Valuentum has been out of Gilead in the newsletter portfolios for some time. As the Best Ideas Newsletter portfolio continues to make new highs, Gilead continues to set new 52-week lows. This is the power of “portfolio thinking,” something we’ve been preaching for a long time.

By Alexander J. Poulos

Gilead Sciences (GILD) burst into the mainstream in 2015 due to its aggressively priced treatment for hepatitis C (HCV). The company gained notoriety as it priced the treatment at $1,000 per tablet, garnering scorn from politicians on both sides of the political aisle. The original treatment (Sovaldi) was improved on with Harvoni, as Gilead ushered in a new age of cures for a dreaded infectious disease. The difficulty in modeling such treatment is the lack of chronic use, once a patient completes the 12-week course of therapy, with a few exceptions, they are “cured” thus negating the need for chronic treatment. The share price has collapsed in the past year, retracing the entirety of the advance since the product class was first introduced onto the marketplace. The article below will discuss our view of the company in light of recent events.

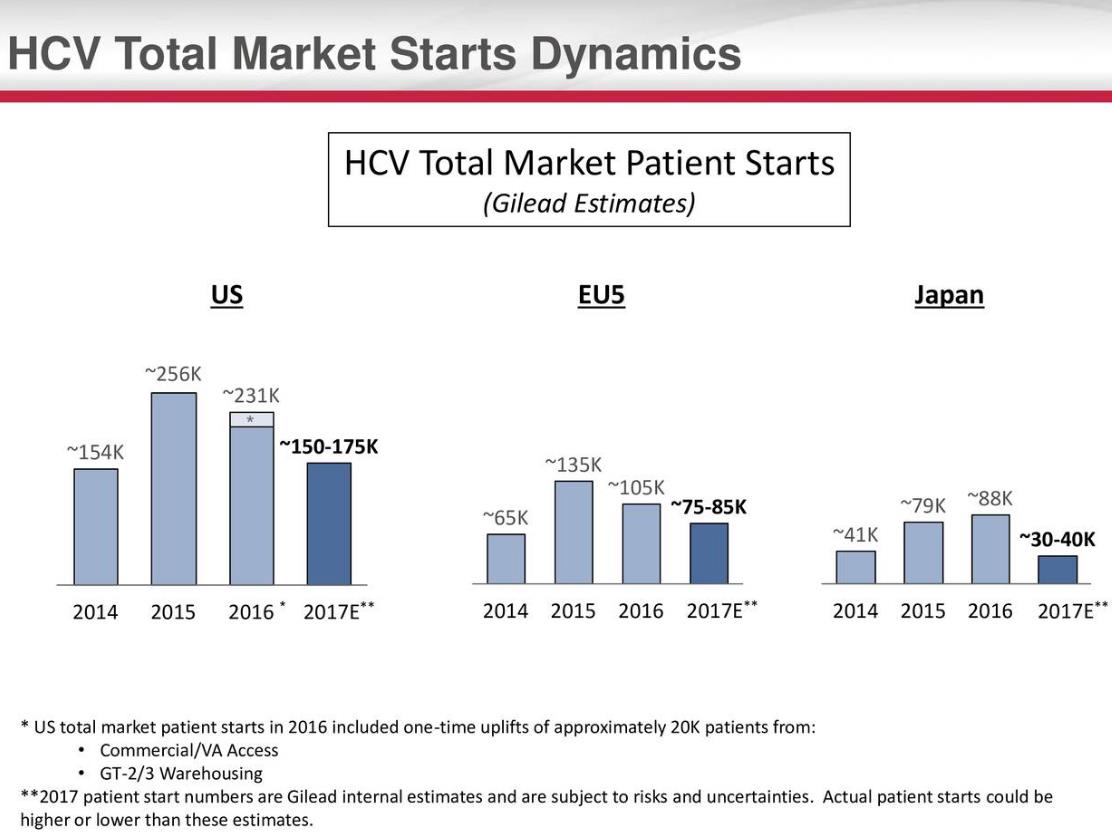

HCV Franchise

Source: Gilead Sciences

The unique dynamics of the HCV marketplace continue to confound most, yet we have a more nuanced point of view. The marketplace was rational with a large rush of patients seeking treatment once a functional cure with minimal side effects became commercially available. This large bolus of patients, in spite of payer protests, accounted for the spike in treatments in the US and Europe. These patients were “warehoused” in anticipation of a revolutionary treatment with a benign side effect profile. As the backlog of patients continues to be worked off, the marketplace is naturally declining as the available patient pool shrinks. The vexing portion is the unpredictable nature of the HCV revenue stream. We view the HCV market through a similar lens as a branded pharmaceutical product that has lost patent exclusivity with a notable exception. Unlike the market dynamics in the patented pharmaceutical space with a rapid loss of share in 3 years (often 80% or more of sales), we expect Gilead’s HCV revenue will continue well into the end of next decade.

The story remains complicated, however, and for those with a shorter term view, the decline in the HCV volume may continue to plague the company’s share price. The market tends to punish companies that report a continuous decline in revenues, as the valuation context creates a mitigating effect on cash-flow growth over the long haul. Thus, it is very likely that Gilead will remain firmly in the penalty box for the rest of 2017, barring an acquisition, which itself may be fraught with selection, integration and overpayment risk. A deal could even be met with severe skepticism. We continue to prefer longer-term ideas in the newsletter portfolios, and we still believe it was the prudent move to remove Gilead from the Best Ideas Newsletter portfolio last year. The company’s recent earnings report may have very well confirmed our fear that the HCV marketplace has not bottomed as many expected. That said, we remain intrigued by the cash-flow generating capacity of the company, and as with all companies in our coverage, we continue to watch shares carefully. The rest of this article will discuss the HIV market along with Gilead’s pipeline.

HIV Pipeline

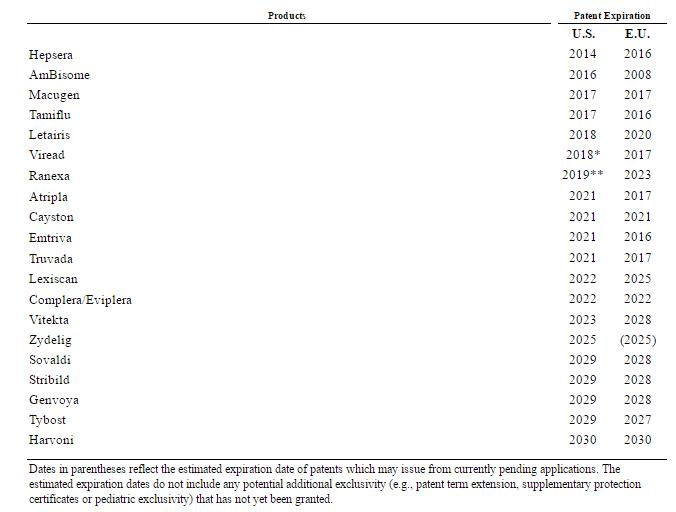

Well before Gilead became a household name, the company grew based on its dominance in the HIV market. We like how Gilead has expanded its HIV franchise by combining new products together to create a single-dose tablet, therefore dramatically reducing the pill load the patient would need to track and consume. By materially reducing the pill burden, Gilead can increase compliance. The increase in compliance aids in negotiations with payers and produces far higher patient outcomes. Aside from the increase in patient outcomes, the combination products allow for a clever bit of lifecycle management. By periodically introducing a new combination product, Gilead can expand the longevity of its HIV franchise.

Source: Gilead Sciences

From our point of view, Gilead is well along in introducing its next generation of combination products, this time utilizing Tenofovir alafenamide (TAF) in place of Tenofovir disoproxil fumarate (TDF). TAF main selling point is the product can be used in a smaller amount, thus reducing the side effect profile. The key benefit is the product is far easier on the kidneys, which become a challenge as the patient ages.

The improvement in the overall side-effect profile should allow Gilead to gain additional traction in the HIV market. Thus far, Gilead has been able to transition a significant portion of its patient base away from its legacy products that lose patent protection in the US in 2021 to the improved version that utilizes TAF. Also, a small percentage that was treated with a non-Gilead product is being converted as well.

We applaud the management team at Gilead for a stellar bit of lifecycle management. By introducing the new TAF-based regiments well before the patents on the TDF products lapse in the US, the company has expanded its patent estate by roughly eight years to the end of 2029. We expect the bulk of the patient population to convert over well before the patent expiration in 2021, thus ensuring Gilead HIV revenue stream well into the end of the next decade.

In addition to the TAF rollout, Gilead is developing a novel class to combat the HIV infection. The new product is Bictegravir, an unboosted integrase inhibitor. Thus far, the product has demonstrated a benign side-effect profile with Gilead slated to release phase 2 data comparing Bictegravir against Dolutegravir in combination with Emtricitabine/Tenofovir Alafenamide. Dolutegravir is manufactured by VIIV Healthcare, Gilead’s chief rival in the HIV space. A positive head-to-head result, if achieved, should allow for Gilead’s new product to steal share in addition to giving clinicians a new approach to combat HIV.

We expect Gilead to remain a force in the HIV market, but for the company to attain top line revenue growth and approach its old high, in our view, a new franchise outside of infectious disease will need to be developed. Thus far, Gilead has made some attempts to gain share in the oncology space with Zydelig, but while the product has been approved it can be considered a “failure” as the side-effect profile remains troublesome. In addition, the company recently reported a clinical failure of Momelotinib for the treatment of Myelofibrosis. We view the oncology pipeline as uninspiring, thus necessitating the need to hire Alexander Rivas from Novartis (NVS) to head up Gilead’s Oncology division. We consider the hire as a positive one, yet it will take time to see if Rivas can turn around the company’s floundering fortunes in Oncology.

Non-Alcoholic Steatohepatitis

The area that retains the greatest potential of a new cornerstone “franchise” for Gilead is a treatment for Non-Alcoholic Steatohepatitis or better known by the acronym NASH. NASH is the more dangerous form of Non-Alcoholic Fatty Liver Diseases, a disorder where fat accumulates in the liver. The danger with NASH is for the disease to progress into cirrhosis, a condition where the liver ceases to function properly. NASH is a natural target market for Gilead as it will expand on its expertise in HCV as both diseases primarily affect the function of the liver. Also, from a cost perspective, Gilead will be able to utilize the extensive sales force that has built a lasting relationship with hepatologists from the promotion of its HCV franchise. This may bestow on Gilead a competitive advantage over chief rival Allergan (AGN), as the latter will need to build a sales force assuming its recently-acquired products reach the market.

Gilead disclosed some important phase 2 results for Selonsertib, an apoptosis signal-regulating kinase 1 (ASK1) inhibitor, as part of a likely multi-drug regimen to treat NASH. The product has been moved into Phase 3 testing after consulting with the FDA on a clinical trial design. Selonsertib is being tested on patients with an F3 and F4 score to determine efficacy. The severity of liver Fibrosis is measured on a 0-4 scale with the most severe case assigned a 4. The treatment for NASH remains an area of significant unmet need; it seems the company is focusing on the patient who is most “ill” with testing, a wise approach in light of what is undoubtedly going to be a lifetime treatment with a heavy cost burden. In addition to Selonsertib, Gilead is looking to pair the product with GS-0979 an allosteric acetyl-CoA carboxylase (ACC) inhibitor and GS-9674 an FXR agonist, to combat NASH from a variety of angles.

An ACC inhibitor works by targeting a key enzyme needed for the development of fat that will be deposited in the liver. The compound was acquired in a deal with Nimbus Therapeutics with Gilead agreeing to pay up to $1.2 billion based on the achievement of certain milestones. Gilead also acquired GS-0979 in a deal with privately-held Phenex Pharmaceuticals for $470 million in addition to undisclosed royalties.

Gilead expects to have additional phase 2 data for 12 and 24 weeks of treatment for each product by the middle of this year. Depending on the data read, Gilead will push forth with combinations to develop an optimal treatment regimen. We will be watching the data carefully; a win in NASH would diversify the company away from the HCV market, thus potentially returning the company firmly to top-line growth.

Balance Sheet and the Role of M&A

By virtue of the tremendous amount of free cash the company generates, Gilead continues to have financial flexibility (even with long-term liabilities of ~$28.3 billion). The company now holds over $32 billion in cash, with an accumulation every quarter. The cash-rich balance sheet coupled with the decline in revenue has brought forth a sonic scream for the company to engage in M&A activity. While we agree, M&A should be a natural part of the business model, one which Gilead has utilized with success in the past (its Pharmasset purchase for $11.2 billion hatched its dominance in the HCV franchise), the biggest return may be generated from acquiring clinical or phase 1 assets instead of de-risked near-term pipeline assets. This is risky.

For example, Tesaro Pharmaceuticals (TSRO) continues its ascent with the company’s market capitalization now exceeding $9.8 billion. Tesaro’s advance is galvanized with what may prove to be a best-in-class PARP inhibitor, fueling speculation of a takeout by one of the larger entrenched pharma companies in a similar manner to the recently-completed Medivation deal. For someone to acquire Tesaro, a hefty premium will need to be paid, which may limit the overall return that can be generated in a hotly competitive field. The management team at Gilead has commented numerous times that some of the premiums paid are uneconomical at this point, a view with which we agree with. We prefer to see additional deals similar to the Phenex, Nimbus, and Galapagos deal that will be discussed below.

Inflammatory Disease

The treatment of inflammatory disease remains the single-largest area of drug spending in the ultra-expensive specialty pharmaceuticals business. Gilead is now well-represented in infectious disease, but was noticeably absent, until a deal was struck with Galapagos for its lead compound Filgotinib for the treatment of Crohn’s Disease and Rheumatoid Arthritis. Galapagos originally had a partnership with Abbvie (ABBV) for the rights to co-develop the product. Abbvie decided to go with its in-house wholly-owned product ABT-494, thus jolting Galapagos. Gilead stepped in, backed by the abundance of cash generated from its HCV franchise, to scoop up the drug at an attractive price.

Figotinib continues to impress in the clinical labs with a particular emphasis on Crohn’s disease. While it was difficult to compare different drug trial results as the control mechanisms vary, the side-effect profile for Filgotinib is very promising. The mechanism for Filgotinib’s more benign side-effect profile rests with the molecule’s ability to target the Janus Kinase enzyme selectively. The older class of meds that lack specificity such as Tofacitinib (Xeljanz) have been plagued with an unwanted side-effect profile. The increased risk of adverse side effects has led to the issuance of a “Boxed Warning” over concerns of an increase in infections and the development of Shingles.

In addition to the indication for Crohn’s, Filgotinib is in phase 3 for the indication of Rheumatoid Arthritis, the most lucrative yet crowded field in inflammatory disease. Galapagos has wisely designed the trial with an arm utilizing top-selling product Humira as a control, thus offering an inspiring reference point. The trial is dubbed “Finch” which commenced in August 2016. The trial is designed to run for 52 weeks, allowing ample time to gather data. A key selling point of Filgotinib is the delivery mechanism; the product does not require injection such as top-selling product Humira. Instead, Filgotinib comes in a convenient oral dosage form, which we expect will be used for marketing purposes to highlight the convenience and ease-of-use of the product.

Conclusion

We view Gilead Sciences through the lens of a pharmaceutical company in that it has lost the patent protection of one of its primary compounds. The upside, as reflected in the upper bound of our fair value range, is that the rate of decline may be far less than the traditional patent exclusivity loss (as the HCV franchise enjoys patent protection out well through the end of the next decade). The issue is the drop in overall patient population has severely hampered year over year revenue growth.

That said, we view the cash flow generated from Gilead Sciences’ existing franchises very favorably, and we view Gilead as better positioned from a patent expiration perspective than most of its pharma/biotech competitors. Its strong free cash flow should allow for generous annual dividend hikes, with Gilead recently announcing a bump in the quarterly payout to $0.52 cents for 2017. The current yield is over 3%, in line with its large-cap competitors.

We’ve always liked the company that “cured” hep C, and we still think shares of Gilead are cheap, but our experience in the market told us to get out when we did, and this proved to be the right move. We substituted the company’s shares with Johnson & Johnson (JNJ), and we’ve been pleased with the relative alpha generated. If Gilead’s technicals settle, we may re-add them to the Best Ideas Newsletter portfolio. Remember: each idea should be viewed in the context of the newsletter portfolios, and the Best Ideas Newsletter portfolio continues to set all-time highs.

Disclosures: Healthcare and biotech contributor Alexander J. Poulos is long Gilead Sciences. Valuentum does not own Gilead nor does it include it in its newsletter portfolios.