Image Source: Gilead

We were generally pleased to see that Gilead Sciences has decided to put its vast cash hoard to use by acquiring a cutting-edge technology that will further its clinical pipeline. Though it has become fashionable for many in the investment world to engage in M&A speculation as to whom Gilead might finally acquire, our research focus has instead been on the fundamental case, and the inevitable decline in HCV sales seems to have stabilized with the company reporting a beat-and-raise quarter this past July. Based on the improved outlook, the vastly improved technical backdrop, and improved technicals, we added the company to the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. We also think Gilead has largely addressed the “what’s next” concern with the announcement of its intent to purchase Kite Pharma.

By Alexander J. Poulos

Overview on Kite Pharma

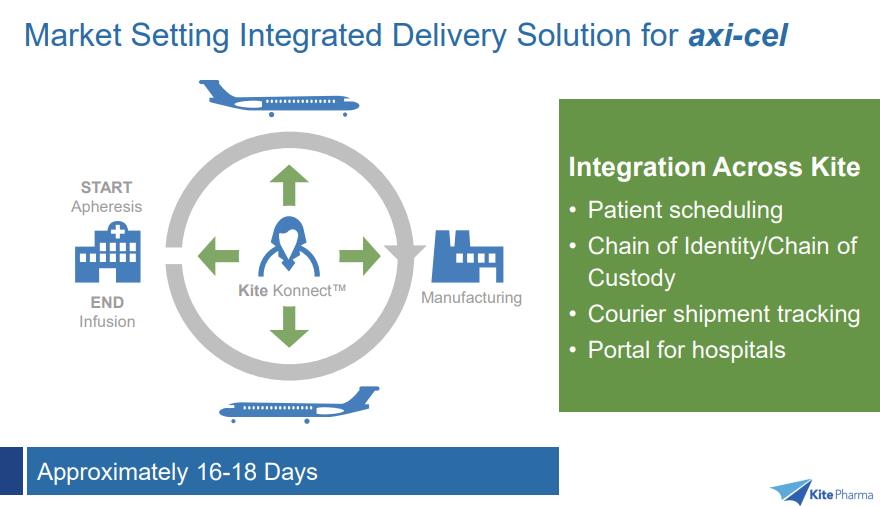

Kite Pharma (KITE) is one of the leading players in the field of CAR-T therapy. CAR-T therapy is part of a new emerging trend in the treatment of various forms of cancer. CAR-T therapy will utilize the patients own immune system which is harvested via the removal of blood from the patient (apheresis). The patient’s blood is then shipped to a lab where the T-cells are extracted and modified. The modified T-cells are then activated and shipped back to the patient for reinfusion. The process is highly personalized, in essence, the therapy is tailored to the individual patient.

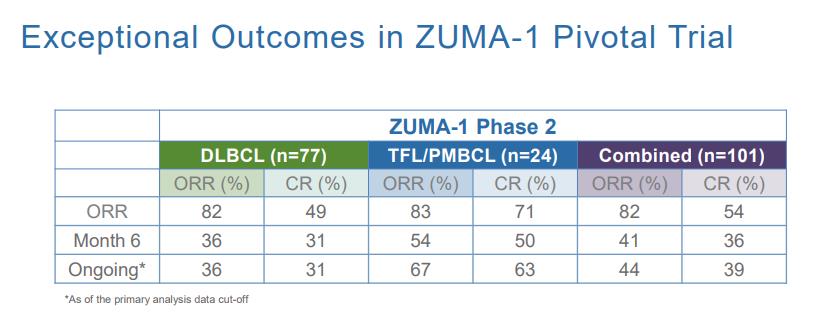

The CAR-T therapy is a significant step towards highly-specific treatments genetically targeted for a particular patient population. In the case of Kite’s CAR-T therapy dubbed axicabtagene ciloleucel (axi-cel), the initial patient population is the relapsed/refractory patient population afflicted with diffuse large B-cell lymphoma (DLBCL), transformed follicular lymphoma (TFL), and primary mediastinal B-cell lymphoma (PMBCL). This particular subset must also be ineligible for autologous stem cell transplant.

Kite has submitted an NDA application in the US and its equivalent in the European Union for axi-cel with a PDUFA date of November 29, 2017, in the US. Kite is positioning axi-cel as the first CAR-T therapy available in adults with Novartis (NVS) nipping at its heels with an expected approval of its own CAR-T therapy (CTL019) for Acute Lymphoblastic Leukemia for the adolescent patient population. The field remains ultra-competitive but, in our view, Kite is in the pole position with a widely-expected first mover advantage thanks to the expected approval of axi-cel. The area offers tremendous promise, which in our view, is the primary motivation on Gilead Sciences (GILD) part to acquire Kite.

Image Source: Kite Pharma Investor Presentation

Zuma Trial

Image Source: Kite Pharma Investor Presentation

Gilead Sciences has a reputation of making large, transformative deals if the science underpinning the molecule is sound. We feel the trial results of axi-cel as demonstrated by the pivotal ZUMA-1 trial may prove the therapy is a true breakthrough. Utilizing conventional therapies to treat with diffuse large B-cell lymphoma (DLBCL), transformed follicular lymphoma (TFL), and primary mediastinal B-cell lymphoma (PMBCL) achieved a complete response rate of 7% with a median survival of 6.3 months. The ZUMA trial produced a complete response rate (CR) of 54% with survival data expected to eclipse the 8-month mark. The patient response to axi-cel is remarkable, but the innovative therapy does pose some clinical challenges that need to be overcome.

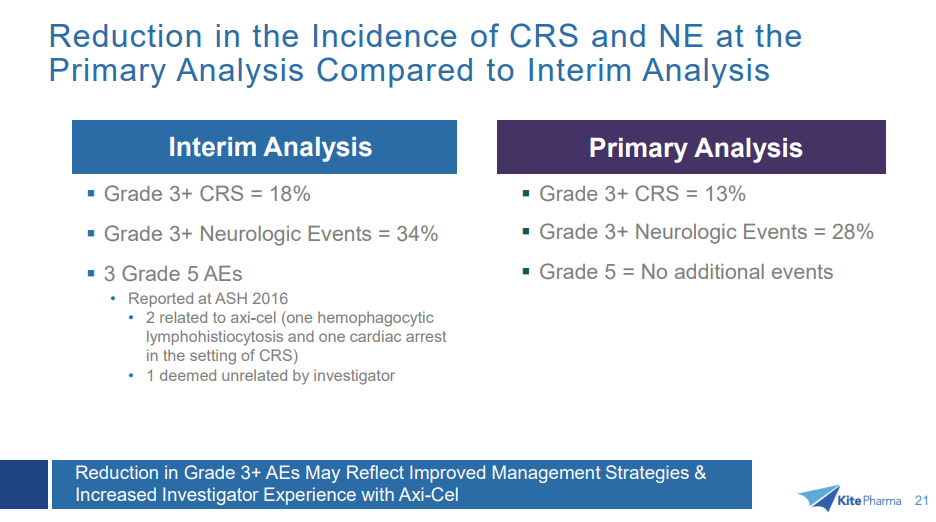

As previously reported, the most common grade 3 or higher adverse events included anemia (43 percent), neutropenia (39 percent), decreased neutrophil count (32 percent), febrile neutropenia (31 percent), decreased white blood cell count (29 percent), thrombocytopenia (24 percent), encephalopathy (21 percent) and decreased lymphocyte count (20 percent). As compared to the interim analysis, grade 3 or higher cytokine release syndrome (CRS) decreased from 18 percent to 13 percent and neurologic events decreased from 34 percent to 28 percent. There were three deaths throughout the course of the trial not due to disease progression. Two events, one hemophagocytic lymphohistiocytosis (HLH) and one cardiac arrest in the setting of CRS, were deemed related to axicabtagene ciloleucel. The third case, a pulmonary embolism, was deemed unrelated. There were no cases of cerebral edema

Source: Kite Pharma

In our view, the most troublesome side effect is the cytokine release syndrome. Cytokines may become released from the body upon the initiation of the CAR-T infusion. A mild release may cause mild side effects such as a headache, fever, rash, and low blood pressure to name a few of the more prominent ones. These side effects are rather mild and are often immediately reversible, though a massive release of cytokines can be life-threatening with the immediate medical care required. The Cytokine Release Syndrome is also evident in Novartis CTL019 therapy; we feel it is a notable side effect which will require careful monitoring. We expect additional dosing strategies to be employed to limit the CRS syndrome, perhaps the initiation of other medications before infusion to offset the potential. We will continue to monitor the side-effect profile in conjunction with additional data released post the completion of multiple phases of the ZUMA trials. The ability to mitigate the side-effect profile in addition to stellar clinical trial results should pave the way for the long-term viability of the therapy, in our view.

The Transformation of Gilead Sciences

Gilead Sciences reached a critical inflection point in 2016 as the durability of the blockbuster HCV franchise began to show signs of decline. The decline was widely expected but the severity was at question. Judging by the rapid descent of the share price, many investors were caught unaware of the steep drop off. In the Best Ideas Newsletter portfolio, we had decided to exit the Gilead Sciences in advance of the final leg down, even as the equity scored favorably on a discounted cash-flow basis. The key ingredient that had been missing was for the technical picture to rebound, but the recent earnings release on July 26 served as the catalyst. We added shares of Gilead Sciences to the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio July 31 in a notification sent to subscribers. To say the least, we are pleased with the jump in the equity price, but we also think the move is far from mature, as the share price remains comfortably below our fair value of $109 per share.

In our view, for Gilead Sciences to experience price-to-fair value convergence or even potential upside, additional therapies from its clinical pipeline would need to be successfully brought to market to make up for the continued decline in the core HCV market. Let’s review the Infectious Disease segment along with the three most important pillars of Gilead’s Clinical platform that, if successful, should power the company forward. Worth noting, however, the capital gains that investors crave from the biotech sector generally may only appear once a new line of therapy is brought to market and remains in the early stages of its life cycle. The growth of the Infectious Disease platform may sustain Gilead’s dividend–hence our comfort in including the company in our Dividend Growth Newsletter portfolio–and we added Gilead to the Best Ideas Newsletter portfolio as we are comfortable with the progress made on the clinical pipeline. An element of risk remains as we are still in the middle of the clinical trials cycle with little in the way of guarantees of course. The data remains encouraging, however, but the products will not become significantly de-risked until final phase 3 results are posted.

Infectious Disease

Gilead Sciences remains one of the most innovative outfits in the infectious disease market. The company’s core competency remains its HIV-franchise which continues to innovate with the replacement of Tenofovir with the far better tolerated TAF in its core combination therapies. The new TAF-containing products are considered a new product with patent life is extending well into the middle of next decade. Gilead has developed a new investigational integrase strand transfer inhibitor (INSTI) dubbed Bictegravir which performed superbly in recently-completed phase 3 trials. The product is on track for approval which will enhance Gilead’s arsenal of HIV treatments. Based on the patent protection of the new line of products, we feel the HIV franchise is well-positioned to continue to grow its cash flow, aiding in underpinning the equity share price. For Gilead to grow, however, it will need additional therapies outside of its core competency in infectious disease. Gilead does have an additional compound that received approval for the use in HCV, but we feel the marketplace remains in a downward spiral as the available pool of patients afflicted continues to shrink.

Inflammatory Disease

We remain bullish on Filgotinib, a JAK-1 inhibitor for the use in various inflammatory disease states. Thus far, Filgotinib has posted impressive stats in inflammatory bowel disease, most notably in Crohn’s disease. We remain very impressed with the upcoming JAK-1 class as a whole, and we feel the elegant once-a-day oral tablet formulation will be a superior option for patients going forward. The parallels with the transformation in the treatment paradigm scene in HIV (once Gilead began to release its once a day combination formulations) may neatly parallel what we believe will transpire in the inflammatory disease space.

As the JAK-1 class starts to enter the market, we feel the therapy will be able to quickly take share from well-established players such as AbbVie’s (ABBV) Humira and Amgen’s (AMGN) Enbrel. We feel patients will gladly opt for a daily tablet versus injections, thus significantly improving compliance and ultimately clinical outcomes. The pace of clinical trials testing Filgotinib are proceeding at a measured clip; thus far, data has been very encouraging. We will continue to monitor the progress of Filgotinib as we view the compound as a unique product in the largest overall spending class in specialty medications.

NASH

Gilead remains mired in the race to bring forth a novel new therapy to treat NASH (Non-Alcoholic Steatohepatitis), an area of considerable recent interest from big pharma (XLV, IBB). Gilead’s believes a multi-pronged approach is necessary–it feels multiple targeted therapies will be needed to treat NASH. In essence, NASH will require combination therapies similar to what we have witnessed in the HIV and HCV. Thus far, Gilead has only made limited information available with Selonsertib, the most advanced molecule which is in Phase 3 trials. If Gilead can bring forth a viable treatment for NASH, it will go a long way towards replacing the revenue loss from the decline in the HCV franchise.

CAR-T therapy

The compounds in clinical trials targeting a treatment for NASH combined with Filgotinib remain the key areas of investigation by Gilead. Noticeably absent are assets in the field of Oncology, easily one of the most competitive and lucrative areas of scientific research. Gilead addressed this deficiency by tendering an offer for Kite Pharma thus gaining a strong position in the burgeoning CAR-T space. By acquiring Kite, Gilead hopes to gain a first-mover advantage and build out the network used to treat adult patients with this revolutionary therapy. We feel that the deep pockets of big pharma/big biotech are the companies that are best suited to drive forth the therapy. We believe the costs associated with the treatment will ultimately become too much for a smaller player to burden, thus necessitating an outright purchase or a strategic partnership.

Concluding Thoughts

All things considered, we think Gilead’s acquisition of Kite will ignite investor’s enthusiasm for the shares of Gilead along with the biotech sector as a whole. The Valuentum methodology has worked very well in the case of Gilead lately; we added the company to both newsletter portfolios in advance of the equity’s strong breakout. Our fair value estimate of Gilead remains north of $100, serving as an indication of the inherent upside we see for the company, but the company is not without risk. The greatest overall risk remains a clinical failure in one or all of Gilead’s late-stage pipeline candidates. For an investor that may wish to gain exposure to the risky biotech sector, however, Gilead may be one of the most interesting considerations.

Healthcare and biotech contributor Alexander J. Poulos is long Gilead Sciences.