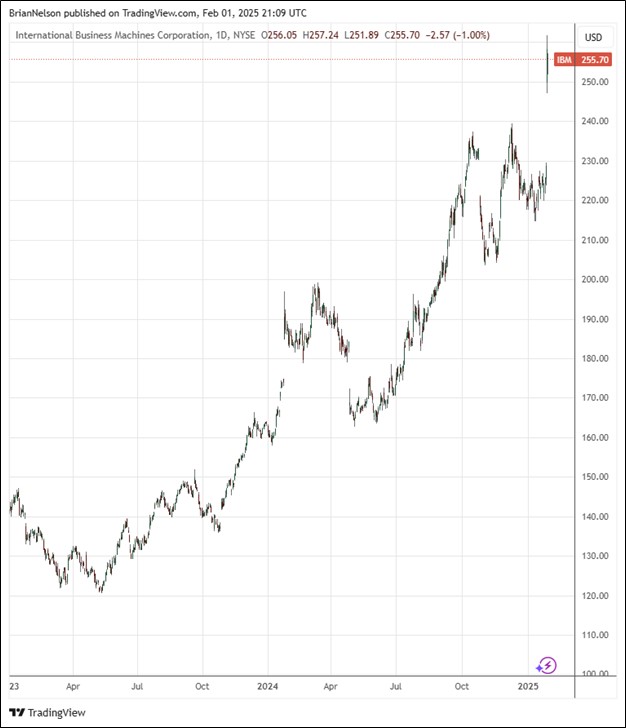

Image Source: TradingView

By Brian Nelson, CFA

IBM (IBM) reported mixed fourth quarter results on January 29, with the company’s revenue coming in line with expectations and the company beating the bottom-line forecast. Revenue advanced 1% (up 2% in constant currency) as strength in software revenue (+10.4%) offset weakness in consulting (-2%) and infrastructure (-7.6%) sales. Gross profit margin increased 40 basis points, to 59.5%, in the quarter. Management was upbeat in the press release:

We closed the year with double-digit revenue growth in Software for the quarter, led by further acceleration in Red Hat. Clients globally continue to turn to IBM to transform with AI. Our generative AI book of business now stands at more than $5 billion inception-to-date, up nearly $2 billion quarter over quarter. Three years ago, we laid out a vision for a faster-growing, more-profitable IBM. I’m proud of the work the IBM team has done to meet or exceed our commitments. With our focused strategy, enhanced portfolio, and culture of innovation, we’re well-positioned for 2025 and beyond and expect revenue growth of at least five percent and free cash flow of about $13.5 billion this year.

With strong performance across our Software portfolio, we continue to drive solid fundamentals within our business. As a result, we generated $12.7 billion in free cash flow, far-outpacing our expectation for the year. Continued strength in operating profitability and free cash flow fuels our ability to invest for the future while returning value to shareholders through dividends.

For the full year 2024, IBM generated net cash from operating activities, excluding IBM financing receivables, of $13.9 billion and hauled in $12.7 billion in free cash flow for the year, up $1.5 billion, and exceeding dividends paid of $6.1 billion. IBM ended the fourth quarter with $14.8 billion in cash and marketable securities, and debt, including IBM Financing debt of $12.1 billion, totaled $55 billion, down $1.6 billion from the end of 2023. For full year 2025, IBM expects full-year constant currency revenue growth of at least 5% and free cash flow of $13.5 billion for the full year, both measures exceeding the consensus forecast. Shares of IBM yield 2.6% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.