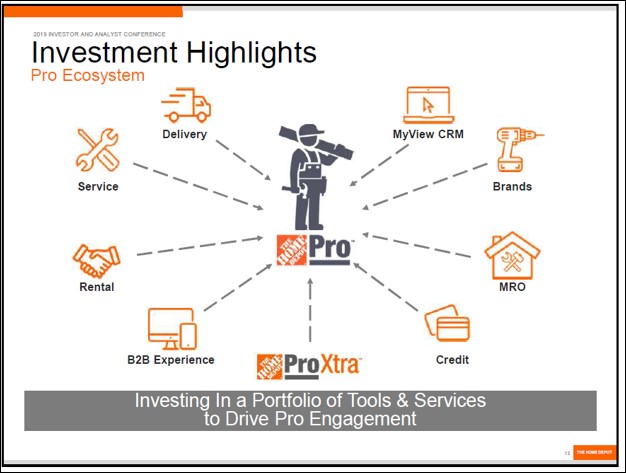

Image Shown: Home Depot Inc has had plenty of success building off of and expanding its ‘Pro’ ecosystem as it relates to generating nice comparable sales growth. Image Source: Home Depot – 2019 Investor and Analyst Day IR Presentation

By Callum Turcan

On February 25, Home Depot Inc (HD) reported fourth quarter and full-year earnings for fiscal 2019 (period ended February 2, 2020) which matched top-line consensus estimates and beat bottom-line consensus estimates. What really caught the market’s attention was Home Depot’s strong comparable sales performance, which was up 5.2% overall and 5.3% in the US during the fourth quarter on a year-over-year basis (for the whole fiscal year, Home Depot’s overall and US comparable sales rose by 3.5% and 3.8%, respectively, keeping in mind the firm has locations in the US, Canada, Mexico, Puerto Rico, Guam, and the US Virgin Islands). This strength is at least partially why management pushed through a 10% sequential increase in Home Depot’s quarterly dividend, bringing it up to $1.50 per share or $6.00 on an annual basis. Shares of HD yield ~2.6% on a forward-looking basis as of this writing.

Image Shown: A look at Home Depot’s total addressable market (‘TAM’). Image Source: Home Depot – 2019 Investor and Analyst Day IR Presentation

Strong Forward Guidance

Management sees Home Depot maintaining its growth trajectory as the firm is forecasting for 3.5%-4.0% comparable sales growth in fiscal 2020, supporting total sales growth of 3.5%-4.0%. On a GAAP basis, Home Depot’s net sales rose by ~2% year-over-year in fiscal 2019; however, when removing the extra week in fiscal 2018 that growth rate climbs up to 3.5% according to management. The company reported solid performance from both its ‘Pro’ and ‘DIY’ (do it yourself) customers, along with strong online sales growth as well last fiscal year. Here’s what Home Depot’s CEO, Craig Menear, had to say during the home improvement retailers latest quarterly conference call:

“We saw broad-based growth across all geographies and merchandising departments in the quarter. All nineteen of our U.S. regions posted positive comps and internationally, both Canada and Mexico reported positive comps in the fourth quarter…

As a complement to our store investments, we are investing to strengthen the competitive advantages that we have built through the blending of our physical and digital platforms into a more seamless interconnected experience. For example, our chain-wide rollout of digital appliance labels connecting ratings from the digital world to the physical world, enhancing the in-store shopping experience. Additionally, Home Depot dot com continues to be a growth engine for our overall business, driving increased traffic online and additional footsteps to our stores. Because of this, we continue to invest in search functionality, category presentation, product content and enhanced fulfillment options to remove friction from the online shopping experience.

Excluding the extra week last year [in fiscal 2018], online sales grew 20.8 percent in the quarter and 21.4 percent for the year [in fiscal 2019], and over 50 percent of the time our customers choose to pick up their order in a store. This is the power of the interconnected retail strategy. We have also expanded our digital capabilities by investing in a B2B [business-to-business] website experience tailored specifically for the needs of our Pro customers. We have now onboarded over one million Pro customers.

Additionally, during the quarter, we completed the integration of a third-party, best-in-class CRM [customer relationship management] system for all of our Pro sales and Services teams. This enhances our visibility, enabling us to better serve our customers. I am excited about the opportunities ahead as we continue to build capabilities to engage with the Pro, no matter when, where or how they want to interact.”

The firm is guiding for an operating margin of 14.0% in fiscal 2020. For reference, Home Depot posted a GAAP operating margin of ~14.4% in fiscal 2019. It appears that due to Home Depot expecting its depreciation and amortization expense to rise by 21% year-over-year to $2.4 billion in fiscal 2020, the company is assuming that its operating margin will come under pressure, which is a reasonable assumption. Home Depot is forecasting 2% diluted EPS growth this fiscal year, which is estimated to hit $10.45. On a GAAP basis, please note the firm’s diluted EPS hit $10.25 in fiscal 2019 (up ~5% year-over-year).

In fiscal 2020, Home Depot forecasts it will generate $13.5 billion in cash flow from operations, spend $2.8 billion on capital expenditures (part of which will go towards opening six new stores this fiscal year), and allocate “at least $5.0 billion” towards share repurchases. Home Depot generated $11.0 billion in free cash flow (net operating cash flows of $13.7 billion less $2.7 billion in capital expenditures), spent $6.0 billion covering its dividend obligations, and allocated $7.0 billion towards share buybacks in fiscal 2019. As of February 2, 2020, Home Depot had a net debt load of $29.4 billion (inclusive of short-term debt). While its free cash flows are quite strong, given its dividend obligations, deleveraging this late in the business cycle would be a prudent move, in our view.

Concluding Thoughts

Home Depot’s results point towards the ongoing strength of the US consumer. However, exogenous headwinds are building, making management’s forward guidance all the more interesting. We’ll be keeping an eye on the space going forward and will update our members as we get deeper into 2020. Should the novel coronavirus, abbreviated as ‘COVID-19’, spread to North America in a big way (which the US Centers for Disease Control and Prevention views as probable), that would likely fundamentally alter Home Depot’s outlook in the near term.

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.