Image Source: Johnson & Johnson – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

On a price-only basis, shares of Johnson & Johnson (JNJ) are up ~2% year-to-date through the end of regular trading hours on March 22, while the S&P 500 (SPY) is down ~6% during this period. We include shares of Johnson & Johnson as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios, and we love the company’s resiliency in the face of whatever challenges are thrown at it.

In our view, the relative strength seen in Johnson & Johnson’s stock price is the product of its legal strategies moving things in the right direction and the favorable fiscal 2022 guidance the firm issued when reporting its final quarterly earnings report for fiscal 2021. Please note that Johnson & Johnson’s fiscal year ends around the end of December or the beginning of January. Shares of JNJ yield ~2.4% as of this writing. Our fair value estimate for Johnson & Johnson sits at ~$160 per share with room for potential upside based on the high end of our fair value estimate range.

Back in November 2021, Johnson & Johnson announced it would spin off its consumer health operations (includes band-aid, skin health, beauty, oral health, and over-the-counter analgesic offerings from brands such as Neutrogena, AVEENO, Tylenol, JOHNSON’S, and BAND-AID) while retaining its pharmaceutical and medical devices operations, a move that will fundamentally alter its business profile. The spinoff is expected to take between 18-24 months to complete, and we may adjust our newsletter portfolios down the road.

Legal Liability Updates

Johnson & Johnson recently created a new subsidiary, LTL Management LLC, and last year transferred its talc-related legal liabilities in the US over to that unit. In October 2021, LTL Management filed for Chapter 11 so it could consolidate and eventually resolve numerous talc-related lawsuits via the bankruptcy process. Johnson & Johnson committed $2.0 billion to the new entity along with royalty streams that had a present value of $0.35 billion to help cover the cost of potential legal settlements. A US bankruptcy judge approved the move in February 2022, though please note that the ultimate cost to Johnson & Johnson could be significantly higher than what has already been set aside.

Additionally, Johnson & Johnson has been hard at work securing settlements with various government entities over its alleged role in the opioid epidemic in the US. Johnson & Johnson agreed to pay $5.0 billion as part of a nationwide settlement covering US state and local governments and Native American governments over nine years, and in February 2022, there was enough participation to move forward with the accord. Other companies are contributing an additional $21.0 billion combined over 18 years as part of this deal, with contributions from AmerisourceBergen Corp (ABC), Cardinal Health Inc (CAH), and McKesson Corp (MCK).

Recent events indicate Johnson & Johnson is steadily putting its legal issues behind it. A resolution on these fronts should remove some of the major clouds hanging over the company’s outlook. Investors now have a much better idea of what Johnson & Johnson’s legal settlement liabilities could end up looking like as compared to where things stood a year ago.

Financial Update

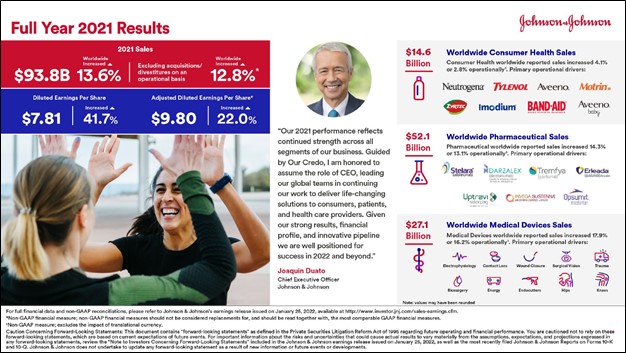

Johnson & Johnson grew its GAAP revenues by 14% annually in fiscal 2021, aided by double-digit growth at its ‘Pharmaceutical’ and ‘Medical Devices’ business segments and modest single-digit growth at its ‘Consumer Health’ segment. The company’s GAAP diluted EPS grew to $7.81 in fiscal 2021, up sharply from $5.51 in fiscal 2020 and $5.63 in fiscal 2019, as Johnson & Johnson’s growth story resumed in earnest last fiscal year. We appreciate the resilience of its business model, keeping in mind the company is in the process of splitting itself up.

Image Shown: Johnson & Johnson reported strong financial performance across its three core business operating segments in fiscal 2021. Image Source: Johnson & Johnson – Fourth Quarter of Fiscal 2021 IR Earnings Presentation

Sales of its coronavirus (‘COVID-19’) vaccine combined with sales growth of its DARZALEX (treats certain cancers) and STELARA (treats plaque psoriasis and psoriatic arthritis) therapeutics supported the performance of its Pharmaceutical segment last fiscal year. Pivoting to its Medical Devices segment, a strong rebound in elective surgery activity in fiscal 2021 from subdued fiscal 2020 levels was key to supporting sales growth here. Sales growth at its Consumer Health segment was supported by its Tylenol analgesics and digestive health offerings along with a rebound in sales of its Neutrogena and AVEENO skin health and beauty products.

Johnson & Johnson generated $19.8 billion in free cash flow in fiscal 2021 while spending $11.0 billion covering its dividend obligations and another $3.5 billion buying back its stock during this period. Its stellar free cash flow generating abilities underpins why we have been big fans of the name for some time.

The firm exited fiscal 2021 with a net debt position of $2.1 billion (inclusive of short-term debt and current marketable securities), a relatively modest figure given its strong free cash flows. Please note that the company’s net debt load stood at $10.1 billion at the end of fiscal 2020 (inclusive of short-term debt and current marketable securities). We see Johnson & Johnson possessing the financial strength to cover its pending legal settlements while maintaining its nice dividend growth track record, aided by its recent deleveraging efforts.

Guidance

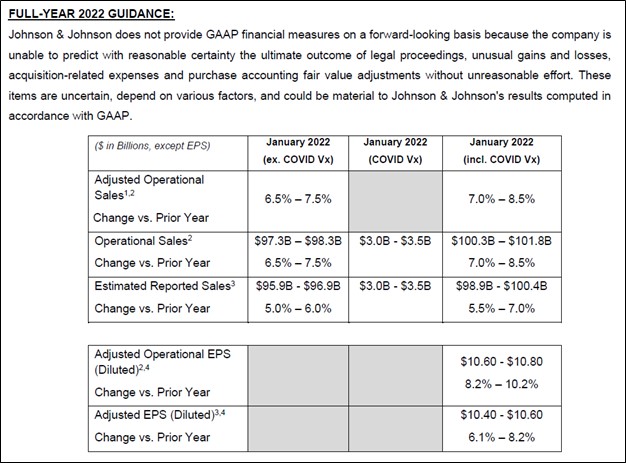

In conjunction with its fiscal fourth quarter earnings update Johnson & Johnson issued guidance for fiscal 2022 that calls for its growth momentum to continue. Johnson & Johnson expects its non-GAAP adjusted operational sales will climb higher 7.0%-8.5% year-over-year while its non-GAAP adjusted operational diluted EPS is expected to grow 8.2%-10.2% year-over-year in fiscal 2022. Its sales growth is expected to be strong even when removing the impact of its COVID-19 vaccine revenues, highlighting the strength of Johnson & Johnson’s underlying operations.

Image Shown: Johnson & Johnson expects its top- and bottom-lines will grow robustly in fiscal 2022. Image Source: Johnson & Johnson – Fourth Quarter of Fiscal 2021 Earnings Press Release

Concluding Thoughts

We appreciate Johnson & Johnson’s resilient business model and promising growth outlook. Its various legal situations and the pending spinoff of its consumer health operations have fundamentally altered its proposition as a straightforward dividend growth opportunity, but the stock continues to hold up in an otherwise tumultuous environment. We’re not counting J&J out by any means, and the stock remains a core holding in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio.

—–

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: ABC, CAH, MCK, VDC, XLV

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, and XLE and is long call options on DIS and FB. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.