With healthcare the primary focus in Washington, let’s evaluate the investment case for DaVita. We discuss how potential changes can impact the economics of the dialysis market.

By Alexander J Poulos

The healthcare sector remains in focus with the renewed emphasis on repealing/replacing the Affordable Care Act. The uncertainty that has crept into the industry may offer an appealing entry into the industry for those currently on the sidelines. The write-up below discusses the prospects of DaVita Inc (DVA), one of the largest providers of dialysis care in the United States.

The Inelastic Demand for Dialysis

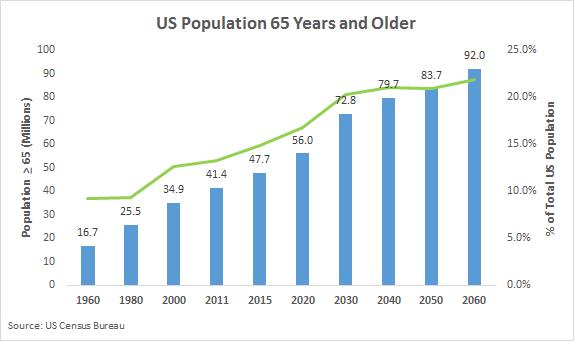

The dialysis market mirrors the use of insulin, the classic economics example of inelastic demand. The demand for dialysis remains unfazed irrespective of market conditions. Companies that exhibit this type of characteristic tend to trade at a premium multiple to the market due to the greater predictability of their business models. DaVita remains a well-run enterprise that dominates the lucrative renal dialysis market. DaVita should continue to profit from the trend toward the aging of the population, a “locked-in” source of long-term trend.

Source: US Census Bureau

Background on DaVita

Since taking the helm of DaVita in October of 1999, CEO Kent Thiry has embarked on a campaign to consolidate the industry. The dialysis market was highly fragmented with numerous regional players generating a poor return on capital. The thrust behind the move towards consolidation was two-fold. The first was to improve margins via the elimination of competition. The second reason rested in the ability to generate negotiating power with the largest single payer of dialysis care, the US government.

The kidneys play a vital role in the body. The kidney’s function is to filter the blood to remove wastes, which are expelled from the body through the excretion of urine. Various diseases can affect the function of the kidneys with diabetes being the leading cause of decreased kidney function. As the kidneys loses its ability to function properly, the body will lose the capacity to remove toxins. At this time, a patient will either require dialysis treatment to serve as a substitute for a properly working kidney or if warranted a transplant. The loss of kidney function is often a slow and gradual process (chronic kidney disease) although some may develop what is known as an acute renal failure, which is often reversible.

Dialysis treatment is typically a three-times-a-week endeavor at a designated facility. Depending on the severity of the individual’s case, it may become a lifetime regimen which can become very costly. DaVita estimates that 93% of all patients will qualify for coverage under Medicare irrespective if they are under 65. For those who have private insurance typically obtained through an employer, the private insurance will cover treatment for 30-33 months with Medicare acting as a secondary insurance covering the remaining costs. After the initial period, Medicare becomes the primary coverage with the private insurance covering the balance. Based on the payer dynamics, size is necessary to effectively negotiate with the largest single payer, the Medicare system.

Storm Clouds on the Horizon

The entire industry sold off in early August after the Centers for Medicare and Medicaid Services (CMS) requested further info on the billing practices of the dialysis industry. The Medicare/Medicaid system provides coverage for roughly 80% of the affected patient pool with private insurance covering the other 20%. The commercial payers continue to subsidize the lower reimbursement from the Medicare providers, thus ensuring DaVita’s dialysis business generates an attractive EBITDA margin.

The particular groups in question are those covered by the Medicare Advantage plans purchased through the exchange. The American Kidney Fund, a charity in existence since the 1970’s has offered to pay the premiums for the dialysis patients if they choose a Medicare Advantage plan. The charity is not breaking any laws and is operating well within its charter. The Medicare system for those who may not be familiar allows private donations to help defray some of the enormous patient costs for expensive treatments.

The current system is set whereas Medicare coverage pays for the bulk of the patient undergoing dialysis treatment. The average reimbursement per Medicare patient is $256 per patient with private insurance coverage reimbursing roughly $1000 per treatment. The average revenue per treatment per patient was $347.60 per patient in 2015. Private insurance patients are subsidizing those covered by Medicare in what can be viewed as an unsustainable system. At some point, reimbursement will need to be smoothed out with the rate paid by the government to fall more in line with the industry’s average per patient. By smoothing out the revenue stream, the favorable demographic tailwind (rapidly aging global population) should provide a favorable backdrop for sustained revenue and earnings growth.

The laws governing Medicare allow for the use of private charities to cover/offset some of the costs involved with modern medicine. In the case with Davita and other providers, if patients that would usually use the Medicare system were steered into the Medicare Advantage plan, the industry would stand to triple reimbursement per patient. We suspect the industry and Davita will be vindicated as the practice is legal (the charity in question is the American Kidney Fund, which has been in existence since the 1970s). We would be far more skeptical of the investigation if the charity in question were recently created.

Temporary Vindication?

The share price of DaVita bottomed in late October 2016 just ahead of the earnings release. DaVita issued a press release stating they would no longer support eligible patients in enrolling in Medicare Advantage plans through the assistance of the American Kidney Fund. The company estimated the move would have an adverse impact of $140 million in operating income for the enterprise. In essence, DaVita took the overhang off the table by discontinuing the legal yet questionable practice.

Temporary vindication occurred in early January with a ruling from the District Court in Eastern Texas that placed the proposed CMS rule on hold. The following release from DaVita neatly sums up the companies stance on the ruling:

On behalf of our patients, we are pleased that the court took the important step of putting a hold on Centers for Medicare and Medicaid Services (CMS) rule that would have harmed thousands of the sickest patients in America.

The court not only suspended the rule from going into effect but determined that it is “arbitrary and capricious” and should be vacated. The court also found that it would “leave thousands of Medicare-ineligible [dialysis] patients without health insurance,” that the government “has long accepted the practice of charitable premium assistance,” and that CMS offered no explanation for the change in policy.

Nevertheless, the threat to dialysis patients by health insurance providers still exists. We ask the new administration and CMS to not only eliminate this rule but to take action to prevent insurance companies from discriminating against a vulnerable group of patients and ensure continued access to charitable premium assistance that has served as an essential patient safety net for the last 20 years.

While a potential positive outcome for the industry, the results have come too late to help 2017 results. The annual enrollment period for Medicare Advantage plans runs from mid-October through December, so the bulk of eligible patients have already made their choice for 2017, unfortunately.

Not All Acquisitions Pan Out

The initial selling pressure in DVA began in mid-2015 as the results from the acquisition of Healthcare Partners began to trickle in. Healthcare Partners is one of the largest medical groups in the in California, a notable departure from Davita’s area of core competency. Davita’s decision to branch is an attempt to expand into a more comprehensive version of coordination of care.

The company’s goal is to follow the patient from primary care through the various paths of care required. By handling all of the patient’s needs in-house, the idea is to provide enhanced outcomes at a lower overall cost. The acquisition thus far has turned out to be an unmitigated disaster with margins far lower than expected on the completion of the deal. The effect can clearly be seen in operating margins dropping in 2012 from 21.2% to 20.3% in 2013, 18.9% in 2014 and 18.2% in 2015. The dialysis division’s EBITDA margins consistently come in the 20% range whereas the EBITDA margins for Healthcare partners comes in at 10%.

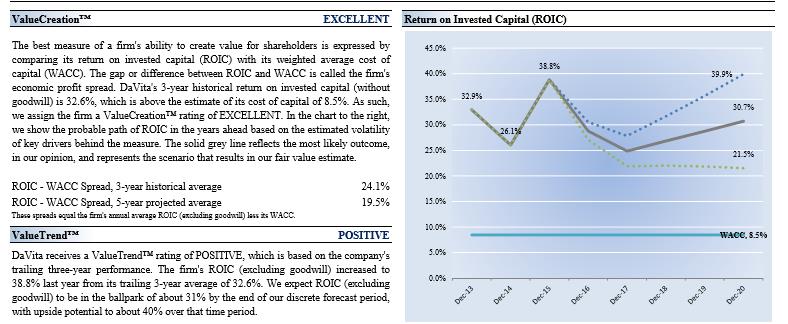

Source: Valuentum Securities

The single biggest area for improvement is the Healthcare Partners division. The margins have been unacceptable, by company standards. The acquisition has all of the hallmarks of a botched acquisition, but DaVita’s visionary CEO Kent Thiry is now leading the charge at Healthcare Partners, and the division is beginning to show signs of stabilization. The stabilization of margins (with the hope for a boost in segment margins) may help to support companywide profit levels and even alleviate an overhang on the equity.

The second area of improvement may come through the legislative process. The following quote from a recent conference call was quite revealing.

Javier Rodriguez, DaVita HealthCare Partners Inc. – CEO-DaVita Kidney Care [5]

At our Capital Markets Day, we talked about the powerful benefits of integrated care for chronic populations, including our own ESRD (end-stage renal disease) patients. Since then, two new pieces of legislation that are supported by the dialysis community have been introduced in Congress. The first is called the Dialysis Patient Demonstration Act, and that provides for true integrated care model for Kidney Care patients. The second is called the ESRD Choice Act of 2016 and that would finally allow for ESRD patients to enroll in MA plans.

Both of these acts would be a great gift to ESRD patients and play to our long-term strategy of integrated care. We are hopeful about their prospects in Congress due to the strong bipartisan support, and we will continue to work hard to pursue integrated care for our patients.

DaVita and the entire industry is at a crossroads, as the legislative process is now attempting to “fix” healthcare. For clear political and optical reasons, politicians are loath to be caught denying predominately ill senior citizens the same rights afforded the healthier ones. Naturally, a higher mix towards Medicare Advantage patients would have a positive effect on industry margins.

The Berkshire Hathaway Effect

Warren Buffet continues to move markets. Buffett’s famed holding company, Berkshire Hathaway controls over 20% of the shares outstanding in DaVita. The position has been built over an extensive period by Ted Weschler, one of Buffett’s top underlings.

While the DaVita stake is a long-standing position, if Weschler decided to unwind the position, it would have a materially adverse effect on the share price. Thus far, there are no apparent signs of selling, yet it can come at any time, thus posing a unique risk to owning the shares.

DaVita is clearly a company at the crossroads; we really like the business’ underlying ability to generate a ton of free cash flow. Our overall concern, however, is how the legislative process will shape up–any movement to smooth out overall reimbursement levels would be a huge positive, however. For now, we are content to watch the legislation unfold before taking a more proactive dive into the entity. At the moment, Buffett disagrees.

DaVita is one you should be watching closely in any case.

Health Care Services: CYH, DVA, HLS, LPNT, MD, THC, UNH, UHS