Simulated newsletter portfolio idea General Motors cut its full-year guidance due to higher than expected commodity cost increases and devaluation of key currencies in South America. Peers Ford and Fiat Chrysler also lowered 2018 guidance measures following a tough second quarter for the group.

By Kris Rosemann

The July 25 trading session was a tough one for simulated newsletter portfolio idea General Motors (GM) as it faced meaningful external pressures on its business and lowered guidance for 2018. Greater-than-expected impacts from rising commodity prices and currency devaluations in Brazil and Argentina were the primary drivers behind the guidance cut. However, some of those pressures may be easing as President Trump has reportedly agreed to work with the European Commission in resolving steel, aluminum, and retaliatory tariffs with the ultimate goal of achieving a “zero tariffs” policy.

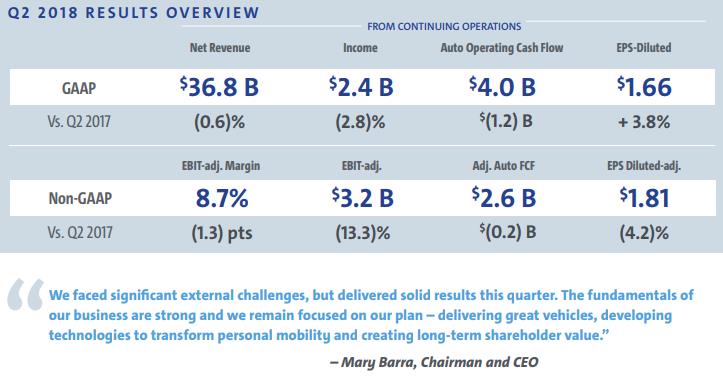

GM’s second-quarter results, released July 25, left a bit to be desired as net revenue fell 0.6%, EBIT-adjusted fell 13.3%, and EBIT-adjusted margin contracted by 130 basis points, all on a year-over-year basis. Nevertheless, the company was able to grow sales and market share in the important US market thanks to ongoing strength in trucks and SUVs, and it reported record second-quarter equity income from China in the period, which was not able to offset weakness in South America as it relates to GM’s international operations. North America EBIT-adjusted margin came in at 9.4% in the quarter, but management noted that its previous 10% target is no longer appropriate given the ongoing commodity price pressures on its bottom line, instead pointing investors to the 9%-10% range as a more appropriate expectation.