Image Source: J&J

By Brian Nelson, CFA

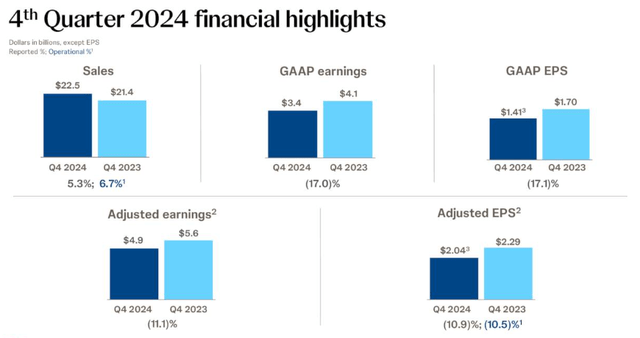

On January 22, Johnson & Johnson (JNJ) reported better than expected fourth quarter results with both revenue and non-GAAP earnings per share exceeding the consensus forecasts. Fourth quarter sales growth came in at 5.3%, with operational growth of 6.7% and adjusted operational growth of 5.7%. Fourth quarter earnings per share came in at $1.41, while adjusted earnings per share came in at $2.04, both measures impacted by IPR&D charges related to the V-Wave acquisition. Adjusted diluted earnings per share was down 10.9% from the prior year period.

Management had the following to say about the quarter:

2024 was a transformative year for Johnson & Johnson, marked by strong growth, an accelerating pipeline and industry-leading investments in innovation. As a healthcare company, with a disease-centric approach, we are improving the standard of care in a broad range of diseases with high unmet need, including multiple myeloma, lung cancer, inflammatory bowel disease, and heart failure. With our strong financial foundation, differentiated portfolio and robust pipeline, we are well positioned to sustain the high pace of growth and innovation that is the hallmark of Johnson & Johnson.

For the fourth quarter, sales in its Innovative Medicine segment advanced 4.4% (6.3% on an adjusted operational basis), while sales in its MedTech division increased 6.7% (4.6% on an adjusted operational basis). Innovative Medicine worldwide operational sales, excluding the COVID-19 vaccine, grew 7.5% driven by DARZALEX, ERLEADA, CARVYKTI, and Other Oncology in Oncology, TREMFYA in Immunology, and SPRAVATO in Neuroscience. Growth was partially offset by STELARA in Immunology and Other Neuroscience in Neuroscience. Growth in its MedTech division was driven by electrophysiology products, Abiomed in Cardiovascular, and wound closure products in General Surgery.

Image Source: J&J

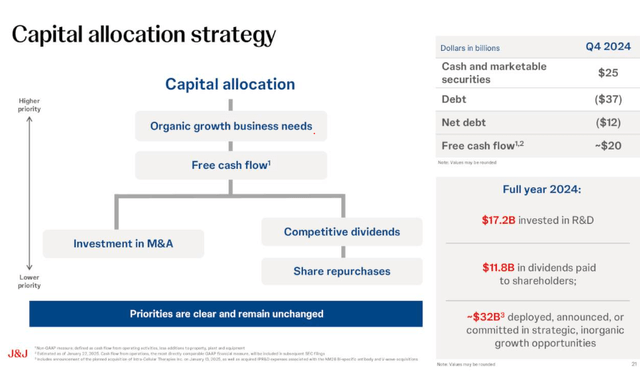

For the full year 2024, J&J’s free cash flow came in at ~$19.8 billion, up from $18.2 billion last year. The company ended the quarter with ~$12 billion in net debt. J&J made significant pipeline progress in the quarter including RYBREVANT + LAZCLUZE overall survival data, initiation of TAR-200 submission, and the approval of investigational device exemption for its general surgery robotic system, OTTAVA. J&J issued guidance or 2025 calling for operational sales growth of 2.5%-3.5%, below the consensus forecast, and adjusted operational earnings per share growth of $10.75-$10.95, reflecting 8.7% growth at the midpoint. We like J&J, but the company does not make the cut for inclusion in any newsletter portfolio at this time.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.