Image Source: Mike Mozart

By Brian Nelson, CFA

On February 21, home improvement retailer Home Depot (HD) reported weak fourth quarter 2022 results that showed comparable store sales for the period falling 0.3% and operating income dropping 1.5% from the same period a year ago. Diluted earnings per share advanced 2.8% from last year’s quarter. The company is dealing with a weakened consumer spending environment and difficult comparisons from pandemic-driven demand of a year ago. Home Depot raised its dividend payout 10%, to $2.09 per share, or $8.36 per share on an annualized basis. That translates into a forward estimated dividend yield of ~2.6%.

Looking to fiscal 2023, Home Depot’s sales guidance was rather weak. The company expects sales and comparable store sales expansion to be “approximately flat” compared to fiscal 2022, and an operating margin of 14.5%, which includes the company’s $1 billion incremental investment in compensation to curb churn among its frontline employees. For fiscal 2022 and fiscal 2021, Home Depot’s operating margin was ~15.3% and ~15.2%, respectively, so the forward guidance is rather disappointing given recent levels of profitability. Diluted earnings per share is expected to decline at a mid-single-digit pace during fiscal 2023, too. All told, Home Depot’s guidance for 2023 was rather disappointing given how resilient the firm has been through all phases of the housing cycle.

The pandemic led to a surge in demand for home-improvement projects. With millions working from home during the worst of the COVID-19 spread, many learned that they preferred more living and working space at home, and investing in their homes made a lot of sense given subsequent work-from-home trends. However, with companies requiring workers to return to the office and life largely returning to “normal” for many in the U.S., time to do home improvement projects has become more limited than it was during the pandemic. Furthermore, consumer budgets are largely tapped out, with excess savings during the pandemic expected to be depleted by the third quarter of this year and credit card debt soaring. 2023 may mark a transitionary period of demand for home improvement retailers as they move from a pandemic to a post-pandemic demand environment.

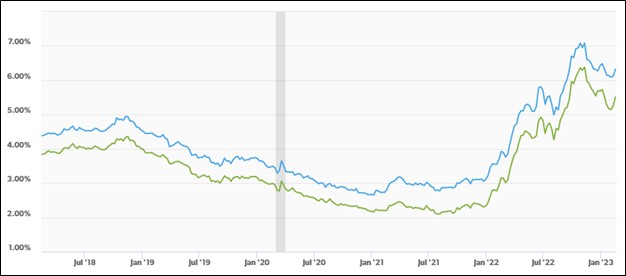

Home Mortgage Rates on the Rise (30-year fixed rate = blue; 15-year fixed rate = green)

Image Source: Freddie Mac. 30-year fixed rate = blue. 15-year fixed rate = green.

The home-buying market is likely to retrench this year with mortgage rates approaching 7%. According to Freddie Mac, for the week ending February 16, the U.S. average weekly fixed rate mortgage for a 30-year mortgage was 6.32% and for a 15-year mortgage, it was 5.51%. These rates are more than double levels of late 2020, where the 30-year mortgage rate fell below 3% and the 15-year mortgage rate was nearly 2%. We think housing prices still have some room to correct lower, and we’ve been quite surprised by the resilience so far. According to the National Association of Realtors, “single-family existing-home sales prices climbed in almost 90% of measured metro areas – 166 of 186 – in the fourth quarter (of 2022). The national median single-family existing-home price increased 4.0% from one year ago to $378,700.” At some point, higher rates will start to drive home prices lower based on affordability, in our view.

The value of “the home” has increased considerably the past few years given work-from-home trends emerging from the COVID-19 pandemic and the hybrid working environment that many employers are adopting these days. Home Depot will continue to benefit from these trends as “the home” becomes a more important facet of the work environment. The stigma of working from home is no longer either, in our view, and employers have to strongly consider the needs and preferences of their employees, more than ever before, particularly in the current tight labor market. We continue to like Home Depot as a strong dividend growth idea over the long haul (its free cash flow handily covered cash dividends paid during fiscal 2022), and its dominance in serving do-it-yourself-ers and professional contractors coupled with its recent acquisition of HD Supply should help it navigate what looks to be a transitional demand year in 2023. Our fair value estimate of $313 per share remains unchanged at this time.

Home Depot’s 16-page Stock Report (pdf) >>

Home Depot’s Dividend Report (pdf) >>

Tickerized for holdings in the ITB.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.