Image Source: Valuentum

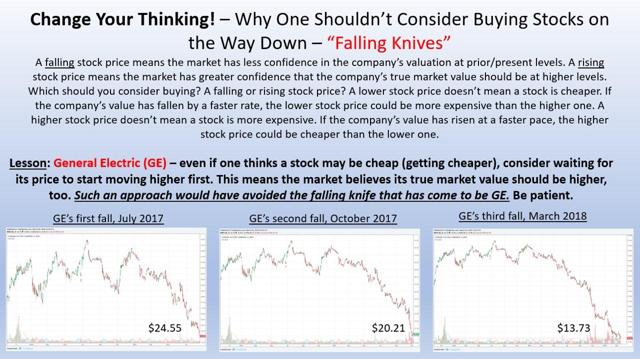

The story of General Electric (GE) is a great one to illustrate how we think about equities. After being a long-time bull on the company, we had removed General Electric from the simulated newsletter portfolios while it was trading a few dollars shy of $30, but that is not the point of this piece. What we want to illustrate is how hazardous catching falling knives can be (see the three stages above). Many an investor believes that stocks are less expensive just because they have fallen in price. This is simply not the case. The relative expensive or cheap nature of a stock is based on a comparison between its price and value. A stock’s price can fall, but its value can fall even further. Under such a scenario, the stock can actually become more expensive as its price falls.

We think this dynamic is one of the most important ones when it comes to investing. Instead of thinking that a stock is cheaper because its price has fallen, think that in the event of a stock price decline, the market believes that the true intrinsic value of the company is lower than it was before. The idea of momentum fits nicely into this example, too. As the market adjusts the price of the company to reflect what it believes is intrinsic value, stocks can exhibit both positive and negative momentum for sustained periods of time. In this light, it becomes much more acceptable to like stocks in which the markets believe are undervalued (stocks that are increasing) than stocks in which the markets believe are overvalued (stocks that are decreasing).

This is why we like stocks not only that we think are undervalued, but also ones in which we think the market believes are undervalued. In many respects, it is discipline to wait for a stock’s price to start moving higher that continues to keep us from being excited about General Electric, even though we believe shares could be considered cheap. However, at times, the market could know more than us so the information contained in pricing activity is vital to consider. Without the backing of the market to drive shares higher, investors that look to scoop up stocks on the way down may be catching falling knives and not bargains. We avoided catching the General Electric “falling knife” because we’re still waiting for things to turn for the better.

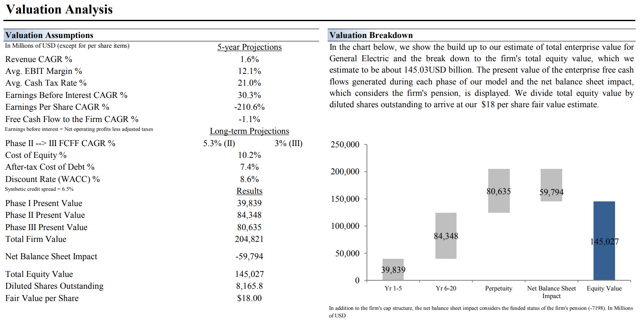

The Valuentum process is multi-faceted in this respect. We just don’t like stocks because they are cheap, but we demand the market to agree that they are cheap before we’d grow excited. We use momentum as a way to gauge this. Though we think there are a number of stocks that are cheap, we would need the stock price to start moving higher for us to really get excited about it. We’re not there with General Electric yet, even though we value the company at $20 each, a far cry from where shares are trading at in the mid-$12 range. Our valuation summary for General Electric can be found in the image below.

Image Source: Valuentum

General Electric At A Glance

• GE is one of the largest and most diversified industrial firms in the world, with products/services ranging from aircraft engines to power generation and beyond. The company has largely completed its portfolio transformation to reduce exposure to financials. It was founded in 1892 and is headquartered in Boston. GE bought Alstom’s power business in 2015.

• GE expects 2018 adjusted EPS to be near the low end of a range of $1.00-$1.07, well below originally expected levels. The company plans to cut 12,000 jobs in its GE Power division, a move it expects to save $1 billion in 2018 as it anticipates ongoing weakness in the business.

• GE has strong liquidity, a large backlog, and major cost programs underway to deal with anything the economic environment has to throw at it. Emerging markets and infrastructure investments are key sources of expansion potential, and its industrial portfolio is as diverse as they come. Though we are still fans of the scope of its business, our opinion of the firm’s cash flow generating sustainability has weakened.

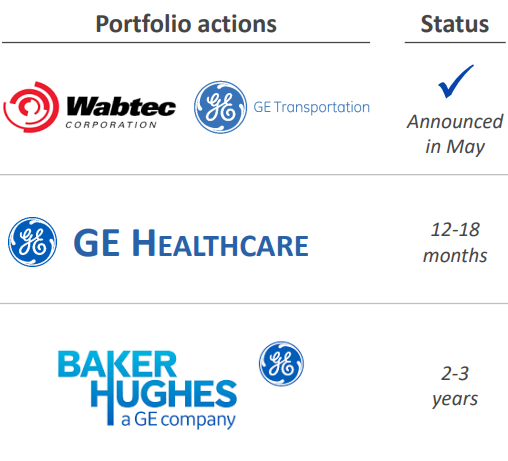

• Reduced reliance on financials and shedding its SIFI designation were smart moves, in our view. The firm is targeting $20+ billion in business exits in the next two years to further streamline the business and help cash shortfalls. It plans to spin-off its healthcare business and divest its stake in Baker Hughes after roughly one year of ownership.

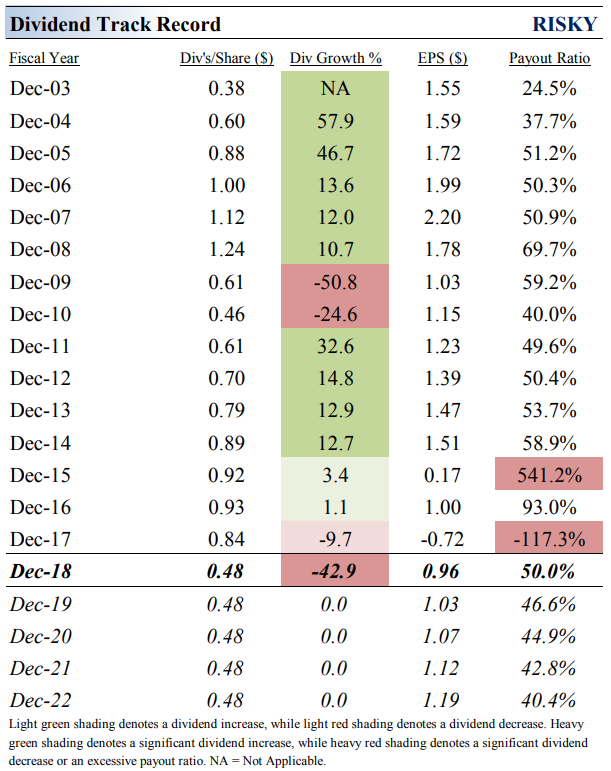

• After stripping GE’s operating cash flows of non-core asset sales and waning GE Capital dividends, our opinion of its dividend safety and fair value have been reduced. Management affirmed our concerns and halved the payout in November 2017, but it is still not out of the woods.

Image Source: Valuentum

• As GE’s portfolio transformation is largely complete, we no longer apply an adjusted Dividend Cushion ratio, which mitigated the impact of its debt load. GE’s Dividend Cushion ratio appropriately warned investors of its recent cut. here is more of what we say about GE’s dividend in our Dividend Report:

Key Strengths

General Electric’s financial make-up has changed quite a bit in recent years as a result of its transformation away from being one of the largest financial institutions on the planet. We’ve made adjustments to the company’s Dividend Cushion ratio to account for the changes, and we generally are in favor of a much leaner, and more focused GE, one that has gone back to its industrial roots. GE will now move more closely with the global economic environment, but a backlog of ~$341 billion of future business and the largest installed base in the world means the trajectory of revenue will remain resilient. Large asset dispositions have helped pad its liquidity, but the company’s massive debt load does little to inspire confidence.

Potential Weaknesses

It seems like GE has had a string of bad luck of late. The once-sprawling financial conglomerate was hit hard during the Financial Crisis and was forced to slash its payout. Moving back to its roots, the company then announced one of its largest acquisitions in history, French energy giant Alstom, just in time for the energy resource price environment to collapse. Its exposure to the volatile energy markets has grown with the Baker Hughes deal. Management has taken its share of lumps, and our concerns over whether industrial free cash flow would be sufficient to cover future dividend obligations have come to fruition as management halved its quarterly payout following its strategic review. Its dividend metrics could be better, even after the cut.

• With its dividend reduction in November 2017, GE announced its intention to refine its portfolio to focus on its three core units: aviation, power, and healthcare, which accounted for ~58% of 2016 total revenue. The company is now merging its $4 billion GE Transportation business, spinning off its $19 billion GE Healthcare business, and parting ways with its 62.5% stake in $22 billion business Baker Hughes. For reference, total revenue for GE came in at ~$122 billion in 2017.

Image source: GE investor presentation

Conclusion

Our enterprise-cash-flow derived fair value estimate of GE may be optimistic at $20 per share. Unless something really positive happens, it may take years for GE to ever fully realize that value, in our view. GE garners a Valuentum Buying Index rating of 3 and a Dividend Cushion ratio of 0.1, we’re just not finding anything remotely exciting about GE’s investment opportunity at this time. It may have to become a single-digit stock to get us excited. Then, the risk-reward might tilt in investors’ favor. But even still we’d have to wait for shares to move higher before we would ever consider them again, which would coincidentally drive a higher Valuentum Buying Index rating. We’re just not interested in GE at this time.

Related: BHGE

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.