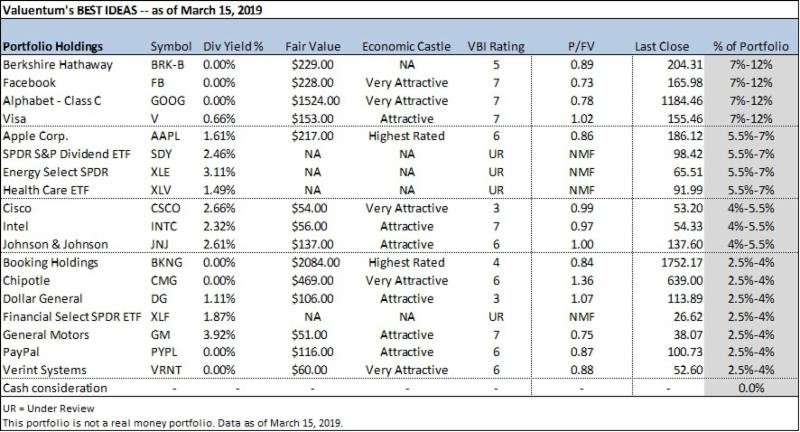

Image shown: Valuentum migrated to a weighting range format for the Best Ideas Newsletter portfolio ideas beginning in 2018.

This article was sent to members via email March 15.

By Brian Nelson, CFA

I was on social media the other day, and somebody was asking whether there would be more engagement/likes/appreciation from a picture of a cat than if someone were to put up great stock picks year after year. I think the poll came back in favor of the cat pictures! It’s an interesting time, and investors are tuning out great research because they simply don’t know what to listen to. They don’t know the real deal, and that’s why writing Value Trap: Theory of Universal Valuation was so important. It’s really that bad out there.

When I think back about starting this Best Ideas Newsletter in 2011, boy have we come a long way. Did you know we measured the performance of the simulated newsletter portfolio from inception through December 15, 2017, and it outperformed the S&P 500 no matter how it was measured, despite a huge “cash position” throughout. But here’s what I want you to know about the date: December 15, 2017. Visa (V) was the top “weighted” idea at 8.6% at that time, and since then, shares of Visa are up ~40% while the S&P 500 is up ~10%.

Do you know how many money managers would love to have had Visa as a near-10% weighting prior to it outperforming the S&P 500 nearly 30 percentage points — and this after all of our prior track record! From the ~80% success rates in the Exclusive publication for both capital-appreciation ideas and short-idea considerations to the performance of the best ideas in the Best Ideas Newsletter portfolio, I don’t think anybody out there is doing better. Most money managers are trailing the S&P 500–the vast majority of them.

With that said, let’s dig into the March edition of the Best Ideas Newsletter. Let me know how you’re doing, too! I appreciate very much that you’re here, and have a wonderful weekend! [Tell your neighbor about Valuentum.]

Thank you,

Brian Nelson, CFA

President, Investment Research

Valuentum Securities, Inc.

Tickerized for ideas in the simulated Best Ideas Newsletter portfolio.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.