Image Source: Johnson & Johnson – Second Quarter of 2022 IR Earnings Presentation

By Callum Turcan

Johnson & Johnson (JNJ) reported second quarter 2022 earnings that beat both top- and bottom-line estimate consensus estimates. Johnson & Johnson maintained the midpoints of its full-year non-GAAP adjusted operational sales and earnings per share guidance during its latest earnings update but reduced its reported sales and earnings guidance due to headwinds stemming from a strengthening US dollar.

We continue to like Johnson & Johnson as an idea in both the Best Idea Newsletter and Dividend Growth Newsletter portfolios. Shares of JNJ yield ~2.6% as of this writing.

Please note that Johnson & Johnson is in the process of spinning off its ‘Consumer Health’ segment as a separate publicly traded entity by 2023 through a tax-free transaction. The firm is still working out the details and intends to finalize the organizational design of the new enterprise by the end of this year.

Earnings Update

Demand for the health care giant’s offerings remains robust as its adjusted operational sales jumped higher 8% year-over-year and its adjusted diluted EPS grew by 4% year-over-year during the second quarter. Adjusted operational sales were up 3% year-over-year at its ‘Consumer Health’ segment. Growth in the segment was supported by its over-the-counter upper respiratory and analgesic products along with its Neutrogena branded beauty and skin care products selling well in international markets. Its Imodium digestive health branded products also sold well last quarter.

Pivoting to its ‘Pharmaceutical’ segment, adjusted operational sales in this area were up 12% year-over-year last quarter. Johnson & Johnson’s oncology (DARZALEX, ERLEADA) treatments, STELARA treatment (treats Crohn’s disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis), and its portfolio of schizophrenia treatments (INVEGA SUSTENNA/XEPLION and INVEGA TRINZA/TREVICTA) were solid revenue generators last quarter. Additionally, the firm’s COVID-19 vaccine (Ad26.COV2.S) put up decent sales performance, albeit from subdued expectations.

Looking at its ‘MedTech’ segment now, adjusted operational sales in this segment were up 3% year-over-year last quarter. Its contact lenses, vision surgical products, and electrophysiology products sold well in the second quarter, though Johnson & Johnson alluded to a slowdown in sales in China (citing “COVID-19 related mobility restrictions in certain regions” as a headwind) as holding back its performance at this segment. Here is what management had to say on the issue in response to an analyst’s question during Johnson & Johnson’s second quarter earnings call:

“Again, it gets really difficult to really draw comparisons around procedure volume because we still are dealing with the impact of COVID in the second quarter alone in China. That impacted growth and procedures were down roughly 25% with a little bit improvement towards the last month from what we saw in April and May.” — Joe Wolk, EVP and CFO of Johnson & Johnson

With economic lockdowns in China easing up of late, there is room for upside at Johnson & Johnson’s MedTech segment going forward. However, we caution that potential future economic lockdowns to contain the spread of COVID-19 in the world’s second largest economy remains a key downside risk.

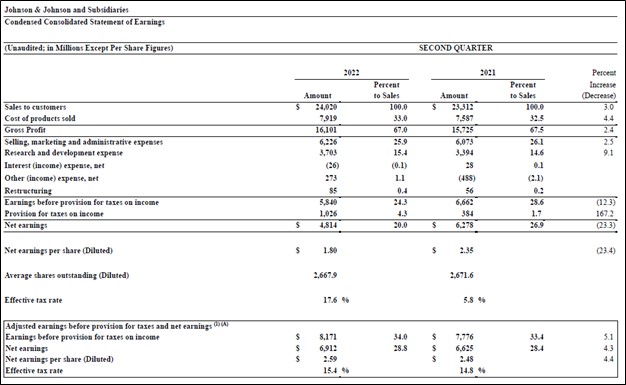

On a GAAP basis, Johnson & Johnson’s revenues grew 3% year-over-year to reach $24.0 billion though its diluted EPS dropped by 23% year-over-year to hit $1.80 in the second quarter of 2022. However, please note that its provision for corporate income taxes more than doubled as a percent of sales during this period and that special items also held down its GAAP earnings.

Its GAAP operating income came in at $6.2 billion in the last quarter, down just 1% year-over-year. Johnson & Johnson’s GAAP gross margin declined by ~50 basis points year-over-year to 67.0% and its core operating expenses (‘selling, marketing and administrative expenses’ and ‘research and development expense’) rose to 41.3% of its net sales (up ~60 basis points year-over-year) in the second quarter.

Image Shown: Johnson & Johnson’s GAAP financials faced headwinds due to special items, a significant increase in its provision for corporate income taxes, and a stronger US dollar last quarter. However, demand for its offerings remained robust and its GAAP operating income held up relatively well. Image Source: Johnson & Johnson – July 2022 8-K SEC filing covering its second quarter of 2022 earnings update

As of this writing on July 26, Johnson & Johnson has yet to publish its balance sheet and cash flow statements covering the second quarter of 2022. In an earnings presentation slide, management noted that the firm’s net cash/debt position was neutral at the end of the period and that the firm generated ~$8 billion in free cash flow during what appears to be the first half of this year. We will have more to say once Johnson & Johnson publishes its 10-Q SEC filing covering the second quarter of 2022.

Image Shown: Johnson & Johnson apparently had a strong balance sheet at the end of the second quarter of this year and remained a stellar generator of free cash flow during the first half of 2022. Image Source: Johnson & Johnson – Second Quarter of 2022 IR Earnings Presentation

Guidance Update

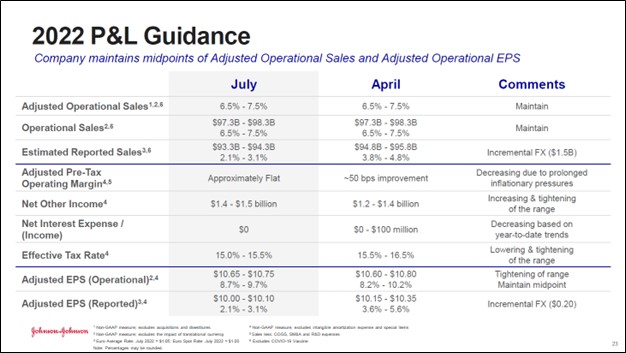

As noted previously, Johnson & Johnson reduced its full-year guidance for its reported sales and EPS performance in conjunction with its latest earnings update. It narrowed the range of its adjusted operational EPS guidance but kept the midpoint the same. Johnson & Johnson now expects its adjusted operating income margin to be broadly flat this year versus 2021 levels (previously, the firm was guiding for a ~50 basis point expansion) with management citing “the prolonged impact of inflationary pressures” as the main culprit. The upcoming graphic down below provides an overview of Johnson & Johnson’s current guidance versus its previous forecasts.

Image Shown: Johnson & Johnson maintained the midpoints of its adjusted operational sales and EPS guidance for 2022 during its latest earnings update. Image Source: Johnson & Johnson – Second Quarter of 2022 IR Earnings Presentation

Concluding Thoughts

Overall, Johnson & Johnson put up decent performance last quarter in the face of major exogenous shocks (inflationary pressures, labor shortages, supply chain hurdles, and the Ukraine-Russia crisis). The firm’s underlying business is growing at a nice clip, its balance sheet is quite strong, and Johnson & Johnson continues to churn out “gobs” of free cash flow. Furthermore, its near term outlook calls for Johnson & Johnson’s underlying business to keep growing at a decent pace going forward (with an eye towards its adjusted operational sales and EPS growth forecasts for 2022).

We like Johnson & Johnson as an idea in the newsletter portfolios. Our recently updated fair value estimate sits at $185 per share of JNJ, moderately above where shares are trading at as of this writing. Additionally, we also view Johnson & Johnson’s dividend growth potential quite favorably due to its strong financial standing.

—–

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: XLV

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, and V. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.