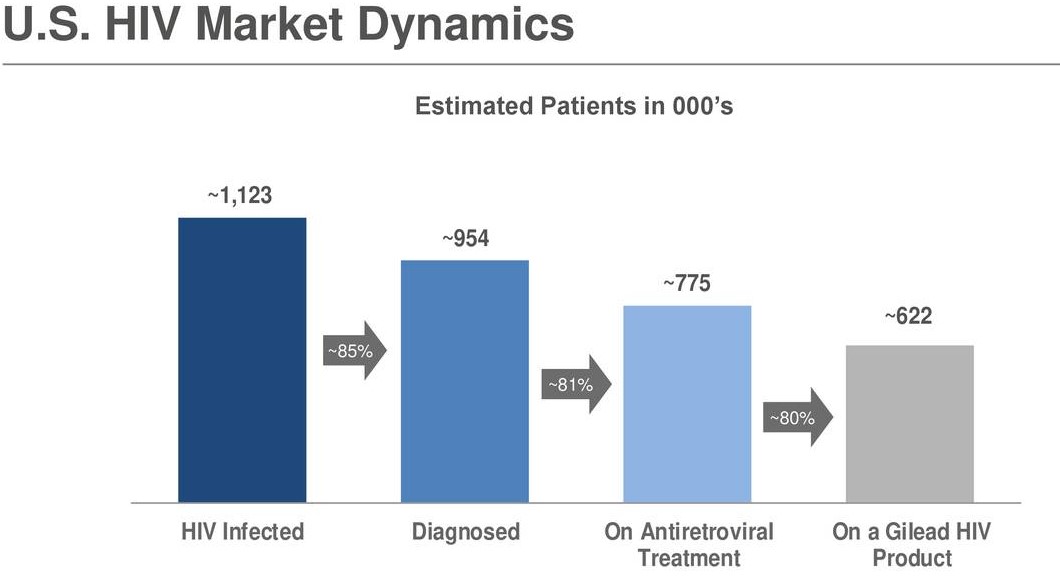

Image shown: Gilead holds an impressive share of the US HIV market, both on an infected and diagnosed basis. Source: Gilead Sciences fourth quarter presentation.

Simulated newsletter portfolio idea Gilead Sciences continues to battle intensifying competition in the HCV market, which has been able to offset its strength in HIV. Top-line growth has been nothing short of elusive, and management does not expect to return to material growth in the near term.

By Kris Rosemann

Shares of simulated newsletter portfolio idea Gilead Sciences (GILD) faced a bit of selling pressure following the February 4 release of its fourth quarter results, as it continues to be unable to drive top-line growth. HCV product sales continued to drop precipitously in the period and came in at $738 million compared to $1.5 billion in the year-ago period as a result of lower average selling price and lower sales volume of Harvoni and Epclusa across all major markets. Competition continues to ramp for the two HCV drugs as a generic version of both became available in the US in the fourth quarter, and 2019 is expected to bring another year of top-line erosion in HCV.

HIV product sales growth of nearly 21% on a year-over-year basis was not enough to offset the significant weakness in HCV, and other product sales did little to offer support. Management continues to have high hopes for Yescarta (cell therapy), which was a key piece in Gilead’s purchase of Kite Pharma, but it has done little to move the needle since its October 2017 launch in the US.

Gilead’s gross margin faced pressure in the fourth quarter as well due in large part to reserves for excess raw material inventory providing upward pressure on cost of good sold. GAAP R&D spending was driven significantly higher as a result of an impairment charge related to in-process R&D for a program in its Kite business, and non-GAAP R&D spending advanced ~11% from the year-ago period due to up-front collaboration expenses and higher growth investments. Non-GAAP net income per diluted share fell 19% from the year-ago period to $1.44 as a result of the combination of the aforementioned margin-impacting factors.

In 2019, Gilead is expecting product sales to be in a range of $21.3-$21.8 billion, compared to ~$21.7 billion in 2018, and non-GAAP product gross margin is being targeted at 85%-87%, which would be a solid improvement from 2018’s suppressed mark of 83.4%. Management notes that its top-line guidance for 2019 includes the anticipated entry of generic competition for Letaris (pulmonary arterial hypertension) and Ranexa (chronic chest pain) in the US and increased generic competition for its HIV products in certain European countries.

Nevertheless, Gilead believes its strong HIV portfolio will be able to deliver another year of double-digit product sales growth in 2019 thanks in large part to its confidence in its Descovy-based regimine, which is led by Biktarvy and accounted for 77% of its HIV treatment volume, and the growing use of Truvada, which is the only drug indicated for the prevention of HIV. Yescarta remains the focal point of Gilead’s ‘Cell Therapy’ business as it works to complete a steady and measured launch following its approval in the EU in August 2018.

Shares of Gilead are currently trading roughly in line with the lower bound of our fair value range and carry a forward dividend yield of ~3.7% following the February 4 announcement of a 10.5% increase in the quarterly payout. The company registers a Dividend Cushion ratio of 3.5 thanks in part to it holding a net cash position on the balance sheet at last check when including long-term marketable securities. We continue to highlight shares in both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.