Image Source: J&J

Johnson & Johnson has been the stalwart of our healthcare exposure within the newsletter portfolios, and the company is off to a fantastic start in 2018.

By Brian Nelson, CFA

On April 17, Johnson & Johnson (JNJ) issued a strong first-quarter 2018 report that showed sales increasing 12.6% thanks to a near-20% jump in international top-line performance. On an operational basis, excluding the net impact of acquisitions and divestitures, worldwide sales advanced 4.3% thanks again to an above-average international sales ramp. The company’s bottom line fared well during the period, too. Adjusted net earnings and adjusted earnings per share for the first quarter came in at $5.6 billion and $2.06, respectively, both up double digits on a year-over-year percentage basis.

Looking ahead to 2018, management is expecting sales to be in the range of $81-$81.8 billion, reflecting strong operational growth to the tune of 4%-5%. Johnson & Johnson also reiterated its adjusted earnings guidance for full-year 2018 to the range of $8-$8.20 per share, reflecting operational growth of nearly 10% at the high end of the range. There was no news about the dividend, but J&J last increased its payout 5% in late April 2017, so we should be expecting something soon.

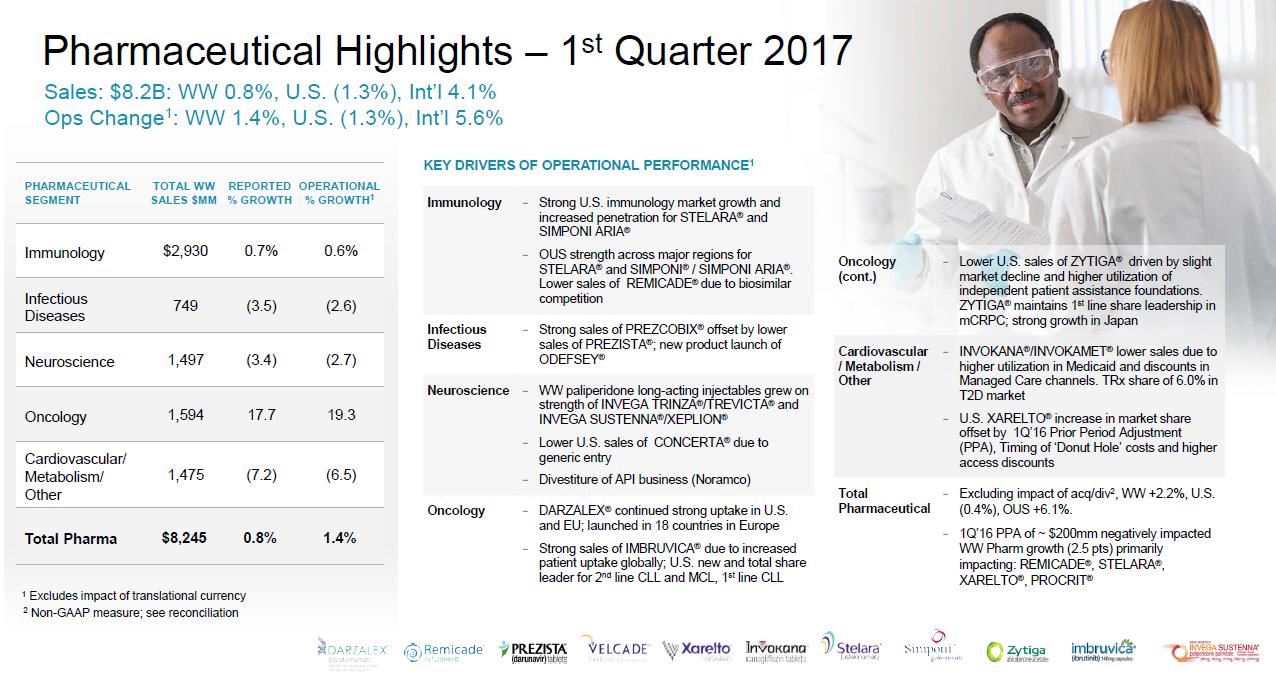

Though Johnson and Johnson’s pharmaceutical portfolio has some risks, “Johnson & Johnson in Transition Mode,” the division was the star performer during the first quarter of 2018, with worldwide sales on an operational basis advancing 7.5%. Sales of Simponi, Stelara, Imbruvica, and Zytiga advanced considerably during the period, and revenue from J&J’s oncology portfolio leapt 37% on an operational basis during the quarter. We’re expecting big things in oncology at J&J, “Key Oncology Assets Powering Johnson & Johnson Higher.”

We think most of the headline risk at J&J is coming from consumer lawsuits regarding talc products, but any settlements in that area will be quite manageable, in our opinion, and won’t disrupt the company’s strong balance sheet. Strong top-line growth and earnings leverage during the first quarter speak to a strong start for 2018 at Johnson & Johnson, in our view, and expectations for ongoing cost cuts may only improve the bottom line. We continue to like Johnson & Johnson and expect good things ahead.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.