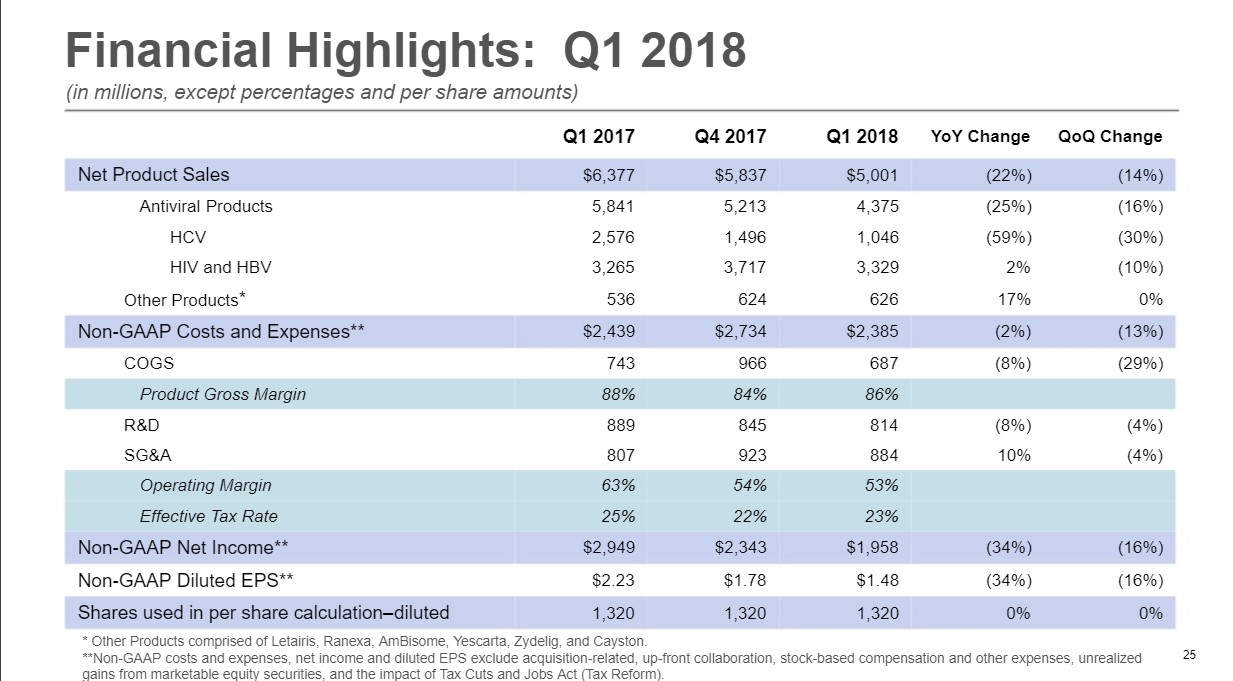

Image Source: Gilead Sciences’ first-quarter 2018 results

The loss of a key revenue-generating molecule is a tough, yet oftentimes manageable, portion of a pharma entity’s overall life cycle. Gilead Sciences is in the midst of a key turnaround as the loss of revenue from its Hepatitis C franchise is beginning to abate, while new novel treatments embark on the early stages of their respective revenue cycles. That said, we’d like to see traction in its HIV and oncology franchises, and perhaps the addition of a new franchise to the portfolio, or we will sour on the stock long-term.

By Alexander J. Poulos

Key Takeaways

We are not at all surprised by the continued decline in revenue posted by Gilead’s HCV franchise as we view the asset, in light of cure rates, through the same lens as a product that has lost patent protection.

The productivity of clinical labs in the pharma/biotech industry is the key indicator of future revenue and profit growth, not necessarily shareholder-friendly maneuvers such as stock repurchases or dividends. Buybacks can add value at the right price, but long-term shareholders should be most interested in pipeline development and sustainable operating improvements.

The star performer for Gilead remains its industry-leading suite of HIV products which recently added a new member named Biktarvy, an unboosted single tablet regimen for the treatment of HIV.

The Car-T therapy, of which Gilead remains in the vanguard, has the potential to revolutionize how oncolytic conditions are treated, to the great benefit of patients and investors of Gilead, in our view.

We feel 2018 is setting up to become the “trough year” as far as revenue growth is concerned, as HIV and oncology growth should lap the decline in HCV. Shares of Gilead look cheap, but the market has them in the penalty box, and we’d like to see the company add another franchise to its portfolio.

Importantly, Gilead is one of ~40 collective ideas in the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio, and rests at the lowest-rung with respect to its weighting profile. It is one of the least favorite of our best ideas.

HCV Franchise

We are not at all surprised by the continued decline in revenue posted by Gilead’s (GILD) HCV franchise (down 59% on a year-over-year basis in the first quarter of 2018) as we view the asset through the same lens as a product that has lost patent protection. As a quick reminder, the pricing dynamics for the HCV treatment differ from the near annuity-like pricing models witnessed in other “treatments” due to the curative nature of the HCV treatment. The idea is rather straightforward: as a patient completes the 8-12-week treatment, they are no longer a “potential customer” of the treatment, hence the potential patient pool shrinks.

Our continued interest in Gilead revolves around the cash flow generated from the HCV franchise, which we fully expect the company to utilize to bring forth additional novel treatment via internal development or through strategic acquisitions. The productivity of clinical labs in the pharma/biotech industry is the key indicator of future revenue and profit growth, not shareholder-friendly maneuvers such as stock repurchases or dividends. Make no mistake: we are big fans of dividends; however, we would prefer perhaps a lower pace of dividend growth, if necessary, with perhaps a heavier emphasis on internal development due to the need to continuously replenish the existing product lineup. Once patent protection is lost, the revenue stream tied to that product vanishes forever.

We found it somewhat off-putting that Gilead CFO Robyn Washington highlighted the wonderful 22% reduction in share count of Gilead, while failing to mention the commencement of an ill-timed $5 billion accelerated share repurchase plan in the first quarter of 2016, with the share price much higher than today’s levels. Further complicating matters is that an additional $5 billion was spent by the end of the third quarter of 2016 at prices ranging between $85-$95 per share.

Though we’ve missed the mark with Gilead in our timing of the idea as well, we continue to caution the company against aggressive buybacks. Building out the pipeline is a much better use of cash, even if it comes at the expense of the pace of dividend growth. We’d be fine with moderating dividend-per-share expansion, if it means Gilead can build a greater safety net around the current payout.

HIV Franchise

The star performer for Gilead remains its industry-leading suite of HIV products, which recently added a new member named Biktarvy, an unboosted single-tablet regimen for the treatment of HIV. The unboosted integrase inhibitor Bictegravir is the key component of Biktarvy, which seems poised to take additional market share from GlaxoSmithKline (GSK), thus cementing Gilead’s hold over the uber-lucrative HIV market (the Glaxo product has a more problematic side-effect profile, in our view).

Biktarvy gained FDA approval on February 8th; thus, the first quarter does not include a full quarter of Biktarvy sales, which may account for some of the tepid 2% year over year growth. On the company’s first-quarter 2018 conference call, management blamed inventory destocking on the part of the wholesalers, which we will believe for now as we have seen the same effect. most notably in Biogen’s (BIIB) recent report. The inventory de-stocking is a one-time event, and we think the second quarter of 2018 should produce more robust numbers, especially as Biktarvy begins to ramp. The selling price of the treatment is notably higher than existing therapies, too.

We continue to view Gilead through the lens of innovative biotech possessing a growing, innovative HIV franchise that is masked by the continued decline in the HCV marketplace. The HCV market in our view will continue to rapidly decline, but the impact on Gilead’s revenue, however, will lessen as new growth products, most notably Biktarvy and the recently acquired Yescarta, begin their initial sales ramp.

Oncology

Yescarta, the recently acquired Car-T therapy, remains in the initial stages of its product ramp as evidenced by the $40 million in sales posted during the first quarter of 2018. The tepid initial sales ramp is expected due to the unique aspects of the treatment. Unlike other traditional oral dosage drug regiments, Yescarta requires the collection of the patients T-cells, which are then shipped to a specialized center where they are modified and shipped back for re-infusion into the patient.

The treatment is tailored to the unique individual aspects of each patient, which is costly and time-consuming. We are not at all surprised by this, as it will take some time for the initial ramp of centers becoming certified to participate in this novel treatment. Gilead mentioned on its quarterly conference call that it anticipates, by the end of the third quarter of 2018, it will have enough cancer centers registered to treat 80% of the potential patient population.

We remain bullish on the prospects of the entire Car-T space as the data shown thus far is a remarkable advance for those who are afflicted with a deadly disease that has a poor prognosis based on conventional treatments. The Car-T therapy, of which Gilead remains in the vanguard, has the potential to revolutionize how oncolytic conditions are treated, to the great benefit of patients and investors of Gilead, in our view.

Based on the promosing potential of its acquisition of Kite Pharma, we think Gilead is on the correct path going forward. The addition of Kite and its novel Car-T therapy opens a new franchise for the company, as it looks to lap the flagging sales of the HCV franchise. We’re optimistic that Gilead will be able to post top-line growth in the coming quarters, as both Biktarvy and the oncology franchise begin their sales ramp, but its HCV franchise is in rapid decline. As Gilead returns to top-line growth, the market may warm up more to its prospects.

The Balance Sheet and Dividend

Gilead Sciences’ balance sheet remains robust with $32 billion in cash and short-term securities versus $29.25 billion in adjusted debt. The enormous cash hoard is the legacy of the growth of the HCV franchise. The key for the company as it heads into the next phase of growth is how the cash hoard is deployed.

If the company opts for an aggressive share repurchase plan that depletes the cash, we’d view this as a negative outcome, as Oncology and HIV alone cannot power the company into the next decade. For Gilead to continue to sustain its dividend and grow the top line, it will need to develop a novel, third pillar, perhaps in Non-alcoholic Steatohepatitis (NASH) or an additional tuck-in acquisition in the mold of Kite Pharma.

In any case, we rate the dividend at Gilead as Good with Dividend Growth Potential rated as Excellent, thanks in large part to the free cash flow generated from its legacy pharmaceutical sales. The company’s Dividend Cushion ratio is 2.2, one of the top ratios in our entire coverage universe, but declining HCV sales pose tremendous risk to the health of the ratio long term. Its HIV and oncology franchises need to deliver.

Conclusion

We still like Gilead, though we are disappointed with the share-price performance in 2018–as the year, thus far, remains a tough one for investors of all types. We’d like to see Gilead add another franchise to its portfolio to help its HIV and oncology franchises offset ongoing weakness in HCV. We will continue to monitor the clinical pipeline, but Gilead can’t rest. It has to keep pushing its development pipeline, or we will sour on the stock.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent Healthcare Contributor Alexander Poulos is long Gilead Sciences. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.