Image Source: Herbalife Nutrition Limited – 2018 10-K

By Callum Turcan

Many of you may remember Herbalife Nutrition (HLF) from the “epic” duel between two very well-known titans in the financial world, Carl Icahn and Bill Ackman, which was held on CNBC in January 2013. The argument at the time fundamentally rested on whether multi-level marketing companies were viable commercial entities or pyramid schemes set to crumble on themselves, with Mr. Icahn backing Herbalife while Mr. Ackman took the other side of that trade. Herbalife is a multi-level marketing company that uses the direct selling business model to market and sell nutritional products to consumers all over the globe with a focus on energy, fitness, and sports. The company’s Formula 1 Nutritional Shake Mix is its best-selling product, generating ~30% of net sales from 2016 to 2018.

FTC Settlement

Regardless of what merits each side had, what is known is that Herbalife settled with the US Federal Trade Commission in 2016, which resulted in the company paying $200 million and restructuring its business in the US. The settlement stems from Herbalife overstating the income potential of selling its various products, which is highlighted in these excerpts from the 2016 FTC settlement here (emphasis added);

“Herbalife International of America, Inc., Herbalife International, Inc., and Herbalife, Ltd. have agreed to fully restructure their U.S. business operations and pay $200 million to compensate consumers to settle Federal Trade Commission charges that the companies deceived consumers into believing they could earn substantial money selling diet, nutritional supplement, and personal care products…

According to the FTC’s complaint, Herbalife claims that people who participate can expect to quit their jobs, earn thousands of dollars a month, make a career-level income, or even get rich. But the truth, as alleged in the FTC complaint, is that the overwhelming majority of distributors who pursue the business opportunity earn little or no money. For example, as stated in the complaint, the average amount that more than half the distributors known as “sales leaders” received as reward payments from Herbalife was under $300 for 2014. According to a survey Herbalife itself conducted, which is described in the complaint, Nutrition Club owners spent an average of about $8,500 to open a club, and 57 percent of club owners reported making no profit or losing money.

The small minority of distributors who do make a lot of money, according to the complaint, are compensated for recruiting new distributors, regardless of whether those recruits can sell the products they are encouraged to buy from Herbalife. Finding themselves unable to make money, the FTC’s complaint alleges, Herbalife distributors abandon Herbalife in large numbers. The majority of them stop ordering products within their first year, and nearly half of the entire Herbalife distributor base quits in any given year.”

The first round of checks from the settlement were sent out in January 2017, primarily to distributors who worked for Herbalife from 2009 to 2015. Mr. Ackman reportedly ended his crusade against Herbalife by 2018, the same year Mr. Icahn began winding down his stake in the company. Icahn Enterprises LP (IEP) first started acquiring HLF shares in late-2012, and even as the entity was selling off part of its stake in the company, Mr. Icahn reiterated that Herbalife was “well-positioned for the future” and that the firm’s “business is stable.” At the end of 2018, Icahn Enterprises’ remaining Herbalife position had a market value of $1.7 billion.

Financial Commentary

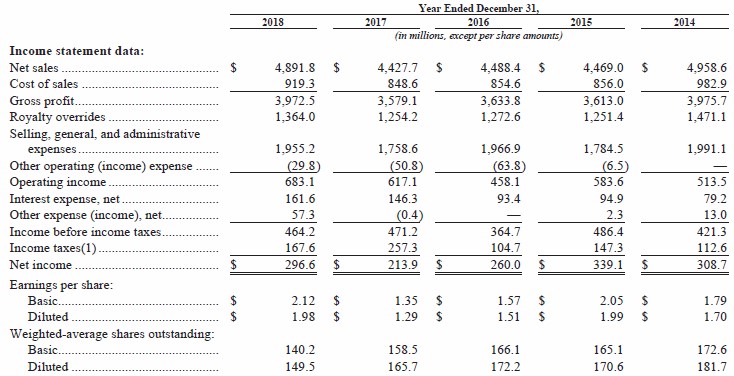

From 2014 to 2018, Herbalife’s GAAP net sales have declined by just over 1% while its GAAP gross profit was broadly flat. The lack of top-line growth is a product of poor publicity (especially in North American markets), the FTC settlement discouraging new distributors from signing up, foreign currency headwinds, and shifting consumer habits. In order to offset stagnant revenue streams, Herbalife better controlled its operating costs (specifically royalty overrides) in order to pad its operating margin.

From 2014 to 2018, Herbalife’s GAAP operating margin surged ~360 basis points, enabling its GAAP operating income to climb by 33% during this period. The firm’s net income still fell by 4% over this timeframe, which was offset by share buybacks reducing its outstanding diluted share count by 18%, enabling Herbalife’s GAAP diluted EPS to climb by over 16% from 2014 to 2018, hitting $1.98 last year. Please note Herbalife’s adjusted (non-GAAP) EPS came in at $2.88 in 2018, up 19% year-over-year according to management.

Image Shown: A snapshot of Herbalife’s financial performance from 2014 to 2018. Image Source: Herbalife – 2018 10-K

Herbalife hasn’t been hitting it out of the park, not by a long shot, but the firm has held its ground in the face of major headwinds. Its net operating cash flows averaged $549 million from 2014-2018, while its capital expenditures averaged $113 million, allowing for almost $437 million in annual free cash flow on average during this period. As the company doesn’t pay out a common dividend, management directed that free cash flow towards repurchasing shares.

In 2017 and 2018, Herbalife spent a combined $1.6 billion buying back stock. While buybacks in 2017 were done at prices well below where HLF is currently trading at, the firm’s 2018 share repurchases were done at prices well above where HLF is current trading, meaning that cash was arguably not put to good use. Using its average free cash flow figure from 2014-2018, a discount rate of 10%, and a perpetual growth rate of 3%, Herbalife’s equity is worth $6.2 billion, about where its market cap stands at as of July 15.

A Rebound Ahead

Going forward, management expects things to improve materially. Herbalife is guiding for net sales growth of -1% (negative 1%) to 5% this year versus 2018 levels, or 2% growth at the midpoint, a growth rate that improves considerably when removing expected foreign currency headwinds (a product of the strong US dollar). Adjusted (non-GAAP) diluted EPS is expected to come in at $2.50-$2.95 (down slightly from 2018 levels), which like Herbalife’s net sales estimate, moves considerably higher when removing expected foreign currency headwinds. We caution that Herbalife expects its capital expenditures to grow to $130-$170 million this year, up from $88 million in 2018, which will put downward pressure on its free cash flows.

Image Shown: Herbalife’s 2019 guidance calls for modest net sales growth and rising capital expenditures. Image Source: Herbalife – First quarter 2019 earnings press release

Herbalife ended the first quarter of 2019 with $1.2 billion in cash on hand versus almost $2.5 billion in total debt, good for a net debt position of $1.25 billion. Its strong free cash flow generation makes managing that burden relatively easy, keeping in mind that future share buybacks, which exceed free cash flows will put pressure on the balance sheet.

Concluding Thoughts

Shares of HLF appear fairly valued as things stand today, with most participants looking to see if Herbalife’s rebound has legs or not. We aren’t interested in the name, but we don’t think the sky is falling either. Herbalife has had a wild ride over the past decade, but now that things are settling down, management sees a slow recovery ahead.

Related multi-level marketing stocks: TUP, AVP, PPD, NUS, USNA, MTEX, NATR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.