Image Source: Keurig Dr Pepper – September 2019 IR Presentation

By Callum Turcan

Keurig Dr Pepper Inc (KDP) markets, sells, and distributes numerous coffees, flavored soft drinks, teas, waters, juices, mixers, energy drinks, and other types of beverages through either its ownership of the brand or through its various partnerships. The beverage giant’s top brands include 7UP, Dr Pepper, Green Mountain Coffee Roasters, Keurig, Snapple, and Mott’s. JAB Holding Company, a privately-held entity, owns ~87% of Keurig Dr Pepper after Dr Pepper Snapple merged with Keurig Green Mountain last year. We expect Keurig Dr Pepper to generate sizable free cash flows as a combined entity going forward, but we also caution that the company’s hefty net debt load weighs negatively on the firm’s ability to grow its future dividend payouts on a per share basis. Shares of KDP yield 2.1% as of this writing.

Nice Free Cash Flows

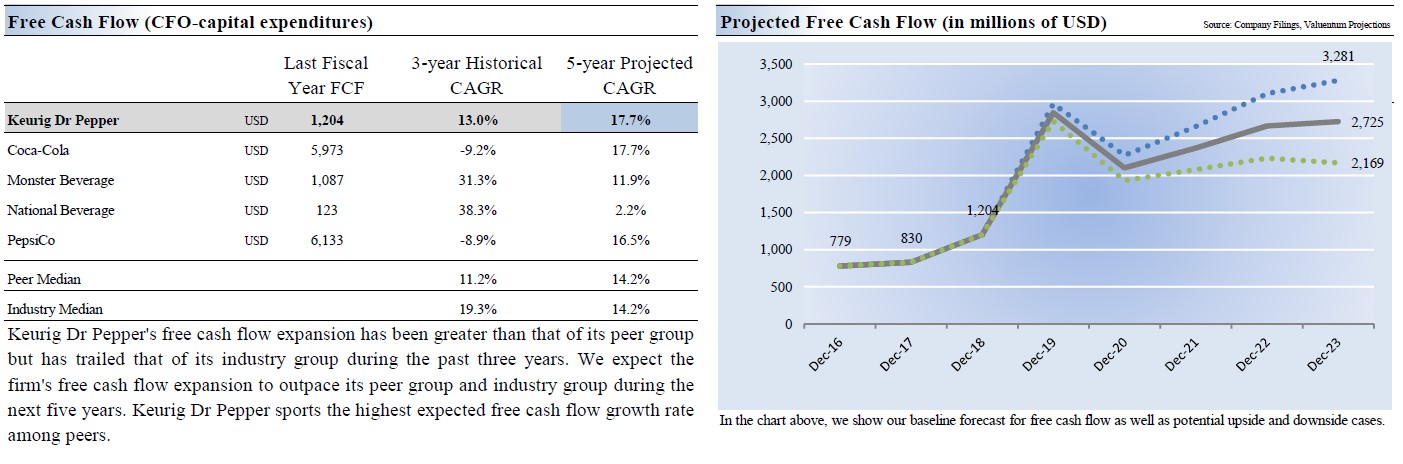

In the graphic below, we highlight our expectations for Keurig Dr Pepper’s free cash flows (net operating cash flows less capital expenditures) over the next five full fiscal years from our recently updated 16-page Stock Report (can be accessed here). Please note that the expected sharp jump in its fiscal 2019 free cash flow performance is largely a product of the aforementioned merger.

Image Shown: After putting near-term volatility aside, we see Keurig Dr Pepper’s free cash flows maintaining a modest growth trajectory into the 2020s and beyond.

Keurig Dr Pepper reported third-quarter 2019 earnings on November 7 that broadly met consensus expectations. Management reaffirmed full-year guidance calling for double-digit adjusted (non-GAAP) EPS growth and modest underling sales growth on an annual basis, which the market liked. Shares of KDP have since moved higher after the earnings report, at least as of this writing.

During the company’s latest quarterly conference call with investors, management noted Keurig Dr Pepper generated a free cash flow conversion rate of 130% during the first nine months of 2019, something we really appreciate. Keurig Dr Pepper has a relatively capital expenditure-lite business model that better allows for material free cash flows. Should Keurig Dr Pepper properly utilize these free cash flows to meaningfully delever, that could change on opinion on the name. Deleveraging is the stated goal, and we’ll cover that in just a moment.

Weak Balance Sheet

At the end of September 2019, Keurig Dr Pepper had just $0.1 billion in cash and cash equivalents on hand versus $1.8 billion in short-term debt and $13.1 billion in long-term debt, good for a net debt position of ~$14.8 billion (we aren’t including ‘structured payables’ in this figure, which management has been steadily paying down as well). The firm paid $0.6 billion in dividends during the first three quarters of 2019, good for an annualized payout of ~$0.8 billion. Free cash flows during the first nine months of 2019 came in at $1.6 billion, easily covering the firm’s dividend payouts during this period, and handily covering those payouts on an annualized basis as well. Management is targeting for Keurig Dr Pepper to generate $2.3 billion – $2.5 billion in free cash flows this year.

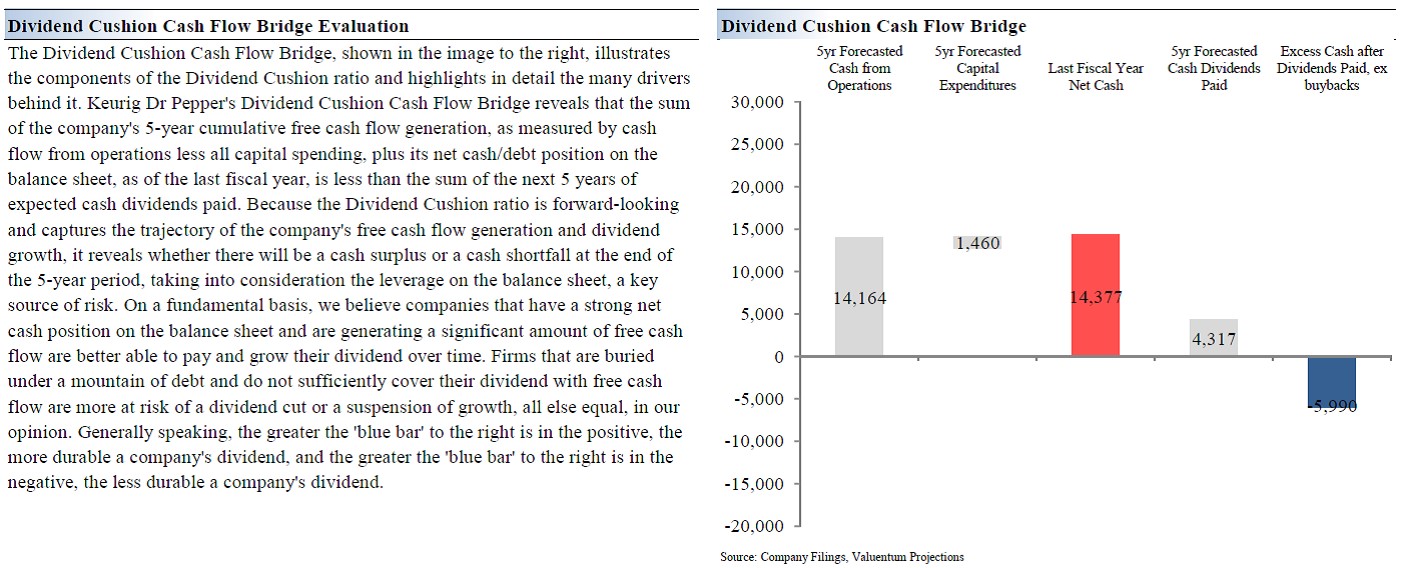

In the graphic down below, from our recently updated two-page Dividend Report (can be accessed here), we break down Keurig Dr Pepper’s lackluster Dividend Cushion ratio. The Dividend Cushion ratio factors in the firm’s forecasted free cash flows over the next five full fiscal years, takes the firm’s last fiscal year net debt or net cash consideration into account (where net debt reduces the amount of free cash flows that can go towards covering future dividend obligations, and conversely, net cash enhances the firm’s coverage of future dividend obligations), and compares that balance (the numerator in this calculation) to forecasted cash dividend payments over the next five full fiscal years (the denominator in this calculation). We give Keurig Dr Pepper a Dividend Cushion ratio of -0.4x (negative 0.4), meaning that our forecasted free cash flows over the next five full fiscal years less the Keurig Dr Pepper’s net debt position is a negative figure. Deleveraging could change that.

Image Shown: We caution that Keurig Dr Pepper’s dividend coverage is rather weak, even though its free cash flow profile is quite strong.

Deleveraging Efforts Underway

Management has been allocating “excess” free cash flows (free cash flows after covering dividend obligations) to cutting debt at Keurig Dr Pepper now that the merger is complete. During the firm’s latest conference call, CFO Ozan Dokmecioglu noted:

“Free cash flow was again strong in the quarter, driven by growth in the net income and continued effective working capital management. As a result, in the third quarter, we paid down approximately $423 million of structured payables and reduced net debt by an additional $71 million, for a total of $494 million in payments. This increases the total amount of debt paid down in the first 9 months of 2019 to $788 million as well as a reduction in structural payables of $188 million.

For the first 9 months of 2019, we generated over $1.6 billion in free cash flow, with a free cash flow conversion rate of 130% and exited the quarter with $74 million of unrestricted cash on hand. The debt reduction in the quarter, along with our growth in adjusted EBITDA, reduced our debt to adjusted EBITDA ratio, which we refer to as our management leverage ratio to 4.8 times. This aggressive pace of deleveraging continues to be consistent with our expectations. And for perspective, since the merger closed, we have paid down a total of over $1.7 billion of debt.

And finally, in terms of our outlook for the balance of 2019. For the full year, we continue to expect adjusted diluted EPS growth in the range of 15% to 17%, representing $1.20 to $1.22 per share. This guidance is in line with our long-term merger target. We continued to expect net sales growth of 1% to 2%, with underlying net sales growth now expected at approximately 3%, the latter of which is at the high end of our long-term merger target of 2% to 3%.”

Reaffirming both its commitment to deleveraging and full-year guidance for 2019 was a promising sign. Keurig Dr Pepper expects to generate ~$2.4 billion (at the midpoint) in free cash flows this year along with 3% annual net underlying sales growth (the high end of its long-term post-merger annual sales growth target).

Going forward, the company expects the merger will allow for $200 million in annual synergies from 2019-2021, with $200 million in synergies expected in 2019. Cost reductions will better allow for deleveraging activities as the company’s already strong free cash flow profile gets even stronger. By the end of 2019, the company hopes to bring its leverage ratio down to 4.4x-4.5x, from 4.8x at the end of September 2019.

Concluding Thoughts

Unlike some of its peers, Keurig Dr Pepper is not trading at a hefty premium to its intrinsic value. Our fair value estimate for shares of KDP stands at $25, with the top end of our fair value estimate range sitting at $30 per share. As of this writing, KDP trades near ~$29 per share, which is within reason in our view. Investors are pricing in Keurig Dr Pepper’s nice underlying sales growth forecast, merger-related synergies, and serious deleveraging efforts which is why KDP trades at the upper end of its fair value estimate range, in our view. We aren’t adding KDP to either of our newsletter portfolios at this time, but should deleveraging activities continue in earnest, that may change our view of the company.

Nonalcoholic Beverages Industry – CCEP FIZZ KDP KO MNST PEP

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.