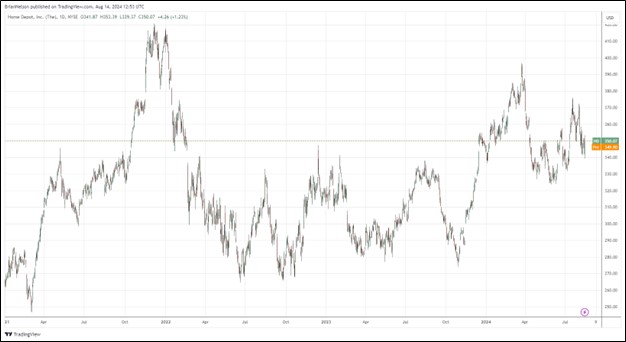

Image: Home Depot’s shares have been choppy the past few years.

By Brian Nelson, CFA

On August 13, Home Depot (HD) reported better-than-expected second quarter results with both its top line and non-GAAP earnings per share coming in higher than the consensus forecast. Comparable sales for the second quarter of fiscal 2024 fell 3.3%, while U.S. comparable sales slid 3.6%, however. Adjusted operating income for the second quarter was roughly flat with the year-ago period, while adjusted operating margin contracted approximately 20 basis points, to 15.3%. Adjusted net earnings nudged slightly lower in the second quarter, to $4.67 from $4.68 in the same period last year.

Management’s commentary in the press release was cautious:

The underlying long-term fundamentals supporting home improvement demand are strong. During the quarter, higher interest rates and greater macro-economic uncertainty pressured consumer demand more broadly, resulting in weaker spend across home improvement projects. However, the team continued to navigate this unique environment while executing at a high level. I would like to thank our associates for their hard work and dedication to serving our customers and communities.

Home Depot ended the quarter with $54.4 billion in total debt and cash and cash equivalents of $1.6 billion. Cash flow from operations dropped to $10.9 billion for the first half of 2024 from $12.2 billion in the year-ago period. Free cash flow for the first six months of 2024 was $9.34 billion versus $10.5 billion in the comparable period of 2023. For the first six months of 2024, cash dividends paid were $4.5 billion, so Home Depot covers its dividend payment with free cash flow by a very nice margin.

Looking to fiscal 2024 guidance, which includes 53 weeks of operating results, Home Depot expects sales to advance 2.5%-3.5% on the year, and comparable sales to decline 3%-4% for the 52-week period compared to 2023. Adjusted operating margin rate is targeted between 13.8%-13.9%, while diluted earnings per share for the 53-week period is targeted to decline 2%-4%. Though Home Depot is navigating a weaker home-improvement spending environment, we like its dividend quite a bit, and the firm remains a key holding in the Dividend Growth Newsletter portfolio. Shares yield 2.6% at the time of this writing.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.