We continue to stay as far away from Tesla as possible. The company’s stock could still crater even more. It does not have a firm foundation at all. Facebook, despite being under continuous and tremendous scrutiny, is operating on a firm foundation, however. We continue to like shares of the social media giant, despite a recently-disclosed security problem. The more Facebook beefs up security and augments its platform, the bigger its competitive advantages become, as the entry costs for new entrants become even more insurmountable.

By Brian Nelson, CFA

On Thursday, market observers were glued to CNBC as the television network broke the story: The SEC has charged Tesla’s (TSLA) Elon Musk with securities fraud. You can read the press release and the SEC complaint here and here, respectively.

Our thesis on Tesla is unchanged. We don’t like the company fundamentally. We don’t like the company’s financials, and we’ve grown concerned that it may not be able to adequately access the capital markets given the news. We believe shares have more downside risk than upside potential at this point.

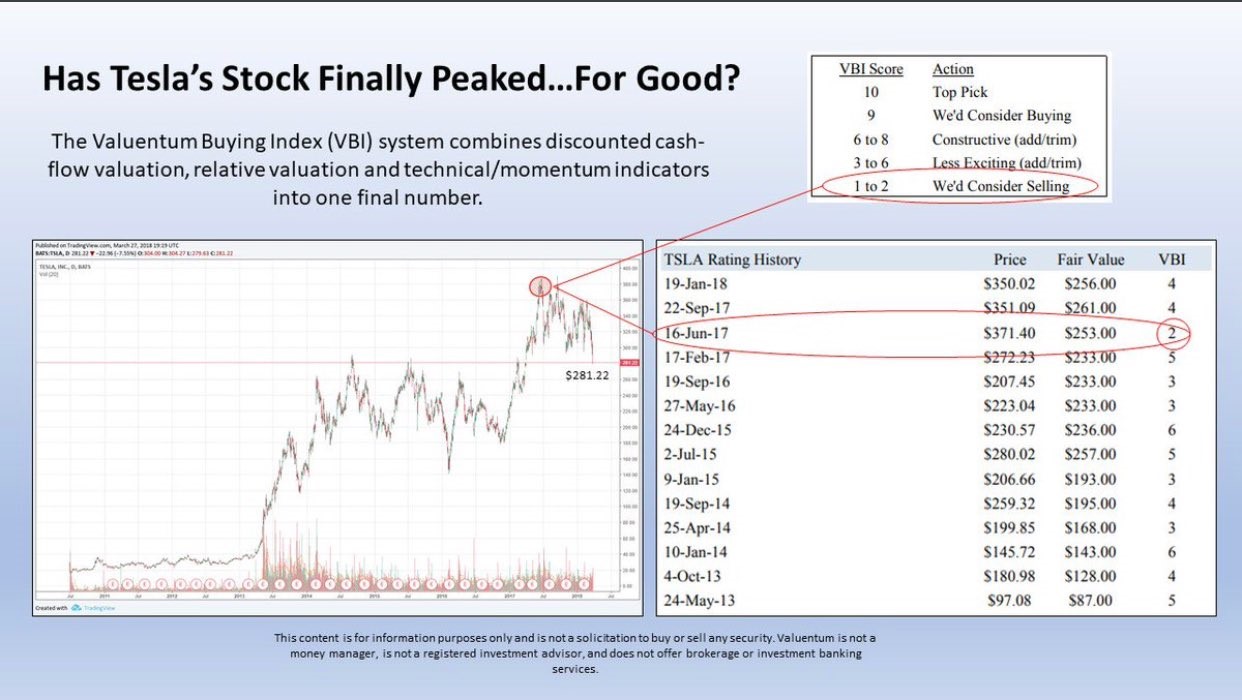

We stand by our “We’d Consider Selling” rating of a 2 in June 2017 when shares were north of $370 per share. Elon Musk is fighting the charge, and while any outcome cannot be predicted at this point, it is very likely that there will be some repercussions on the entrepreneur. We didn’t like Tesla before the charges were filed, and we definitely don’t like it now.

The downside range of our fair value estimate of Tesla is $212 per share.

In other news, Facebook (FB) noted that “on the afternoon of Tuesday, September 25, (its) engineering team discovered a security issue affecting almost 50 million accounts. (The company is) taking this incredibly seriously and wanted to let everyone know what’s happened and the immediate action (its) taken to protect people’s security.” The investigation remains in the early stages, from what we can tell, and we’re glad to see that the company has acted quickly in notifying law enforcement.

We continue to like shares of Facebook, and we maintain our view that the social-media giant’s long-term outlook remains extremely bright, despite near-term challenges related to the Cambridge Analytica scandal and now this event. It is possible that there may be more bad news to come, but as the company continues to increase the security of its platform and make it better, it only enhances its competitively-advantaged profile.

We value shares of Facebook at $233 each. It has been a rare highly-rated stock on the Valuentum Buying Index that has not worked out (yet), unfortunately.

Auto Manufacturers: F, GM, HMC, HOG, TM, TSLA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.