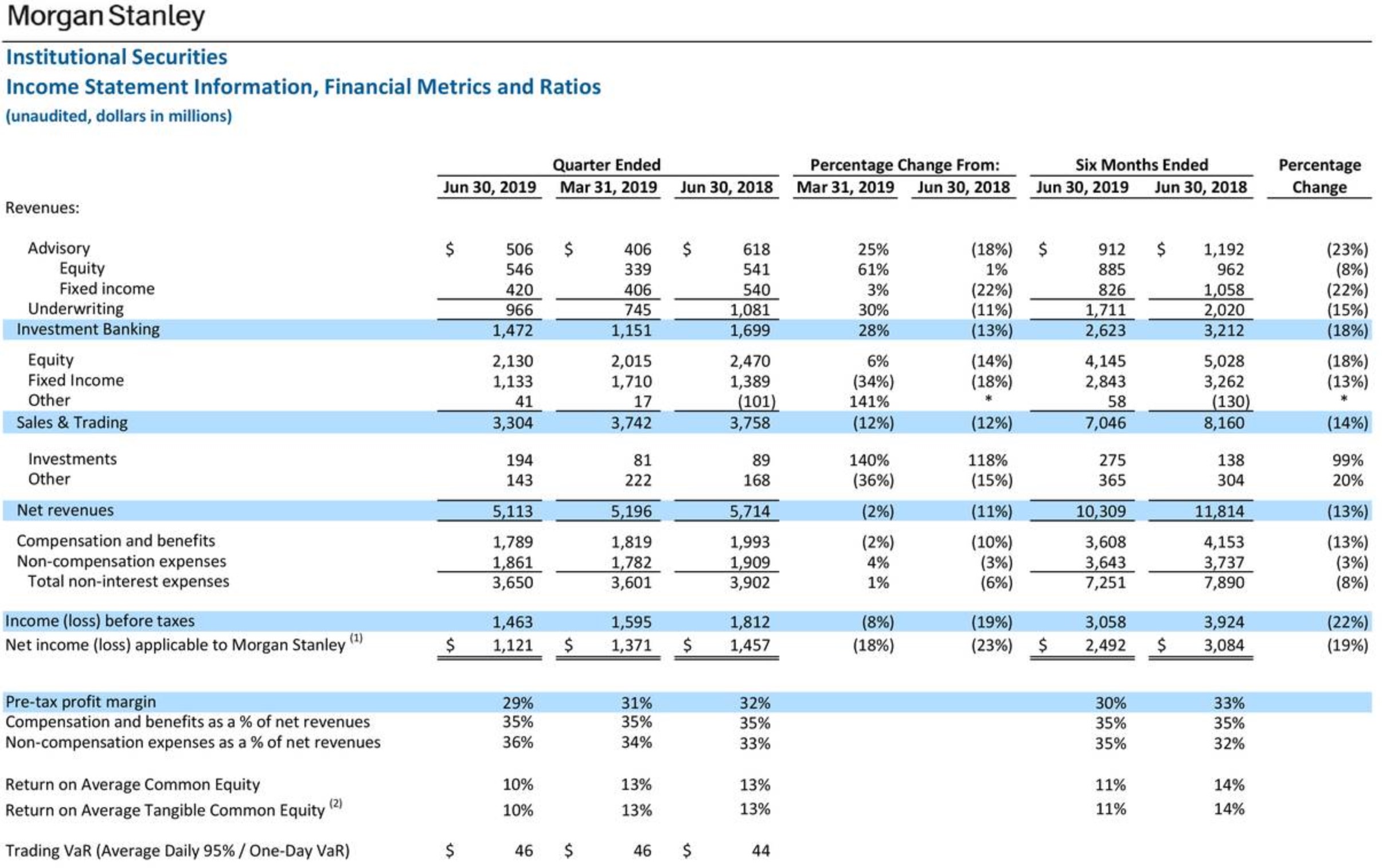

Morgan Stanley (MS) posted second-quarter 2019 results July 18 with net revenue down 3% from last year to $10.2 billion and diluted earnings per share down 5% to $1.23, better than the Wall Street consensus of $1.16 per share. The Institutional Securities segment, with net income applicable to Morgan Stanley down 23% versus last year, was the major drag on overall results, while the much smaller Investment Management unit provided some ballast with net income applicable to Morgan Stanley up 23%. Weakness in Institutional Securities was very broad-based compared to last year (a strong year) as you can see in the below graphic:

Image Source: Morgan Stanley 2Q2019 Earnings Presentation

While it might not be fair to parse any one quarter as compared to the prior year’s quarter, Morgan Stanley did post bigger revenue declines than its large US peers this time around. We wouldn’t read too much into this unless the trend persisted over a longer timeframe.

Aside from its largest segment by revenue and profit coming under such pressure, we were also struck by the cautious tone from management. We are ten years into a bull market with many securities markets at all time highs, and yet Morgan Stanley management mentioned quite prominently in the earnings call that clients don’t seem to have much conviction, as evidenced by a lack of more bullish portfolio re-positioning and a lack of financial leverage applied to portfolios as compared to other bull markets. It does make one wonder if the markets are susceptible to a significant downdraft like what happened in late 2018.

Aside from that pondering, we continue with our view that investment banking and securities businesses are not particularly attractive, as evidenced by Morgan Stanley’s 10% return on average tangible common equity for its Institutional Securities segment in the quarter. This from one of the premier US firms in this space. On the other hand, we do like Wealth Management and Investment Management segments, which posted 36% and 33% returns on average tangible common equity, respectively. These businesses are thriving at this point in the cycle, given current market levels. We are lowering our fair value estimate to $45 from $50 to update our view of what mid-cycle results might look like.

Related: XLF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.