Image Source: GameStop Corporation – Fourth Quarter Fiscal 2018 Earnings IR Presentation

By Callum Turcan

On December 10, video game retailer GameStop Corp (GME) reported third quarter earnings for its fiscal 2019 (13-week period ended November 2, 2019) that were simply terrible. Shares of GME were down big after-hours on December 10. GAAP net sales were down 26% year-over-year last quarter, hitting $1.4 billion, while the company’s GAAP operating loss came in at ~$0.05 billion, an improvement versus an operating loss of $0.5 billion (due to a large goodwill impairment charge) in the same period last fiscal year. GameStop halted its common dividend program in the middle of 2019, which freed up substantial cash flow for share buybacks and deleveraging efforts. Investors looking to avoid disruptions to their dividend income streams should consider utilizing Valuentum’s Dividend Cushion ratio to avoid value traps (read more about the importance of our Dividend Cushion ratio here).

Earnings Overview

Weakness stemmed from GameStop’s poor same-store sales performance. Comparable store sales fell by 23.2% year-over-year last quarter, and furthermore, GameStop is expecting “a decline in the high-teens” in comparable store sales this fiscal year. GameStop’s GAAP gross margin shifted higher by almost 185 basis points year-over-year last quarter (more on that later), but given its high fixed operating costs, that did little to offset substantial top-line pressures when it comes to posting positive net income. GameStop posted an almost $0.1 billion GAAP net loss last quarter.

The only strength from GameStop’s recent performance came from its capital allocation strategies. Deleveraging efforts reduced the company’s net debt load (inclusive of short-term debt) from ~$0.4 billion at the end of the third quarter of fiscal 2018 to ~$0.1 billion at the end of the third quarter of fiscal 2019. Share buybacks reduced GameStop’s weighted-average diluted outstanding share count from 102.2 million in the third quarter of fiscal 2018 to 82.1 million in the third quarter of this fiscal year.

When GameStop publishes its 10-Q filing covering its latest earnings report, we’ll know more about the current state of its cash flow profile. We appreciate GameStop’s deleveraging efforts, but caution that funds allocated towards share buybacks would arguably be better spent on further deleveraging activities given GameStop’s ongoing operating losses. Our fair value estimate for GME stands at $6 per share, around where shares are trading at as of this writing, indicating shares of GameStop are fairly valued as of this writing.

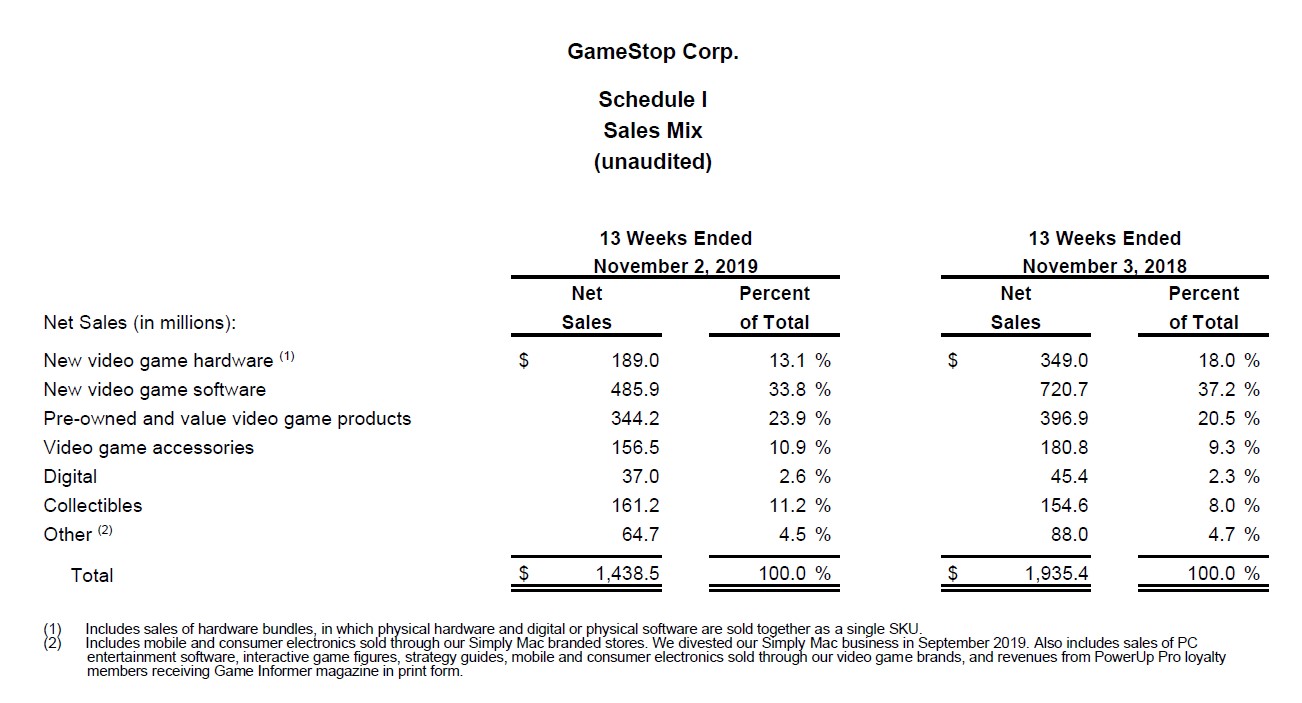

In the graphic down below, please note the weakness GameStop experienced across the board. New video game hardware and new video game software sales were down big year-over-year. Even a recent source of strength, GameStop’s used video game operations, performed poorly. The only category to grow was collectibles and that isn’t a large source of sales for GameStop.

Image Shown: GameStop experienced sales weakness across the board last quarter, which played a key role in shares plummeting after-hours on December 10 when the news broke. Image Source: GameStop – Third Quarter Fiscal 2019 Earnings Press Release

As you can see in the upcoming graphic below, GameStop’s highest margin businesses include its very small digital sales footprint and most importantly, its ‘pre-owned and value video game products’ operations. When those operations perform poorly, that severely limits the company’s ability to grow. GameStop’s GAAP gross margin increased year-over-year last quarter due to weakness seen at its new video game software and hardware sales, both of which carry relatively low margins, rather than realizing sales strength elsewhere. While the margins on GameStop’s collectibles segment (the only category to post year-over-year revenue growth last quarter) are decent, they are only modestly stronger than its company-wide performance.

Image Shown: GameStop’s year-over-year increase in its GAAP gross margin was due to weakness at its new video game software and hardware sales, which carry lower margins relatively speaking, than realizing sales strength elsewhere. Image Source: GameStop – Third Quarter Fiscal 2019 Earnings Press Release

GameStop expects to generate adjusted (non-GAAP) EPS of $0.10 – $0.20 this fiscal year. In the segment below, from our 16-page Stock Report covering GameStop (which can be accessed here), we cover how we view the specialty retailers industry:

The specialty retail segment is fragmented, highly competitive, and economically-sensitive. The group covers a broad array of businesses and is dominated by retailers with large brick-and-mortar store footprints. Though some constituents may be insulated from e-commerce competition, others risk obsolescence as product distribution moves to digital means, and online retailers offer lower prices for identical goods and services. We’re fairly neutral on the structure of the industry, though some constituents will inevitably face secular and permanent declines.

We caution that the structural problems faced by GameStop during benign economic conditions could be viewed as a harbinger of worse times to come should US economic activity slow down materially.

Concluding Thoughts

We aren’t optimistic on GameStop’s prospects. The structural problems facing the company won’t be fixed by a new big video game console launch, largely due to the industry-wide shift to digital sales. Major video game publishers like Activision Blizzard Inc (ATVI) and Electronic Arts Inc (EA) have seen digital sales as a percentage of their total sales grow substantially over the past decade, a trend that’s unlikely to change anytime soon. That severely limits the size of the market GameStop can cater to, and additionally, the retailer’s ability to grow its digital sales will be limited by the desire of video game publishers to take as much of those very high-margin proceeds as possible. Put another way, GameStop’s physical and digital operations don’t have a moat, and neither does its business at-large.

Members looking for our favorite potential capital appreciation and dividend growth ideas should check out our Best Ideas Newsletter portfolio (link here) and Dividend Growth Newsletter portfolio (link here). Those portfolios include our favorite names across several quality industries, including health care (read more about that here).

Software (Graphics) Industry – ATVI AVID EA GLUU TTWO ZNGA

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

Related: NTDOY MSFT SNE

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Microsoft Corporation (MSFT) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.