Image Source: Johnson & Johnson – Second Quarter of 2021 IR Earnings Presentation

By Callum Turcan

On July 21, Johnson & Johnson (JNJ) reported second-quarter 2021 earnings that beat both consensus top- and bottom-line estimates. The company (once again) boosted its full-year guidance in conjunction with its latest earnings update as Johnson & Johnson’s business is steadily rebounding from the worst of the coronavirus (‘COVID-19’) pandemic, with an eye towards the ongoing recovery in the sales of its medical devices and related offerings.

We include shares of JNJ as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Its latest earnings report and guidance boost reinforced our favorable view towards the name. Shares of JNJ yield ~2.5% as of this writing, and the top end of our recently updated fair value estimate range sits at $206 per share of Johnson & Johnson, well above where shares are trading at as of this writing.

Earnings Snapshot

The healthcare giant’s ‘Consumer Health’ unit posted 10% year-over-year adjusted operational sales growth in the second quarter due to strong demand for skin care and beauty products, though this segment remains embattled due to recent voluntary product recalls and various long running potential legal liabilities.

Its ‘Pharmaceutical’ unit posted 14% year-over-year adjusted operational sales growth with strength seen at its oncology (DARZALEX, ERLEADA, and IMBRUVICA), infectious diseases (STELARA), plaque psoriasis (TREMFYA), and schizophrenia (INVEGA SUSTENNA/XEPLION/INVEGA TRINZA/TREVICTA) treatments.

Finally, the company’s ‘Medical Devices’ unit came roaring back last quarter and posted 59% year-over-year adjusted operational sales growth as elective surgeries delayed during the worst of the COVID-19 pandemic resumed in earnest, with the segment reporting strength across the board.

On a GAAP basis, Johnson & Johnson’s revenues grew by 27% year-over-year, its gross profit surged higher by 34% year-over-year, and its net income rocketed higher by 73% year-over-year in the second quarter of 2021. The company’s GAAP operating income (gross profit less selling, marketing, and administrative expenses and research and development expenses) grew by 54% year-over-year.

Economies of scale, meaningful gross profit expansion (aided by the recovery at its Medical Devices unit), and managed growth in its operating expenses led to Johnson & Johnson’s operating margin stagging an impressive recovery last quarter (which were up ~470 basis points year-over-year last quarter). We are impressed with Johnson & Johnson’s financial rebound.

Johnson & Johnson did not provide a balance sheet or cash flow statement within its second-quarter earnings press release. During the company’s latest earnings call management had this to say regarding the firm’s financial performance (emphasis added):

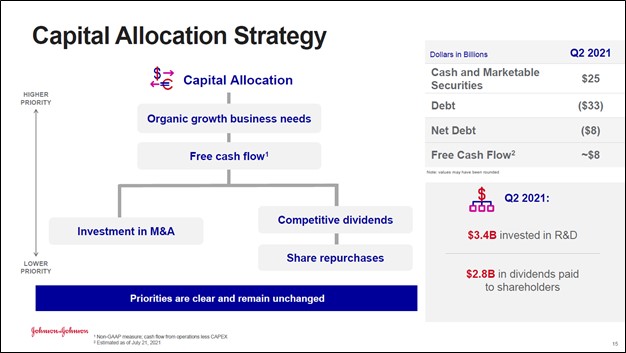

“Let’s get into the results with an update on our cash position. We continue to generate strong free cash flow, with approximately $8 billion year-to-date.

We ended the second quarter with approximately $25 billion of cash in marketable securities and approximately $33 billion of debt, resulting in $8 billion of net debt. Our financial position and balance sheet remains strong. As we enter the back half of the year, we are well-positioned to continue to deploy capital in a strategic, value-creating way that will benefit stakeholders over the long term.

Our dividend remains a key priority. And during the quarter, we distributed $2.8 billion to shareholders. Regarding M&A, we continually evaluate strategic opportunities that have the potential to further enhance our business, while also driving better health outcomes for patients and consumers.” — Joseph Wolk, Executive Vice President and CFO of Johnson & Johnson

The upcoming graphic down below highlights Johnson & Johnson’s capital allocation priorities, though please note some of the information is not labeled in a straightforward manner when compared to management’s commentary (namely the estimated free cash flow figure provided in the below graphic does not specify whether it is a year-to-date or quarterly figure, though recent management commentary indicates that it is a year-to-date figure, and the dividend payout figure is just for the second quarter of 2021). We will have more to say when the company posts its 10-Q SEC filing covering the second quarter of 2021, though we appreciate that Johnson & Johnson apparently remained quite free cash flow positive and retained its balance sheet strength last quarter.

Image Shown: A snapshot of Johnson & Johnson’s financial strength at the end of the second quarter of this year. We are big fans of its stellar free cash flow generating abilities and its sizable liquidity position on hand, though we will have more to say when the firm posts its 10-Q SEC filing covering the second quarter of 2021. Image Source: Johnson & Johnson – Second Quarter of 2021 IR Earnings Presentation

Johnson & Johnson has the financial strength to manage its various potential legal obligations while still making good on its dividend obligations, in our view, and its net debt load is relatively tame when stacked up against its impressive free cash flow generating abilities.

Reportedly, Johnson & Johnson recently reached a major settlement worth ~$5 billion with a group of US state attorneys general regarding its alleged role in the opioid crisis, and we are glad the firm is working to put the past behind it. Additionally, the company is reportedly considering spinning off all or a portion of its unit that concerns its potential baby power talc liabilities (particularly in the US), and then having that entity declare bankruptcy as a way to manage litigation and potential payouts going forward, though nothing for is certain at this point.

Guidance Update

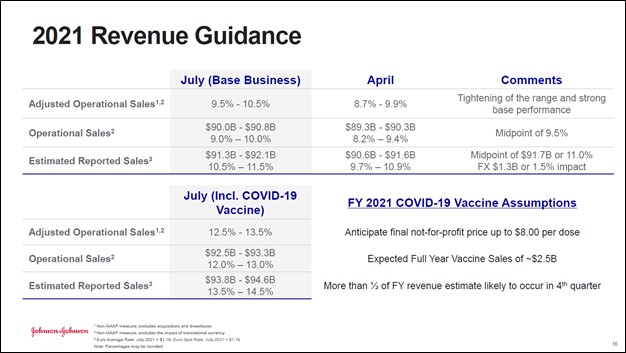

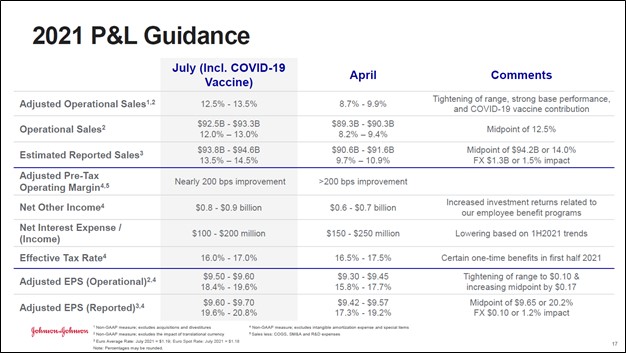

In the upcoming two graphics down below, Johnson & Johnson highlights its updated full-year guidance for 2021 which saw the firm boost both its sales and EPS forecasts versus previous guidance. Please note that Johnson & Johnson expects to generate approximately $2.5 billion in sales from its COVID-19 vaccine this year (most of which is expected to be realized in the final quarter of 2021). Additionally, Johnson & Johnson now expects its non-GAAP adjusted pre-tax operating margin to expand by “nearly 200 basis points” this year versus its previous guidance calling for an expansion north of 200 basis points, and we would like to stress here than inflationary headwinds are likely playing a role on this front.

Image Shown: An overview of Johnson & Johnson’s updated revenue forecast for 2021, which saw the firm boost its estimated sales guidance as it concerns both its “base business” and its business when including its forecasted COVID-19 vaccine sales. Image Source: Johnson & Johnson – Second Quarter of 2021 IR Earnings Presentation

Image Shown: An overview of Johnson & Johnson’s updated financial guidance for 2021, which saw the firm increase its EPS guidance on the back of strong underlying demand for its offerings across the board. Image Source: Johnson & Johnson – Second Quarter of 2021 IR Earnings Presentation

We appreciate the firm’s latest guidance boost as it highlights management’s growing confidence that Johnson & Johnson’s financial and operational performance will rebound strongly from the worst of the COVID-19 pandemic. The pandemic is still raging in many parts of the world, and Johnson & Johnson will be able to play a leading role in helping bring the public health crisis under control by ensuring a steady ramp in its vaccine production levels.

Please note that we do not expect Johnson & Johnson to generate needle-moving revenue and profits from its COVID-19 vaccine over the long haul, but we do expect that a successful rollout of the vaccine would earn the firm goodwill from governments, consumers, and other entities around the globe. There were plenty of hiccups at the start of the company’s vaccine manufacturing ramp up strategy (some of which were not Johnson & Johnson’s fault but the fault of its partners), though more recently, the manufacturing ramp up has been moving in the right direction, which we appreciate.

Concluding Thoughts

Johnson & Johnson is a rock-solid enterprise on the upswing and its latest earnings report reinforced why we are big fans of the name. The company continues to work towards putting the past behind it in regard to its legal liabilities, which we appreciate, and greater certainty on those fronts going forward should support Johnson & Johnson’s outlook. We continue to view both Johnson & Johnson’s capital appreciation and dividend growth upside quite favorably.

Johnson & Johnson’s 16-page Stock Report >>

Johnson & Johnson’s Dividend Report >>

—–

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: VDC, XLV

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund ETF (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.