Image Shown: While Lear Corporation appears attractive at first glance, its technical performance tells a different story. The market is concerned that the global synchronized downturn that has emerged will get worse, which would weigh on Lear’s expected financial trajectory. Global automotive sales are already coming under pressure, and there’s not much Lear, as a leading auto parts supplier, can do about that. We think the market might be right on this one.

By Callum Turcan

On August 16, we updated our reports for the auto parts supplier industry and those updated reports can be accessed here. Lear Corporation (LEA) stood out right away. The company supplies auto parts to customers all around the world, namely electrical power management systems and automotive seating. Its scale gives the company the edge needed to be competitive in this space, but Lear’s 2009 bankruptcy in the wake of the Great Financial Crisis showcases why that only goes so far in a highly-cyclical industry. Shares of LEA yield 2.8% as of this writing.

A Possible Value Trap

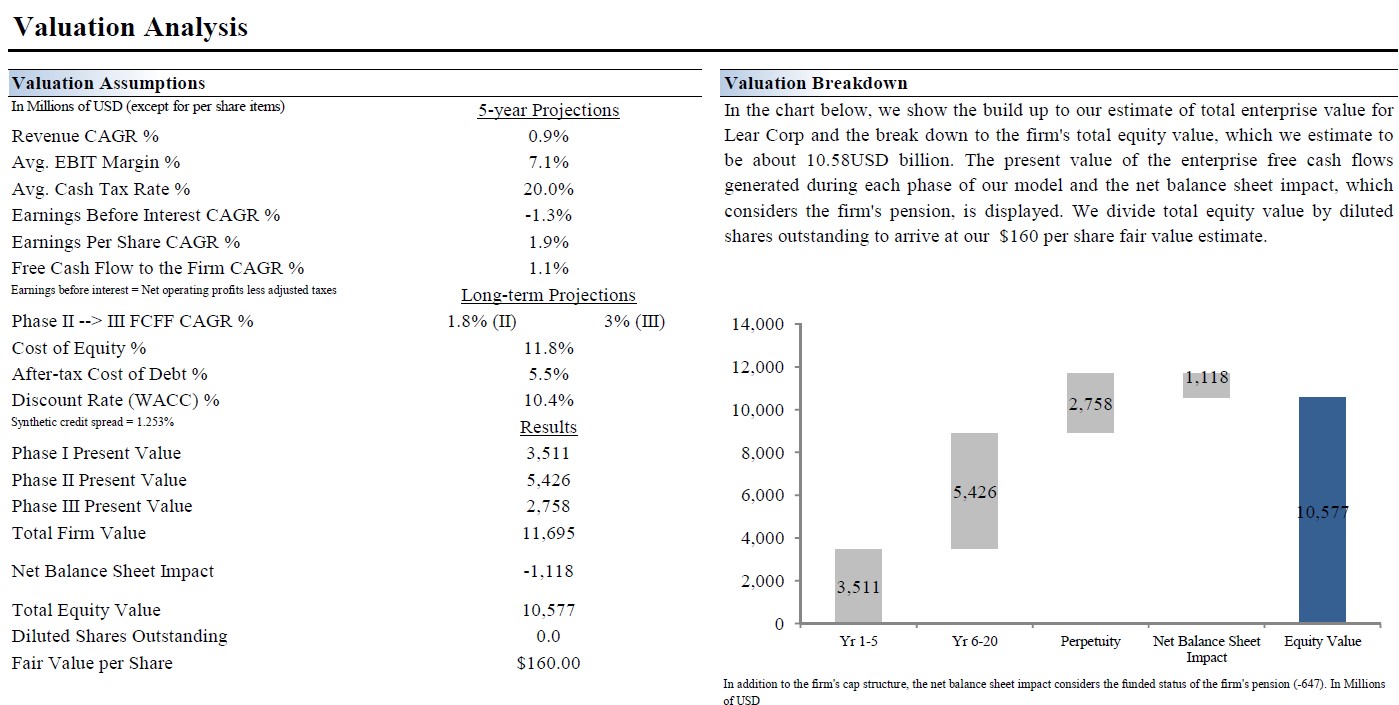

Below is a look at our valuation analysis of Lear from our 16-page Stock Report that can be accessed here.

Image Shown: We give Lear a Fair Value Estimate of $160/share with a Fair Value Range of $120/share – $200/share.

We give Lear a Fair Value Estimate of $160/share with its dividend policy supported by a solid 3.9x Dividend Cushion ratio, the kind of coverage that supports a nice dividend growth runway. From 2013 to 2019, Lear’s quarterly dividend per share has grown by more than four-fold.

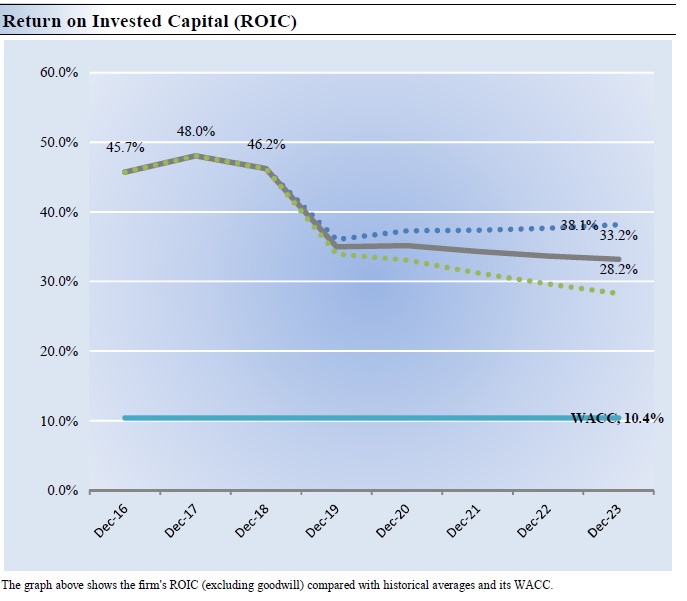

Lear has done a great job generating value for its shareholders and we give the firm an Excellent ValueCreation rating due to the company’s ROIC ex-goodwill consistently exceeding its estimated WACC over the past few fiscal years. Going forward, we expect that to continue, albeit the magnitude of the spread will come down a bit as you can see in the graphic below from our 16-page Stock Report.

Image Shown: Lear has seen its return on invested capital, excluding goodwill, consistently exceed its estimated weighted-average cost of capital over the past few years and we expect that to continue going forward.

With LEA trading closer to ~$109/share as of this writing, below the low end of our fair value estimate range, which stands at $120/share, it appears that the company offers investors a compelling capital appreciation opportunity. However, we caution that Lear’s technicals tell a different story and that’s a story worth hearing out. LEA peaked at ~$205/share back in the summer of 2018 and has since moved aggressively lower.

After a short-lived rebound at the beginning of 2019, LEA continued to drift lower likely due to investor concerns regarding declining global vehicle production, the US-China trade war, the negative impact tariffs have on input prices, and how that is feeding into the global slowdown in industrial activity.

Exogenous Threats in a Highly-Cyclical Industry

Car sales have likely peaked in the US, auto sales in China have slumped since the summer of 2018, car sales are trending lower in the Eurozone (particularly on the passenger vehicle side of things, commercial vehicle sales are performing better), and are holding up well in Japan ahead of a planned increase in the VAT (we will see how auto sales perform afterwards). Lear’s weak technical performance appears to be an indication that investors expect exogenous headwinds to materially hamper its future financial performance.

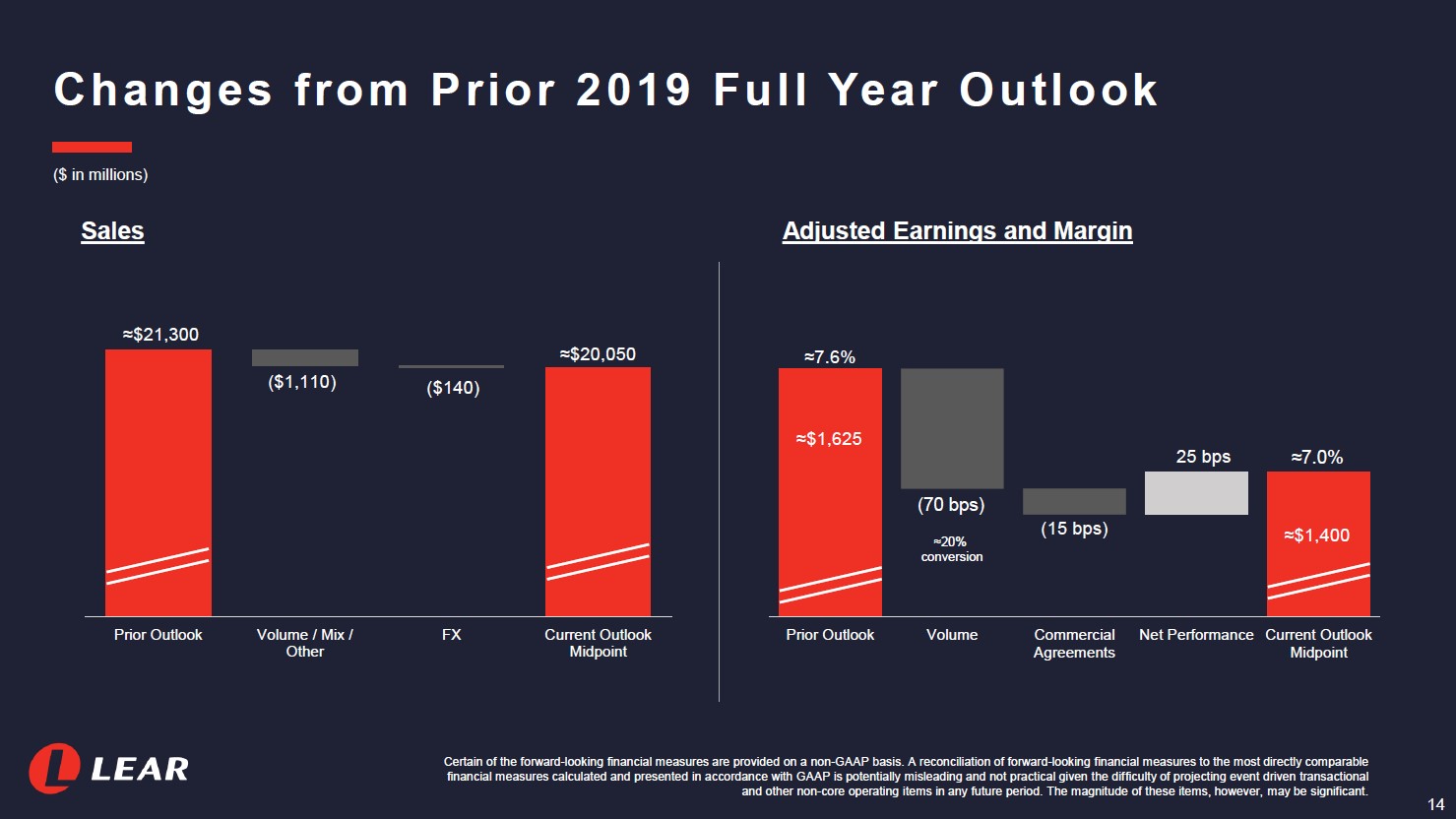

That thesis is reinforced by the act of Lear lowering its guidance for the full fiscal year during its second quarter FY2019 earnings report released July 26. Management’s guidance cut was a product of weaker-than-expected sales volumes, negative sales mix effects, and greater-than-expected foreign-currency headwinds. Reduced volume expectations forced Lear to cut its adjusted earnings margin by a significant amount as you can see in the graphic below.

Image Shown: Lear reduced its outlook for FY2019 on the back of its sales volumes coming in weaker than expected, which weighed negatively on its expected adjusted margins. Image Source: Lear – IR Presentation

Changes in commercial agreements further reduced Lear’s expected adjusted margin for FY2019 (seems to be related to Lear settling “certain commercial issues” regard its E-Systems segment), highlighting the power its customers can have when times get tough. Please note Lear’s second quarter FY2019 ended on June 29, 2019. The sharp reduction in Lear’s expected adjusted margins says it all. Here we would like to note why we generally don’t like the auto parts supplier space (from Lear’s 16-page Stock Report):

“The highly-cyclical auto supplier industry depends on economic conditions and consumer confidence. Volatile gas prices impact a supplier’s input costs and the types of vehicles demanded by consumers. OEMs have considerable bargaining power over suppliers in negotiating terms on largely-commoditized parts. The industry is regulated by environmental and safety laws, providing both challenges and opportunities. Suppliers have considerable operating leverage and remain extremely competitive, which prevents outsize economic returns over the long haul. In general, we don’t like the group.”

Adding on to that, here’s a choice quote from management that was provided in Lear’s earnings report:

“We continue to face a challenging macroeconomic and industry environment. In the second quarter of 2019, global vehicle production was down more than 7% compared to last year, with China down 17% and Europe down 7%. Lear’s financial results in the second quarter were negatively impacted by continued declines in industry production, a significant number of program changeovers, slower production ramp ups on new vehicles, and continued weakening of global currencies against the U.S. dollar.”

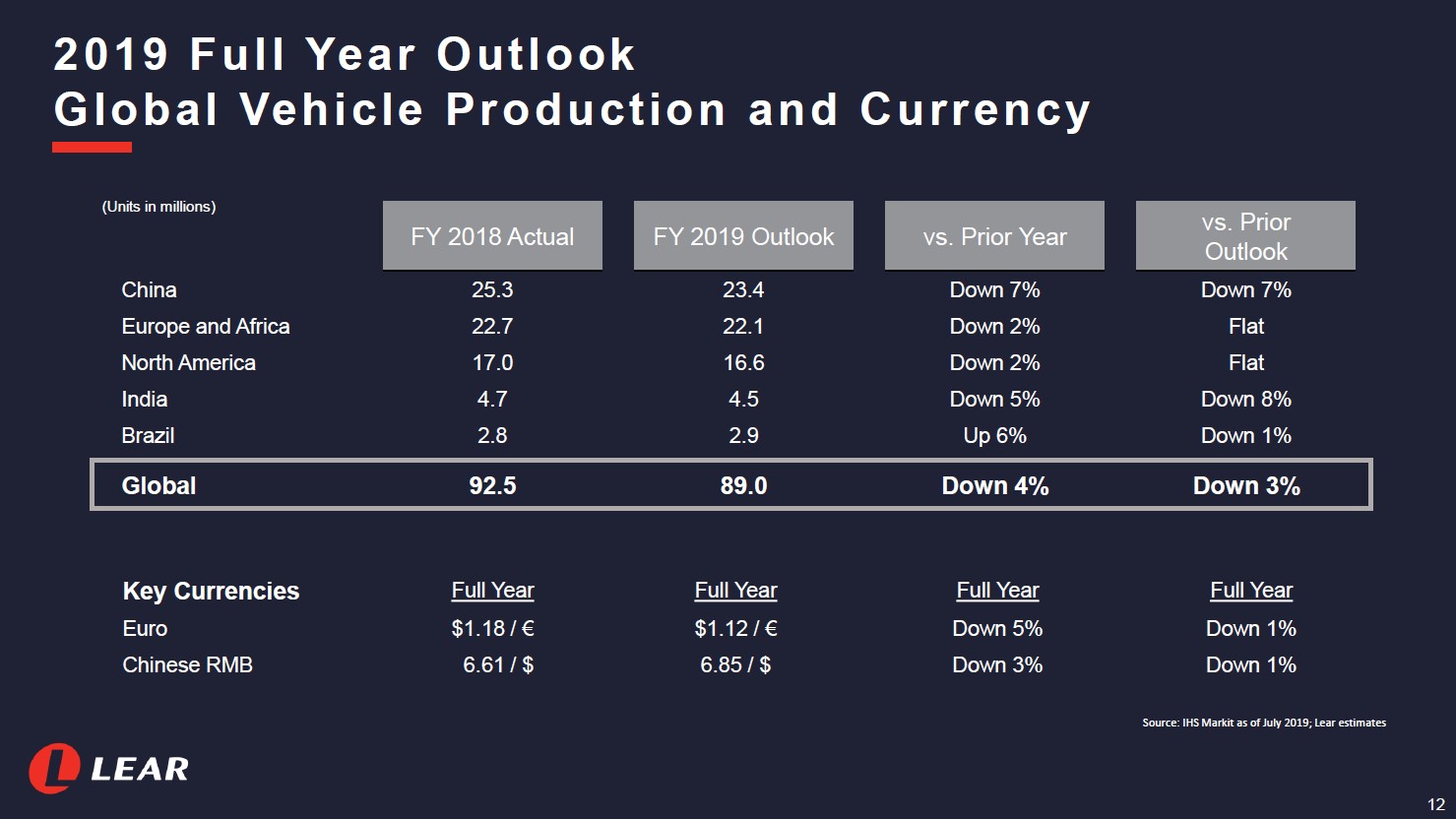

The exogenous headwinds facing Lear are clearly laid out in the graphic down below. Lear sees global vehicle production falling by 4% year-over-year in FY2019, to 89.0 million units. Going forward, if global vehicle production keeps falling as global economic growth starts to really slow down (if that’s the case), please note that would have a major adverse effect on Lear’s future financials and ultimately future free cash flows. Reduced volume cuts deep into the company’s revenue generation and margins, something Lear can’t really avoid. Data from IHS Markit Limited (INFO) was used to support Lear’s estimates according to the graphic below.

Image Shown: Lear expects global vehicle production will decline in FY2019 versus FY2018 levels. Investors are more worried about the firm’s future trajectory than the past, and likely are punishing shares of LEA due to worries over how vehicle production will fare in the event the global synchronized slowdown in economic activity gets worse. Image Source: Lear – IR Presentation

Concluding Thoughts

Lear had a net debt load of $1.1 billion at the end of the second quarter FY2019 and its market capitalization stands at $6.7 billion as of this writing. While its historical free cash flows have been quite strong, exogenous forces pose a very real threat to Lear’s future financial performance. Its net debt load is quite manageable as Lear generated $1.1 billion in free cash flow in FY2018, easily covering ~$0.25 billion in total dividend payments and $0.7 billion in share repurchases. We caution that share buybacks this late in the business cycle may not be prudent, and that Lear would be better served aggressively bulking up its cash pile going forward to prepare for the worst. While Lear appears cheap at first glance, we think this is another Value Trap.

Auto Parts Supplier Industry – ALSN APTV JCI LEA MGA

Auto Making Industry – F GM HMC HOG TM TSLA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. General Motors Company (GM) is included in Valuentum’s simulated Dividend Growth Newsletter and Best Ideas Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.