Image Source: JNJ third quarter earnings presentation

Simulated newsletter portfolio idea Johnson & Johnson turned in a strong third quarter report that was driven once again by growth in its ‘Pharmaceutical’ segement, namely its ‘Oncology’ division.

By Kris Rosemann

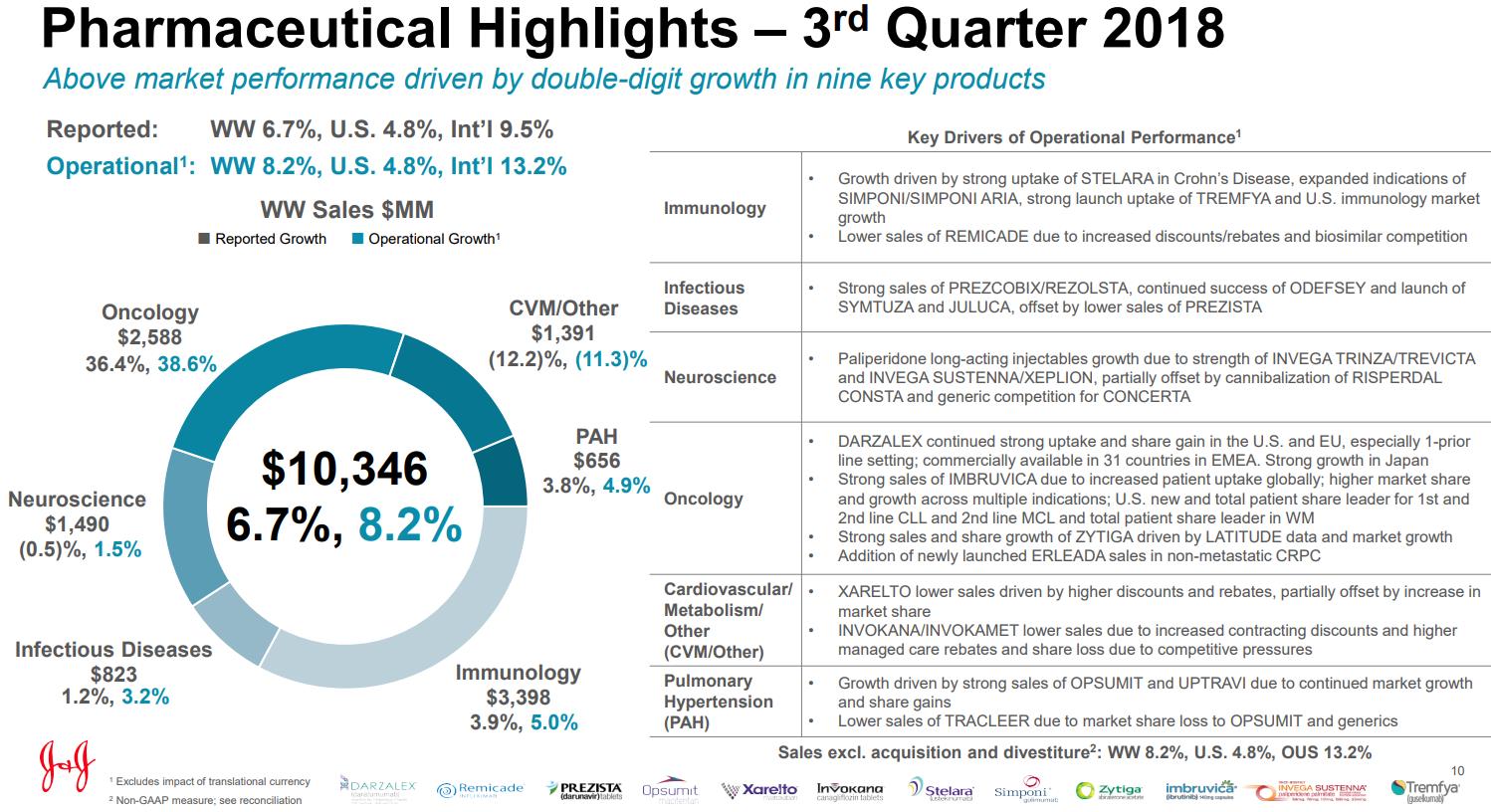

Johnson & Johnson (JNJ) reported 3.6% year-over-year revenue growth in the third quarter of 2018 thanks to ongoing strength in its ‘Pharmaceutical’ segment, which turned in reported revenue growth of 6.7% as reported revenue in its ‘Oncology’ division within the segment leapt 36%+ from the year-ago period. Key sales growth leaders in ‘Oncology’ were DARZALEX, IMBRUVICA, and ZYTIGA, while REMICADE revenue erosion from biosimilar competition was more than offset by strength in other key ‘Immunology’ drugs including STELARA and SIMPONI/SIMPONI ARIA. Overall, nine key pharma products turned in double-digit sales growth in the quarter.

The company’s ‘Consumer’ segment grew reported revenue 1.8% on a year-over-year basis as strength in ‘Beauty’ and ‘OTC’ product lines were offset by weakness in ‘Wound Care/Other,’ ‘Baby Care,’ and ‘Women’s Health,’ while its ‘Medical Devices’ segment revenue was down slightly from the comparable period of 2017 as high growth in ‘Interventional Solutions’ was offset by weakness in ‘Diabetes Care’ and ‘Orthopaedics,’ the latter of which was impacted by pricing pressure. Management remains confident in the ‘Meidcal Devices’ segment as it gears up in targeting a goal of above-market performance in 2020.

J&J’s operating line faced some pressure in the quarter as a result of a partial write-down of an ‘in-process research and development’ asset associated with the acquisition of Alios BioPharma, but its bottom line benefit from a lower tax rate than in the year-ago period as adjusted earnings per share grew 7.9% to $2.05. Management reported a net debt position of roughly $12 billion at the end of the quarter, comprised of $19 billion in cash and marketable securities and ~$31 billion in debt.

The company took the opportunity following its strong third quarter to raise a number of guidance metrics for the full year 2018. It now expects reported revenue to grow 6%-6.5% to $81.0-$81.4 billion compared to prior guidance of 5.3%-6.3% growth and a guidance range of $80.5-$81.3 billion. Adjusted pre-tax operating margin is now projected to improve by at least 150 basis points as compared to prior guidance for roughly 150 basis points of expansion, which is expected to help drive reported adjusted earnings per share to a range of $8.13-$8.18 compared to prior guidance of $8.07-$8.17.

We currently value shares of Johnson & Johnson at $133 each, and its Dividend Cushion ratio sits at a healthy 2.2 to go along with a dividend yield of ~2.65% as of this writing. We expect to continue highlighting the company in the simulated newsletter portfolios for the time being.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.