Image Source: HP Inc.

By Brian Nelson, CFA

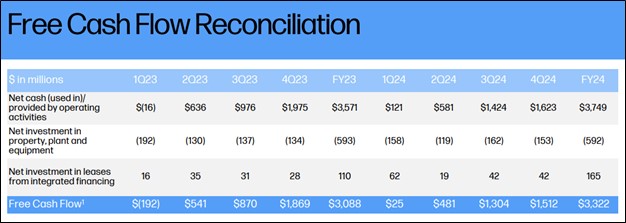

HP Inc. (HPQ) recently reported fourth quarter results for its fiscal 2024. Fourth quarter net revenue was up 1.7% (2.3% in constant currency) from the prior-year period, while fourth quarter non-GAAP diluted earnings per share of $0.93 was roughly in-line with the company’s previously provided outlook between $0.89-$0.99. Net cash provided by operating activities was $1.6 billion, while free cash flow totaled $1.5 billion in the quarter. The company returned $1.2 billion to shareholders in the form of share purchases and dividends in the quarter, while it raised its dividend 5%.

Management had the following to say about the quarterly results:

We are pleased with our Q4 performance where we saw revenue growth for the second consecutive quarter, driven by steady progress in Personal Systems and Print. With momentum heading into FY25, we are well-positioned to capitalize on the commercial opportunity and lead the future of work.

In FY24 we drove non-GAAP EPS and free cash flow growth which allowed us to return approximately $3.2 billion to shareholders. As we look ahead, we are well positioned to deliver solid growth across revenue, non-GAAP net earnings, EPS and free cash flow in FY25. And given our confidence in the future, we are raising our annual dividend by 5 percent.

In the quarter, Personal Systems net revenue increased 2% year-over-year (up 3% in constant currency), while Printing net revenue advanced 1% (up 2% in constant currency). Looking to the first quarter of fiscal 2025, HP expects non-GAAP diluted net earnings per share to be in the range of $0.70-$0.76, the midpoint well below the $0.86 per share analysts had been expecting. Non-GAAP earnings per share excludes restructuring and other charges, acquisition and divestiture charges, amortization of intangible assets, non-operating retirement-related credits, tax adjustments, as well as the tax impact of these items.

HP continues to face pressure with respect to commodity costs, but the firm is working diligently to take actions on pricing and cost to mitigate this over time. Artificial intelligence (AI) PC units were more than 15% of its shipments in the quarter, and the firm has the number one market share of AI PC in the Windows ecosystem. HP put up strong performance in supplies and industrial graphics in its Printing business, but the environment remains competitive with respect to price. Still, HP gained share in both home and office. Management was upbeat on the call:

Looking forward to fiscal year ’25, we assume that the PC market will grow faster than in fiscal year ’24, fueled by multiple catalysts for refresh, including AI. And we expect the print market to decline low single-digits. We expect revenue for both Personal Systems and Print to perform at least in line with the respective market. We have significant opportunities to accelerate in our key growth areas, especially in commercial, where the market is growing faster than consumer. We also remain committed to returning approximately 100% of free cash flow over time, unless opportunities with a higher return on investment arise and as long as our gross leverage ratio remains under 2x EBITDA. We are confident our strategic focus and operational capabilities will enable us to deliver solid growth in fiscal year ’25 across revenue, non-GAAP earnings and EPS and free cash flow.

ESG Matters

In Climate Action, HP Inc. “received the MSCI ESG AA rating, recognizing HP as a leader among 122 companies in the technology sector.” Its “HP Renew Solutions was awarded the OEM Circular Innovation Award at the IT Asset Disposition Summit in 2024.” In Human Rights, HP was “recognized by Great Place to Work 2024,” with the “USA, India, Australia & Singapore offering an outstanding employee work experience.” Its “HP Human Rights Policy was updated to reflect the growing expectations of stakeholders and the evolving regulatory environment.” In Digital Equity and Philanthropy, “2025 Digital Equity Accelerator will focus on supporting nonprofits in Indonesia, Greece, Nigeria and Spain.” It also “launched HP AI Teacher Academy, designed to educate teachers on practical, effective, ethical ways to use AI (Earnings Announcement, November 26, 2024).”

Concluding Thoughts

For fiscal 2025, HP Inc. expects non-GAAP diluted net earnings per share to be in the range of $3.45-$3.75, the midpoint in-line with the consensus forecast of $3.60. Free cash flow is targeted in the range of $3.2-$3.6 billion on the year, the midpoint up from $3.3 billion last fiscal year and well in excess of the company’s annual run-rate dividends of ~$1.1 billion. During fiscal 2024, the company returned $2.1 billion via share repurchases. HP ended the quarter with $3.3 billion in cash and cash equivalents and $9.7 billion in short-and long-term debt. HP is set to benefit from an AI PC refresh, and even though expectations weren’t set as high as what the market was looking for in the first quarter of fiscal 2025, HP Inc. remains a strong dividend payer. Shares yield 3.5% at the time of this writing.

———-

Tickerized for HPQ, DELL.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.