Image Source: International Business Machines Corporation – October 2021 IR Presentation

By Callum Turcan

While still a major enterprise, International Business Machines Corporation (IBM) is no longer the tech juggernaut it used to be and hasn’t been a leading tech company for over a decade. The company recognizes this and back in October 2020, IBM announced that it planned to “separate its Managed Infrastructure Services unit of its Global Technology Services division into a new public company” that will be called Kyndryl. By the end of 2021, this tax-free spinoff is expected to be complete (shares of Kyndryl will be spun off to IBM shareholders). In October 2021, IBM provided a major update to its shareholders covering its medium-term financial outlook, key operational updates, and what to expect going forward as it concerns its dividend policy, areas that we are going to cover in this article.

Overview

Kyndryl is built around offering “hosting and network services, services management, infrastructure modernization, and migrating and managing multi-cloud environments.” IBM views the managed infrastructure services provider industry (which Kyndryl is catering to) as a $500 billion market opportunity, though this industry has a lackluster outlook and is full of competitors. For instance, F5 Networks Inc (FFIV) caters to this industry, though in recent years F5 Networks has acquired several firms in the realm of cybersecurity and cloud-computing services to improve its growth outlook (I, II, III) as it recognizes the various limitations of its legacy businesses.

Back in 2019, IBM acquired Red Hat through a deal with an equity value of ~$34 billion that significantly grew IBM’s exposure to the hybrid cloud computing industry. IBM views the hybrid cloud platform space as a $1 trillion and growing opportunity with a promising outlook that houses ample upside for IBM to capitalize on.

Red Hat was billed as a “leading provider of enterprise open source software solutions, using a community-powered approach to deliver reliable and high-performing Linux, hybrid cloud, container, and Kubernetes technologies. Red Hat helps customers integrate new and existing IT applications, develop cloud-native applications, standardize on (its) industry-leading operating system, and automate, secure, and manage complex environments.” By joining forces with Red Hat, IBM was able to significantly improve its hybrid cloud operations which ultimately set the stage for IBM to jettison its legacy businesses (those included in its pending Kyndryl spinoff).

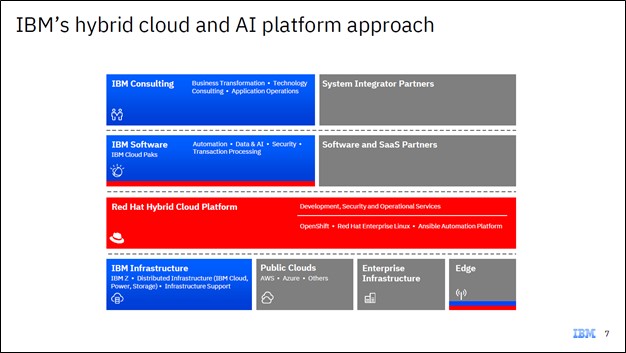

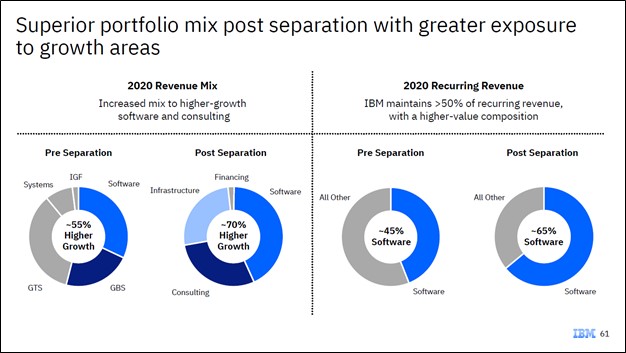

Going forward, IBM is focused on developing its open hybrid cloud platform, AI and data analytics capabilities, automation offerings, cybersecurity operations, consulting business (covering business, strategy, and technology), and more. IBM’s new business model will be built around providing software and cloud-based solutions to its clients. The upcoming graphic down below highlights how IBM’s post-separation revenue mix will shift heavily towards software and consulting services, offerings with juicy margins and promising growth outlooks. IBM’s post-separation recurring revenue streams will be ~65% weighted towards software versus ~45% currently.

Image Shown: IBM intends to shed its legacy business so it can pivot towards its lucrative software and cloud-based solutions offerings that have promising growth outlooks. Image Source: IBM – October 2021 IR Presentation

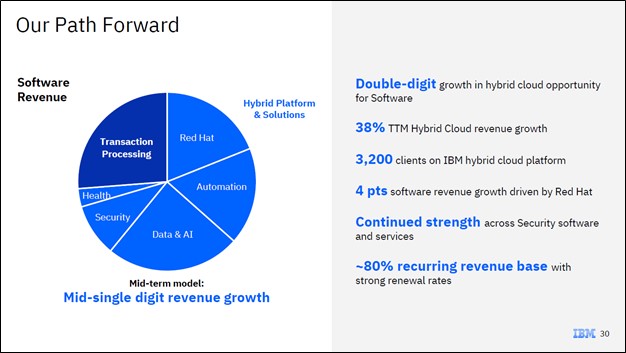

The upcoming graphic down below breaks down IBM’s software revenue by category. Transaction processing, Ret Hat offerings, automation, and data & AI represent the four major categories, though its security and health offerings are also intriguing. Cybersecurity is a huge growth market as malevolent cyber actors are on the rise worldwide.

Image Shown: An overview of IBM’s software business profile. Image Source: IBM – October 2021 IR Presentation

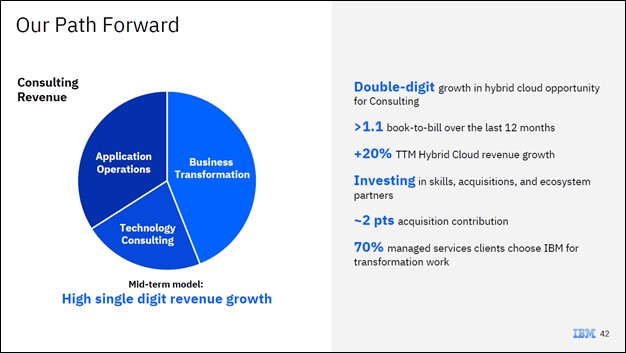

As it concerns IBM’s consulting business, the upcoming graphic down below provides an overview of its revenue mix and recent performance. There are ample synergies to be had across IBM’s business segments as it concerns potential cross-selling opportunities.

Image Shown: An overview of IBM’s consulting business profile. Image Source: IBM – October 2021 IR Presentation

In the upcoming graphic down below, IBM highlights what its post-separation revenue and free cash flow performance would have looked like in 2020. Please note that IBM will continue to have a commercial relationship with Kyndryl, which will provide a one-off, sustainable boost to IBM’s financial performance (particularly its revenue growth rate) in 2022. We are impressed that IBM will remain a free cash flow generating powerhouse once the separation is complete.

Image Shown: IBM forecasts that it will remain a free cash flow generating powerhouse once it completes the spinoff of its legacy businesses. Image Source: IBM – October 2021 IR Presentation

Impressive FCF Generation Capabilities, Stronger Growth Outlook

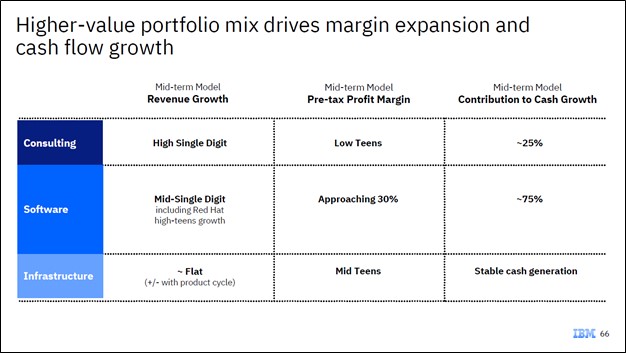

Looking ahead, IBM provided medium-term revenue and free cash flow growth forecasts along with margin guidance during its big investor event. These forecasts were broken down by its major business operating segments to paint a picture of how its business will evolve in the coming years. As part of its transformation, IBM consolidated its various reporting segments to four core business operating segments including ‘Consulting,’ ‘Software,’ ‘Infrastructure,’ and ‘Financing.’ Its two core cash flow growth drivers going forward will be its Consulting and Software business segments, as its Infrastructure business is expected to tread water (post-separation, IBM will still retain a sizable IT infrastructure operation).

Image Shown: IBM sees its Consulting and Software business operating segments representing its two core cash flow growth drivers post-separation. Image Source: IBM – October 2021 IR Presentation

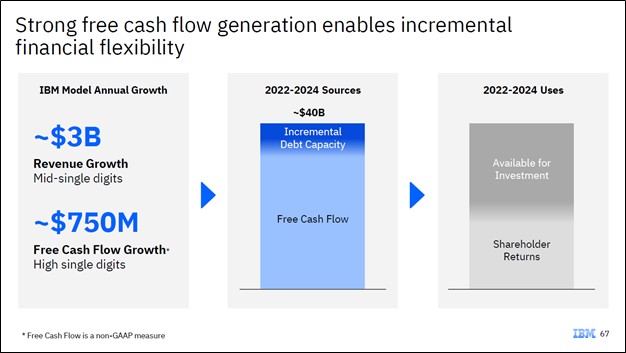

Management expects the new IBM will generate ~$35 billion in cumulative free cash flow from 2022-2024. Here is what IBM’s management team had to say during the October 2021 investor event (emphasis added, lightly edited):

“We have an improving business mix profile skewed more towards higher growth markets. We have a much higher value recurring revenue profile and you combine that with a chance to reset and redefine our client relationships for incremental wallet share and it lends itself to an attractive financial model an investment thesis over the midterm horizon… [from] ’22 to ’24.

Our IBM financial model, mid-single-digit revenue growth, top line and you combine that mid-single-digit growth top line with an improving mix profile and it naturally lends itself to operating margin leverage. That operating margin leverage then translates into high single-digit free cash flow, $750 million of free cash flow growth generation per year.

You now couple that with the baseline of $10 billion of free cash flow, you compound that free cash flow at high single digits and that delivers $35 billion of cumulative free cash flow over the midterm horizon. So from an investment thesis, the new IBM, improving revenue growth profile, higher operating margin, a free cash flow yield that’s very strong, lower capital intensity business and a higher return on invested capital overall.” — Jim Kavanaugh, CFO of IBM

IBM forecasts that its post-separation free cash flows will grow by ~$0.75 billion per year in the medium-term, representing a high single-digit annual growth rate. Forecasted mid-single-digit annual revenue growth, with an eye towards recurring revenues, along with expected favorable business mix shift are largely why management is confident IBM will remain a free cash flow generating entity in the coming years. Additionally, the relatively modest capital expenditure requirements of IBM’s business, post-separation, to maintain a given level of revenues supports its ability to turn net income into free cash flow.

Image Shown: IBM expects its annual free cash flows will grow at a nice clip post-separation due to expected revenue growth and a more favorable business mix. Image Source: IBM – October 2021 IR Presentation

Balance Sheet Concerns

We caution that IBM exited June 2021 with a total debt load of $55.2 billion (inclusive of short-term debt) which was modestly offset by $8.0 billion in cash, cash equivalents, and current marketable securities on hand (exclusive of restricted cash and non-current ‘investments and sundry assets’). IBM, on a post-separation basis, will remain a stellar free cash flow generator, though its sizable net debt load weighs negatively on its financial flexibility. IBM has a stellar ‘A-rated’ investment grade credit rating (A2/A-) and should retain solid access to capital markets at attractive rates going forward, particularly debt markets, which should support its future refinancing activities.

IBM aggressively repurchased its stock over the past decade, though going forward, we would prefer the company pare down its net debt load to improve its financial strength. However, that does not appear to be likely given how management referred to IBM’s ability to take on more debt to fund shareholder returns during its latest investor event.

Image Shown: It does not appear that debt reduction will be a core focus for IBM going forward as the firm cited its “incremental debt capacity” during its latest investor presentation, a sign IBM intends to further grow its already large debt pile. Image Source: IBM – October 2021 IR Presentation

Dividend Consideration

Shares of IBM yield ~4.6% as of this writing, though that is primarily because its stock price has languished over the past decade. At ~$140-$145 per share, IBM is currently trading around levels last seen in October-November 2010 as of this writing. While we view IBM’s dividend strength favorably as its stellar free cash flow generating abilities should enable the firm to stay on top of its future payout obligations and refinancing activities, its large net debt load remains one of our biggest concerns. Additionally, IBM’s major business transformation comes with substantial execution risks.

IBM’s growth outlook is improving due to its business transformation, though management would be wise to take a page from the successful tech behemoths out there such as Microsoft Corporation (MSFT), Alphabet Inc (GOOG) (GOOGL), and Facebook Inc (FB), which all have fortress-like balance sheets (i.e., enormous net cash balances).

Management had this to say regarding IBM and Kyndryl’s dividend policy and financial strength during the firm’s recent investor presentation (emphasis added, lightly edited):

“And I’ll reiterate… that we fully expect the initial combined dividend of IBM and Kyndryl to be no less than IBM’s dividend today. And finally, we are very comfortable at the capital structure we have today operating at a single A credit rating. The high-value recurring business mix that we have within our company, you couple that with substantial liquidity pools and that strength of that balance sheet I talked about, we’re right where we need to be in terms of leverage and capital structure.” — CFO of IBM

Please note that post-separation, IBM may moderately reduce its dividend as a standalone entity to reflect the lost cash flow from spinning off Kyndryl, though the combined dividend payout of both firms would remain at least the same as it is currently. However, given that IBM expects to remain very free cash flow positive post-separation, that may not end up being the case though things remain up in the air at the momentum. We are keeping an eye on the situation.

Concluding Thoughts

We are not interested in adding shares of IBM as an idea to any of our newsletter portfolios at this time, but only because we are already overweight large cap tech companies. IBM’s transformation is intriguing, though we will need to see if the company can actually live up to its targeted revenue and free cash flow growth rates from 2022 onwards. Its large debt load is also worth watching closely.

At the very least, IBM shedding its legacy assets should result in an entity that can direct more attention and resources towards its major growth opportunities in the realm of hybrid cloud computing, AI and analytics, cybersecurity, and other offerings. Our fair value estimate for IBM sits at $133 per share with the top end of our fair value estimate range sitting at $160 per share, indicating shares of IBM are about fairly valued at this time.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for IBM, KD, FFIV, HPQ, HPE, CSCO, DELL, NTAP, PSTG, BB