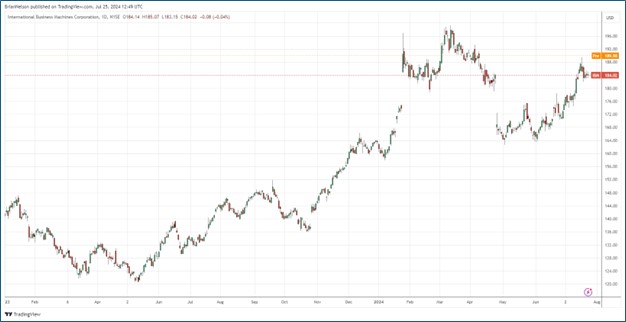

Image: IBM’s shares have staged a nice recovery since the beginning of 2023.

By Brian Nelson, CFA

On July 24, IBM (IBM) reported solid second quarter results with both revenue and GAAP earnings per share coming in better than expectations. Total revenue was up 2% on a year-over-year basis (up 4% in constant currency) thanks to strength in its software revenue, which advanced 7.1% (8.4% in constant currency). Consulting revenue and infrastructure revenue were up marginally on a constant currency basis in the quarter.

IBM’s margins also fared well in the quarter. Its gross profit margin increased 190 basis points on an operating (non-GAAP) basis, while its pretax income margin expanded 220 basis points on an operating (non-GAAP) basis. Cash flow was strong at IBM, too. Though operating cash flow has faced pressure on a year-to-date basis, free cash flow of $4.5 billion was up $1.1 billion from the same period last year. On a trailing twelve-month basis, free cash flow was $12.3 billion.

Management spoke positively about its outlook in the press release:

We had a strong second quarter, exceeding our expectations, driven by growth in both revenue and free cash flow. We continue to see that clients turn to IBM for our technology and our expertise in enterprise AI, and our book of business for generative AI has grown to more than two billion dollars since the launch of watsonx one year ago. Given our first-half results, we are raising our full-year view of free cash flow, which we now expect to be more than $12 billion.

IBM’s strength during the quarter came from Red Hat, where revenue increased 7% (8% in constant currency) and Automation, where revenue increased 15% (16% in constant currency). On the consulting side of its business, Business Transformation showed strength, with revenue up 3% (6% in constant currency), while its Hybrid Infrastructure division revealed 4% revenue growth (6% in constant currency) in the quarter.

Looking ahead to full-year 2024 expectations, IBM continues to expect constant currency revenue growth in the mid-single-digit range, while it now expects free cash flow to be in excess of $12 billion on the year. IBM ended its second quarter with $56.5 billion in total debt and $13.7 billion in cash and marketable securities. We like IBM’s improvement in free cash flow generation and exposure to AI, but we prefer other ideas in big cap tech, namely Alphabet (GOOG) (GOOGL) and Microsoft (MSFT). Shares yield 3.6%.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.